Spring 2023 Solar Industry Update

New Guidance on the Energy Communities Bonus

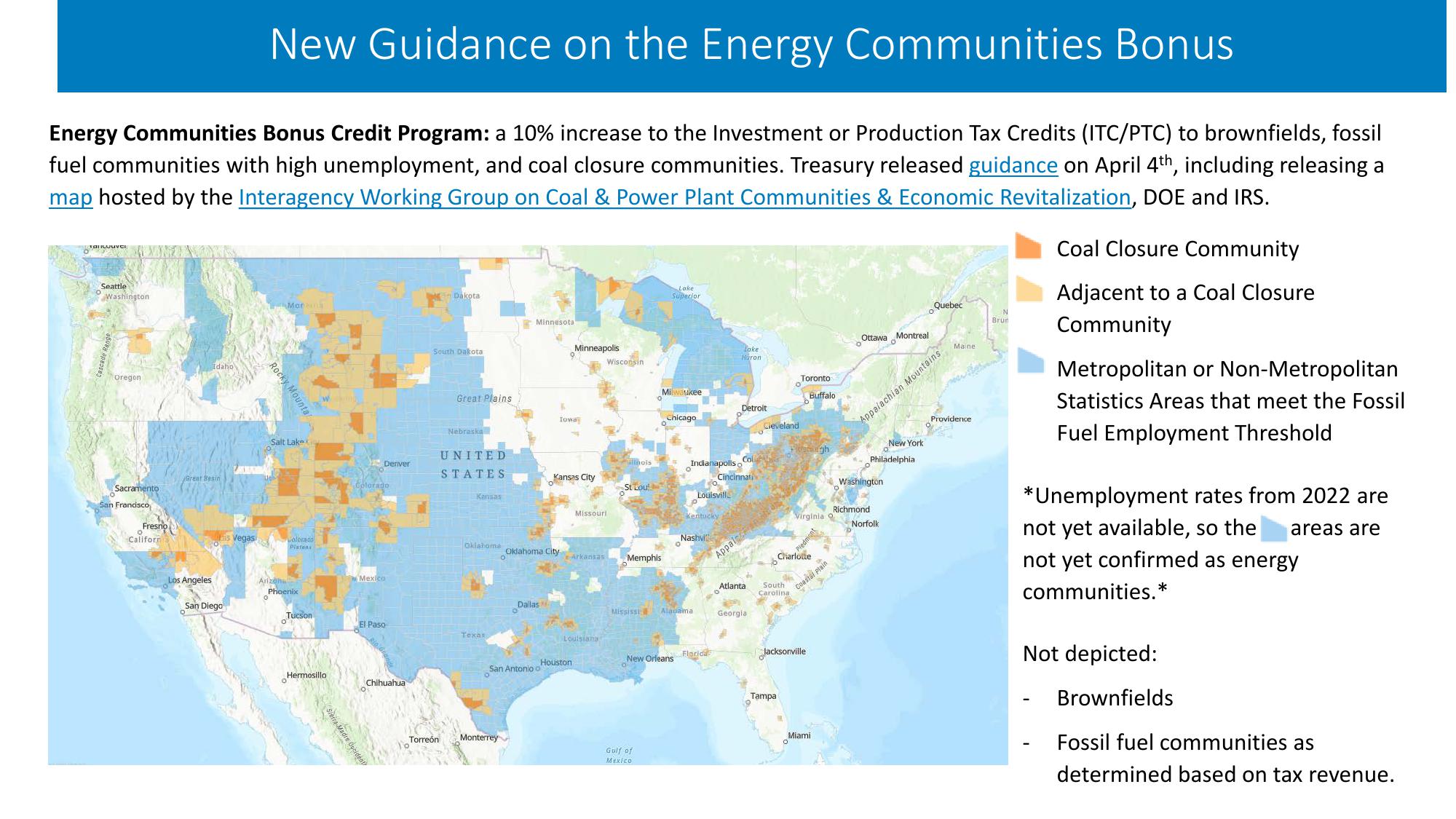

Energy Communities Bonus Credit Program: a 10% increase to the Investment or Production Tax Credits (ITC/PTC) to brownfields, fossil

fuel communities with high unemployment, and coal closure communities. Treasury released guidance on April 4th, including releasing a

map hosted by the Interagency Working Group on Coal & Power Plant Communities & Economic Revitalization, DOE and IRS.

Seattle

Washington

Maran

Oregon

Sacramento

San Francisco

Fresno

Californ

Great Besin

Los Angeles

San Diego

Rocky Mounta

Salt Lake

is Vegas

Colorado

Pistons

Arizona

Phoenix

Tucson

Hermosillo

Sierra Madre Occident

Dakota

Minnesota.

South Dakota

Minneapolis

°

Wisconsin

Great Plains

T

Iowa

Nebraska

Denver

UNITED

STATES

Colorado

Mexico

Lake

Superior

Lake

Haron

Milwaukee

Detroit

Chicago

Cleveland

-

Col

hois

Indianapolis o

Kansas City

Cincinnati

St Lou

Louisvill

Kansas

Kentucky

Nashvi

Oklahoma

Oklahoma City

Arkansas

Memphis

El Paso

Texas

Chihuahua

Torreón

Dallas

Missouri

Appalecan

b

Toronto

Buffalo

Quebec

N

Brun

Ottawa o

Montreal

Maine

Appalachian Mountains

New York

Philadelphia

Washington

Richmond

Virginia o

Norfolk

Charlotte

Atlanta South

Carolina

Mississi

Alauama

Georgia

Louisiana

Florida

New Orleans

Houston

San Antonio o

Monterrey

Gulf of

Mexico

Coastal Plain

Jacksonville

Tampa

Miami

Providence

Coal Closure Community

Adjacent to a Coal Closure

Community

Metropolitan or Non-Metropolitan

Statistics Areas that meet the Fossil

Fuel Employment Threshold

*Unemployment rates from 2022 are

not yet available, so the areas are

not yet confirmed as energy

communities.*

Not depicted:

Brownfields

Fossil fuel communities as

determined based on tax revenue.View entire presentation