Ashtead Group Results Presentation Deck

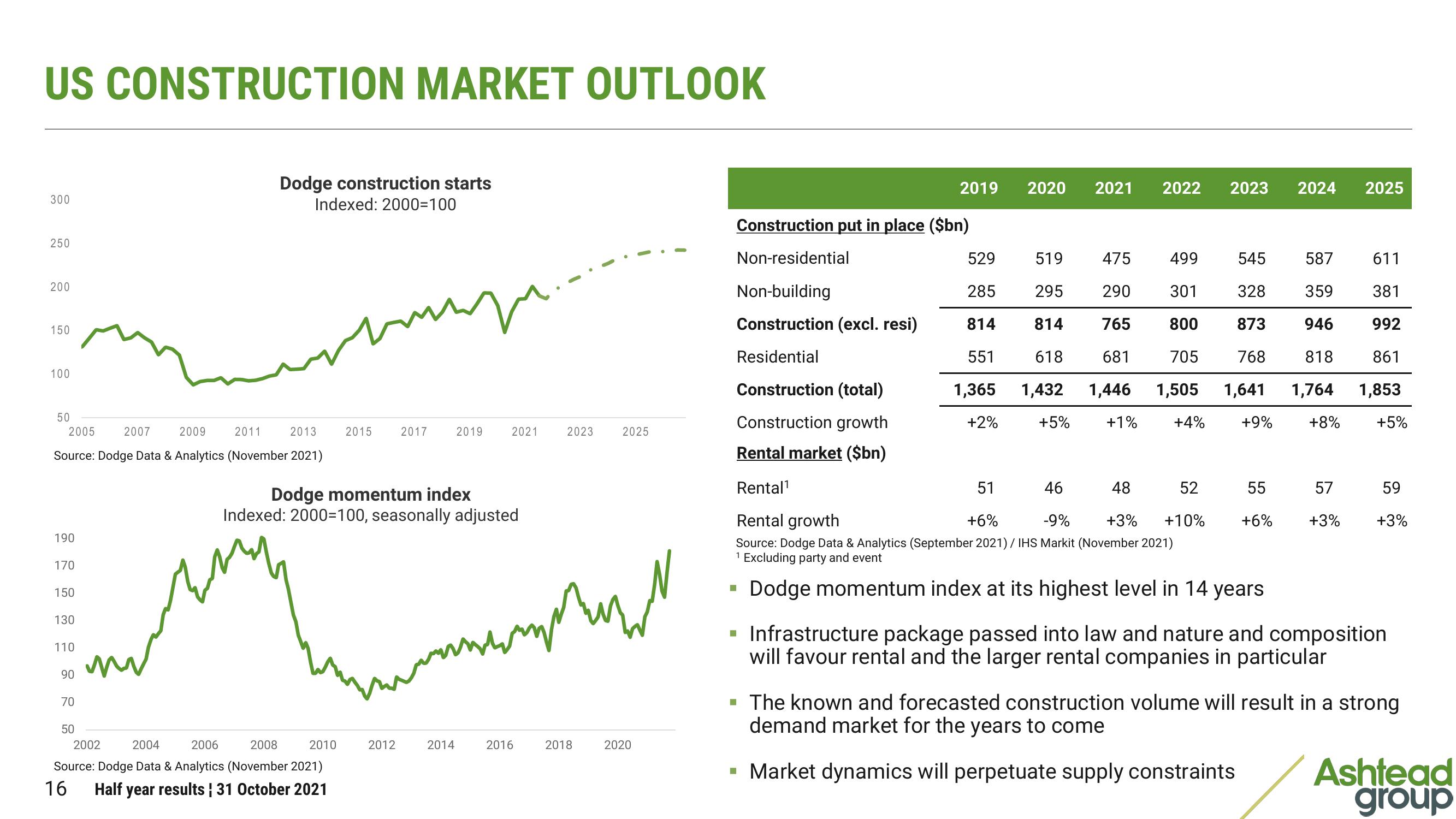

US CONSTRUCTION MARKET OUTLOOK

300

250

200

150

100

50

2009

2013

2005 2007

Source: Dodge Data & Analytics (November 2021)

190

170

150

130

110

90

70

50

Dodge construction starts

Indexed: 2000-100

2011

2015

2002

2004

2006 2008 2010

Source: Dodge Data & Analytics (November 2021)

16

Half year results ¦ 31 October 2021

سہ

2017

2012

Dodge momentum index

Indexed: 2000=100, seasonally adjusted

2019

2021

2014

2023

numphant

2016

2025

2018

2020

Construction put in place ($bn)

Non-residential

Non-building

Construction (excl. resi)

Residential

Construction (total)

Construction growth

Rental market ($bn)

Rental¹

2019

■

2020

2021 2022

■

2023 2024 2025

51

52

46

48

-9% +3% +10%

Rental growth

+6%

Source: Dodge Data & Analytics (September 2021) / IHS Markit (November 2021)

1 Excluding party and event

Dodge momentum index at its highest level in 14 years

529

519

475

499

545

285

295

290

301

328

814

814

765

800

873

618 681

705

768

551

1,365 1,432 1,446 1,505 1,641

+2% +5% +1%

+4%

+9%

55

+6%

587

611

359

381

946

992

818

861

1,764 1,853

+8%

+5%

57

+3%

59

+3%

▪ Infrastructure package passed into law and nature and composition

will favour rental and the larger rental companies in particular

The known and forecasted construction volume will result in a strong

demand market for the years to come

▪ Market dynamics will perpetuate supply constraints

Ashtead

groupView entire presentation