Imperial Brands Results Presentation Deck

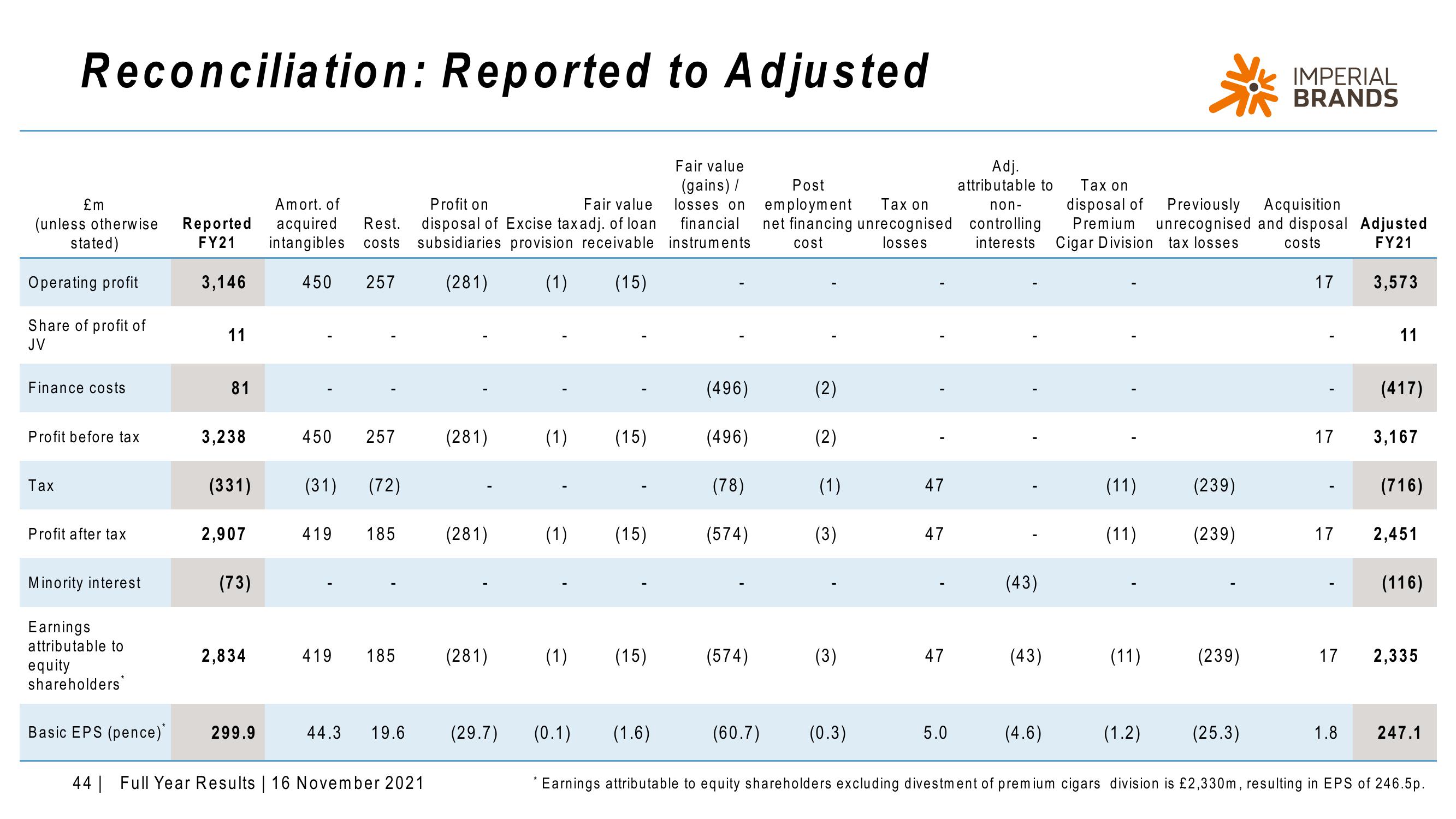

Reconciliation: Reported to Adjusted

Fair value

(gains) /

losses on

financial

instruments

£m

Amort. of

(unless otherwise Reported acquired Rest.

stated)

FY21 intangibles costs

3,146

450 257

Operating profit

Share of profit of

JV

Finance costs

Profit before tax

Tax

Profit after tax

Minority interest

Earnings

attributable to

equity

shareholders

11

81

3,238

(331)

2,907

(73)

2,834

Basic EPS (pence)* 299.9

450 257

(31) (72)

419 185

419 185

44.3 19.6

Profit on

Fair value

disposal of Excise tax adj. of loan

subsidiaries provision receivable

(281)

(1) (15)

44 | Full Year Results | 16 November 2021

(281)

(281)

(281)

(29.7)

(1) (15)

(1) (15)

(1) (15)

(0.1) (1.6)

(496)

(496)

(78)

(574)

(574)

(60.7)

Adj.

Post

attributable to

non-

employment

Tax on

net financing unrecognised controlling

cost

losses

interests

(2)

(2)

(1)

(3)

(3)

(0.3)

47

47

47

5.0

(43)

(43)

(4.6)

Tax on

disposal of Previously

Acquisition

Premium unrecognised and disposal Adjusted

Cigar Division tax losses costs

FY21

(11)

(11)

(11)

(1.2)

(239)

(239)

(239)

IMPERIAL

BRANDS

(25.3)

17

17

17

17

1.8

3,573

11

(417)

3,167

(716)

2,451

(116)

2,335

247.1

* Earnings attributable to equity shareholders excluding divestment of premium cigars division is £2,330m, resulting in EPS of 246.5p.View entire presentation