Presentation to Vermont Pension Investment Committee

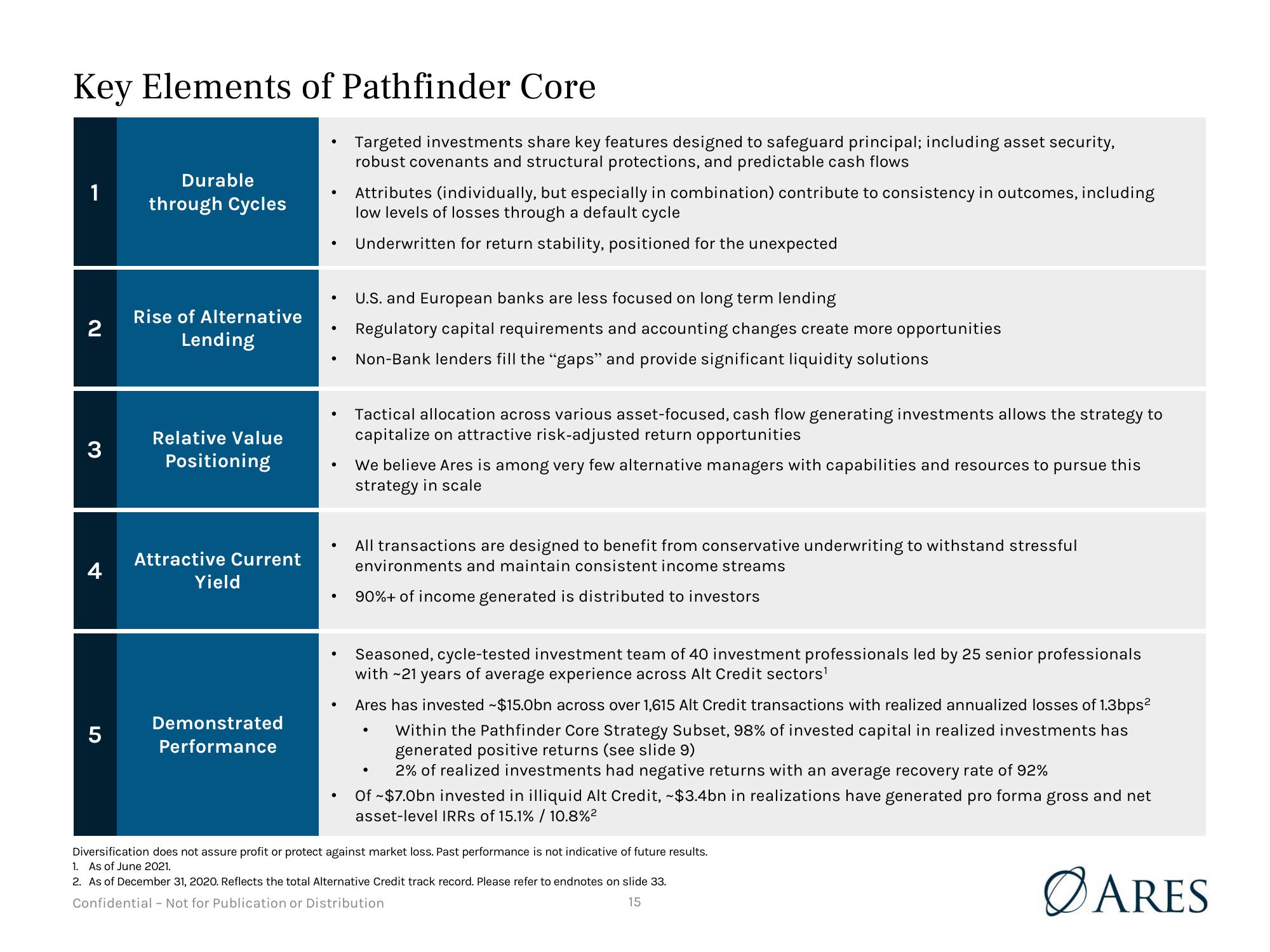

Key Elements of Pathfinder Core

1

2

3

+

5

Durable

through Cycles

Rise of Alternative

Lending

Relative Value

Positioning

Attractive Current

Yield

Demonstrated

Performance

●

●

●

Targeted investments share key features designed to safeguard principal; including asset security,

robust covenants and structural protections, and predictable cash flows

Attributes (individually, but especially in combination) contribute to consistency in outcomes, including

low levels of losses through a default cycle

Underwritten for return stability, positioned for the unexpected

U.S. and European banks are less focused on long term lending

Regulatory capital requirements and accounting changes create more opportunities

Non-Bank lenders fill the "gaps" and provide significant liquidity solutions

Tactical allocation across various asset-focused, cash flow generating investments allows the strategy to

capitalize on attractive risk-adjusted return opportunities

We believe Ares is among very few alternative managers with capabilities and resources to pursue this

strategy in scale

All transactions are designed to benefit from conservative underwriting to withstand stressful

environments and maintain consistent income streams

90%+ of income generated is distributed to investors

Seasoned, cycle-tested investment team of 40 investment professionals led by 25 senior professionals

with ~21 years of average experience across Alt Credit sectors¹

Ares has invested ~$15.0bn across over 1,615 Alt Credit transactions with realized annualized losses of 1.3bps²

Within the Pathfinder Core Strategy Subset, 98% of invested capital in realized investments has

generated positive returns (see slide 9)

2% of realized investments had negative returns with an average recovery rate of 92%

●

●

Of ~$7.0bn invested in illiquid Alt Credit, ~$3.4bn in realizations have generated pro forma gross and net

asset-level IRRS of 15.1% / 10.8%²

ØARES

Diversification does not assure profit or protect against market loss. Past performance is not indicative of future results.

1. As of June 2021.

2. As of December 31, 2020. Reflects the total Alternative Credit track record. Please refer to endnotes on slide 33.

Confidential - Not for Publication or Distribution

15View entire presentation