jetBlue Results Presentation Deck

APPENDIX B: CALCULATION OF LEVERAGE RATIOS

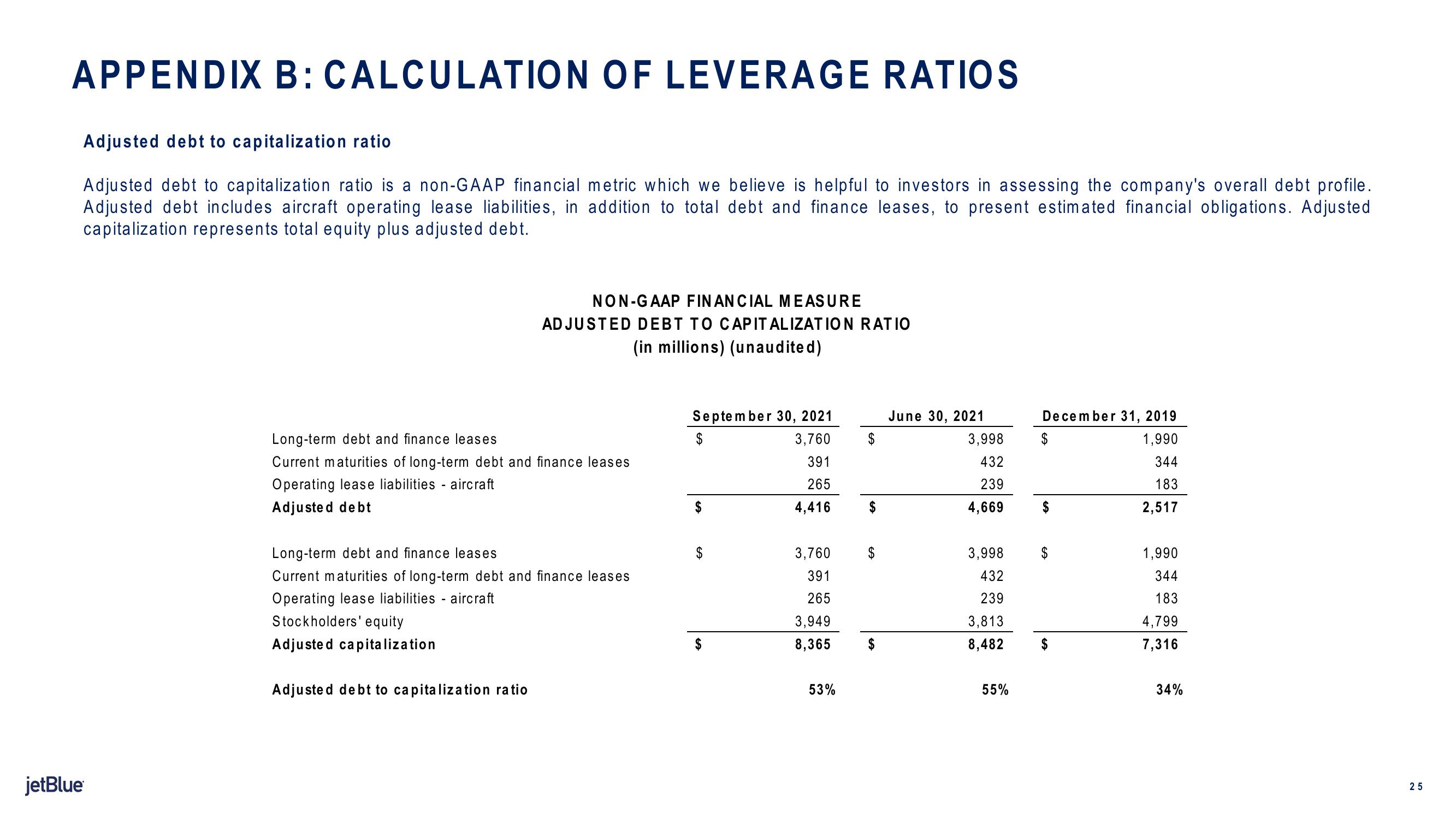

Adjusted debt to capitalization ratio

Adjusted debt to capitalization ratio is a non-GAAP financial metric which we believe is helpful to investors in assessing the company's overall debt profile.

Adjusted debt includes aircraft operating lease liabilities, in addition to total debt and finance leases, to present estimated financial obligations. Adjusted

capitalization represents total equity plus adjusted debt.

jetBlue

Long-term debt and finance leases

Current maturities of long-term debt and finance leases

Operating lease liabilities - aircraft

Adjusted debt

NON-GAAP FINANCIAL MEASURE

ADJUSTED DEBT TO CAPITALIZATION RATIO

(in millions) (unaudited)

Long-term debt and finance leases.

Current maturities of long-term debt and finance leases

Operating lease liabilities - aircraft

Stockholders' equity

Adjusted capitalization

Adjusted debt to capitalization ratio

September 30, 2021

3,760

391

265

4,416

$

$

3,760

391

265

3,949

8,365

53%

$

June 30, 2021

3,998

432

239

4,669

3,998

432

239

3,813

8,482

55%

December 31, 2019

1,990

344

183

2,517

$

1,990

344

183

4,799

7,316

34%

25View entire presentation