Atalaya Risk Management Overview

Relative Yield on Credit Spectrum

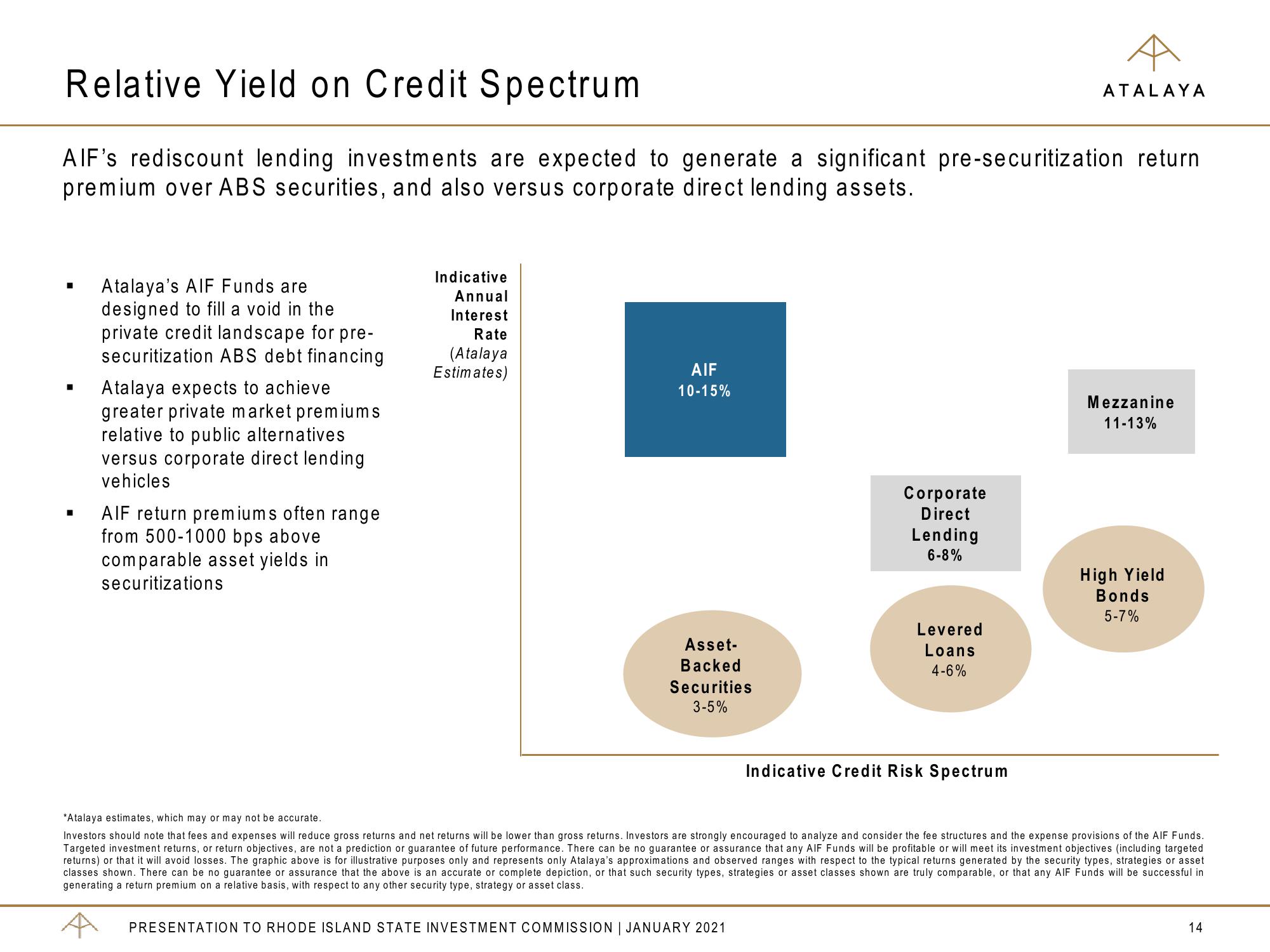

AIF's rediscount lending investments are expected to generate a significant pre-securitization return

premium over ABS securities, and also versus corporate direct lending assets.

1

Atalaya's AIF Funds are

designed to fill a void in the

private credit landscape for pre-

securitization ABS debt financing

Atalaya expects to achieve

greater private market premiums

relative to public alternatives

versus corporate direct lending

vehicles

AIF return premiums often range

from 500-1000 bps above

comparable asset yields in

securitizations

Indicative

Annual

Interest

Rate

(Atalaya

Estimates)

AIF

10-15%

Asset-

Backed

Securities

3-5%

Corporate

Direct

Lending

6-8%

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

Levered

Loans

4-6%

Indicative Credit Risk Spectrum

ATALAYA

Mezzanine

11-13%

High Yield

Bonds

5-7%

*Atalaya estimates, which may or may not be accurate.

Investors should note that fees and expenses will reduce gross returns and net returns will be lower than gross returns. Investors are strongly encouraged to analyze and consider the fee structures and the expense provisions of the AIF Funds.

Targeted investment returns, or return objectives, are not a prediction or guarantee of future performance. There can be no guarantee or assurance that any AIF Funds will be profitable or will meet its investment objectives (including targeted

returns) or that it will avoid losses. The graphic above is for illustrative purposes only and represents only Atalaya's approximations and observed ranges with respect to the typical returns generated by the security types, strategies or asset

classes shown. There can be no guarantee or assurance that the above is an accurate or complete depiction, or that such security types, strategies or asset classes shown are truly comparable, or that any AIF Funds will be successful in

generating a return premium on a relative basis, with respect to any other security type, strategy or asset class.

14View entire presentation