Liberty Global Results Presentation Deck

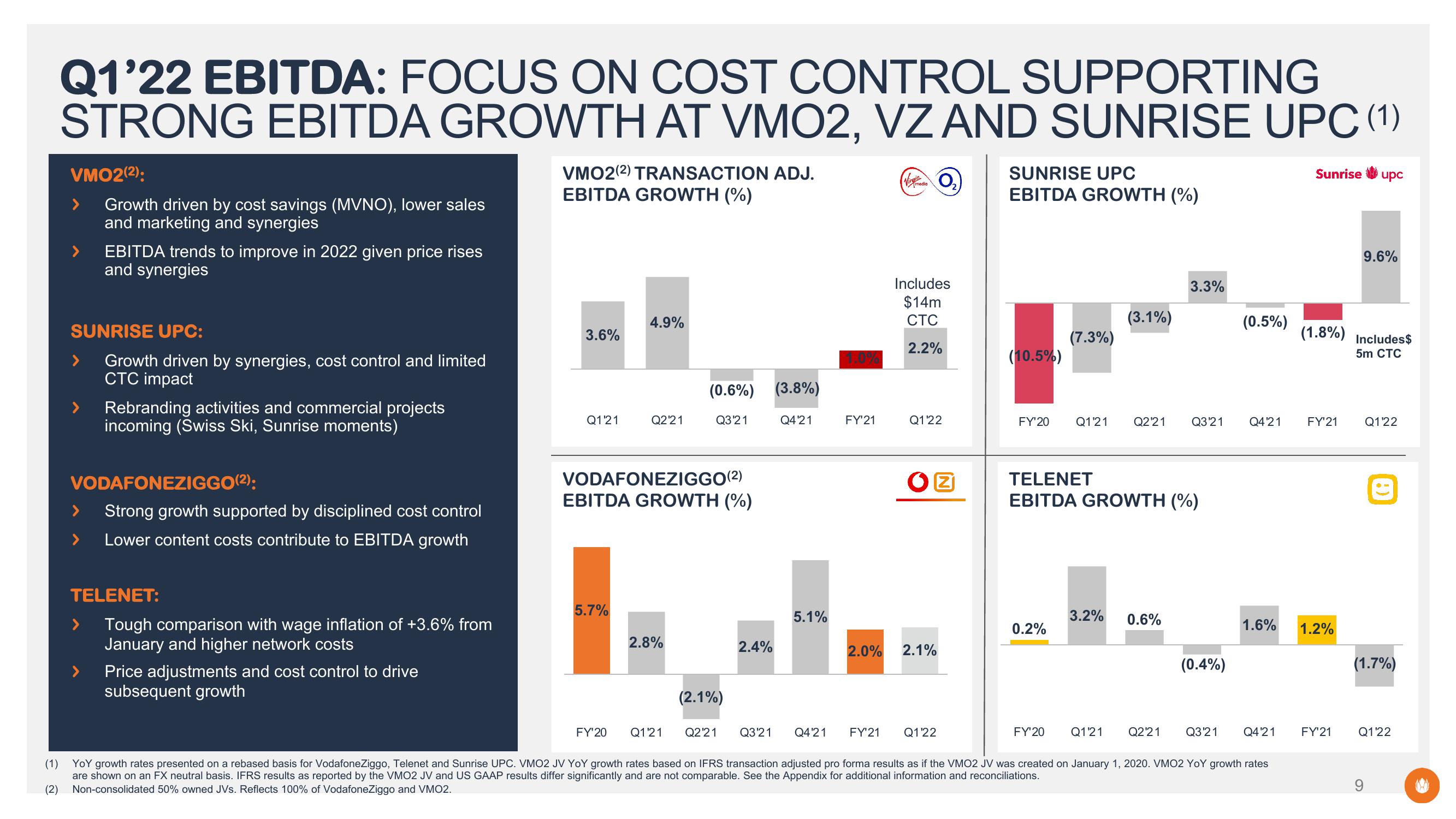

Q1'22 EBITDA: FOCUS ON COST CONTROL SUPPORTING

STRONG EBITDA GROWTH AT VMO2, VZ AND SUNRISE UPC (1)

VMO2(2):

Growth driven by cost savings (MVNO), lower sales

and marketing and synergies

EBITDA trends to improve in 2022 given price rises

and synergies

SUNRISE UPC:

Growth driven by synergies, cost control and limited

CTC impact

Rebranding activities and commercial projects

incoming (Swiss Ski, Sunrise moments)

VODAFONEZIGGO(2):

Strong growth supported by disciplined cost control

Lower content costs contribute to EBITDA growth

TELENET:

Tough comparison with wage inflation of +3.6% from

January and higher network costs

Price adjustments and cost control to drive

subsequent growth

VMO2(2) TRANSACTION ADJ.

EBITDA GROWTH (%)

3.6%

Q1'21

5.7%

4.9%

FY'20

Q2'21

VODAFONEZIGGO (²)

EBITDA GROWTH (%)

(0.6%) (3.8%)

Q3'21

2.8%

(2.1%)

2.4%

Q4'21

5.1%

FY¹21

2.0%

(VirgiO₂)

Includes

$14m

CTC

2.2%

Q1'22

OZ

2.1%

Q1'21 Q2'21 Q3'21 Q4'21 FY'21 Q1'22

SUNRISE UPC

EBITDA GROWTH (%)

(10.5%)

(7.3%)

(3.1%)

0.2%

FY'20 Q1'21 Q2'21 Q3'21

3.3%

TELENET

EBITDA GROWTH (%)

3.2% 0.6%

(0.4%)

(0.5%)

Q4'21

1.6%

FY'20 Q1'21 Q2'21 Q3'21 Q4'21

(1) YOY growth rates presented on a rebased basis for VodafoneZiggo, Telenet and Sunrise UPC. VMO2 JV YOY growth rates based on IFRS transaction adjusted pro forma results as if the VMO2 JV was created on January 1, 2020. VMO2 YoY growth rates

are shown on an FX neutral basis. IFRS results as reported by the VMO2 JV and US GAAP results differ significantly and are not comparable. See the Appendix for additional information and reconciliations.

(2) Non-consolidated 50% owned JVs. Reflects 100% of VodafoneZiggo and VMO2.

Sunrise upc

(1.8%) Includes $

5m CTC

FY'21

1.2%

9.6%

FY'21

Q1'22

A

(1.7%)

Q1'22View entire presentation