Baird Investment Banking Pitch Book

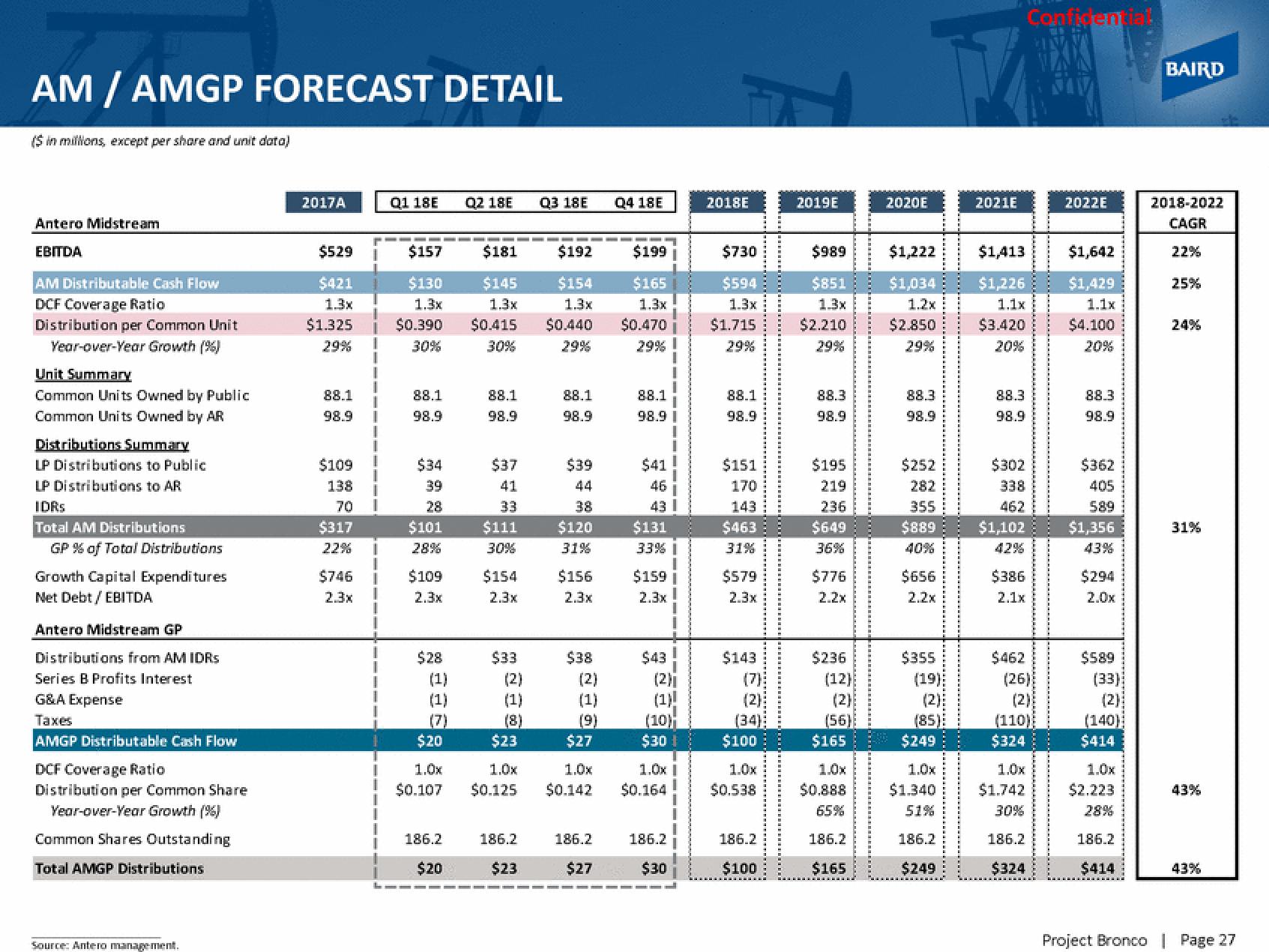

AM / AMGP FORECAST DETAIL

($ in millions, except per share and unit data)

Antero Midstream

EBITDA

AM Distributable Cash Flow

DCF Coverage Ratio

Distribution per Common Unit

Year-over-Year Growth (%)

Unit Summary

Common Units Owned by Public

Common Units Owned by AR

Distributions Summary

LP Distributions to Public

LP Distributions to AR

IDRS

Total AM Distributions

GP % of Total Distributions

Growth Capital Expenditures

Net Debt / EBITDA

Antero Midstream GP

Distributions from AM IDRS

Series B Profits Interest

G&A Expense

Taxes

AMGP Distributable Cash Flow

DCF Coverage Ratio

Distribution per Common Share

Year-over-Year Growth (%)

Common Shares Outstanding

Total AMGP Distributions

Source: Antero management.

2017A

$529

$421

1.3x

$1.325

29%

88.1

98.9

$109

138

70

$317

22%

$746

2.3x

Q1 18E

$157

$130

1.3x

$0.390

30%

88.1

98.9

$34

39

28

$101

28%

$109

2.3x

$28

(1)

(1)

(7)

$20

1.0x

$0.107

186.2

$20

Q2 18E

$181

$145

1.3x

$0.415

30%

88.1

98.9

$37

41

33

$111

30%

$154

2.3x

$33

(2)

(1)

(8)

$23

1.0x

$0.125

186.2

$23

Q3 18E

$192

$154

1.3x

$0.440

88.1

98.9

$39

44

38

$120

31%

$156

2.3x

$38

(2)

(1)

(9)

$27

1.0x

$0.142

186.2

$27

Q4 18E

T

$199

$165

1.3x

$0.470

29% I

88.1

98.9 I

$41

46

43 1

$131

33% 1

$159 |

2.3x!

$43

(2)

(1)

(10)

$30 1

1.0x I

$0.164

186.2

$30

2018E

$730

$594

1.3x

$1.715

29%

88.1

98.9

$151

170

143

$463

31%

$579

2.3x

$143

(7)

(2)

(34)

$100

1.0x

$0.538

186.2

$100

2019E

$989

$851

1.3x

$2.210

29%

88.3

98.9

$195

219

236

$649

36%

$776

2.2x

$236

(12)

(2)

(56)

$165

1.0x

$0.888

65%

186.2

$165

2020E

$1,222

$1,034

1.2x

$2.850

29%

88.3

98.9

$252

282

355

$889

40%

$656

2.2x

$355

(19)

(2):

(85)

$249

1.0x

$1.340

51%

186.2

$249

2021E

$1,413

$1,226

1.1x

$3.420

20%

88.3

98.9

$302

338

462

$1,102

42%

$386

2.1x

$462

Confidential

(26)

(2)

(110)

$324

1,0x

$1.742

30%

186.2

$324

2022E

$1,642

$1,429

1.1x

$4.100

20%

88.3

98.9

$362

405

589

$1,356

43%

$294

2.0x

$589

(33)

(2)

(140)

$414

1.0x

$2.223

28%

186.2

$414

BAIRD

2018-2022

CAGR

22%

25%

24%

31%

43%

43%

Project Bronco | Page 27View entire presentation