Appreciate SPAC Presentation Deck

APPENDIX

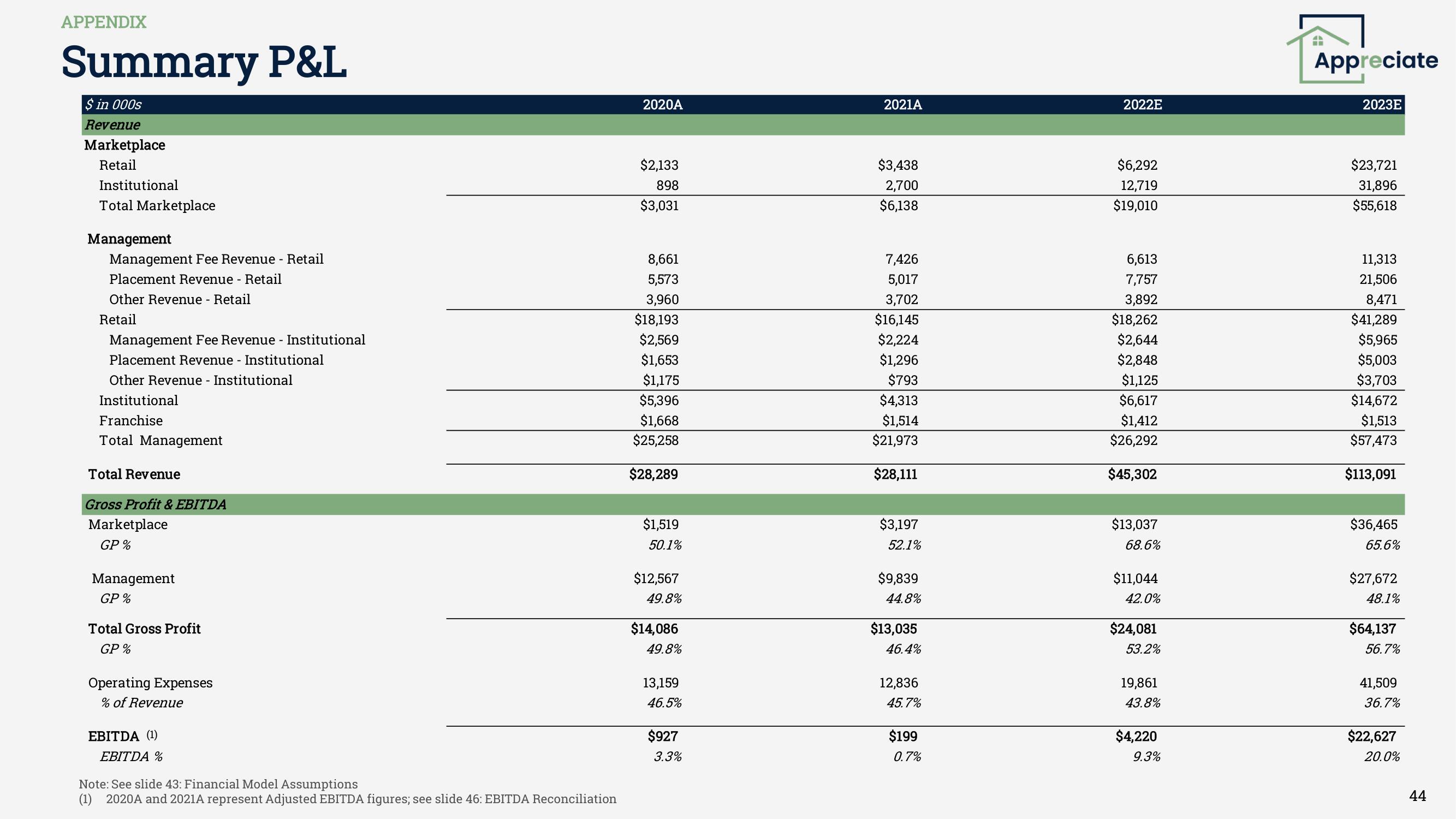

Summary P&L

$ in 000s

Revenue

Marketplace

Retail

Institutional

Total Marketplace

Management

Management Fee Revenue - Retail

Placement Revenue - Retail

Other Revenue - Retail

Retail

Management Fee Revenue - Institutional

Placement Revenue - Institutional

Other Revenue - Institutional

Institutional

Franchise

Total Management

Total Revenue

Gross Profit & EBITDA

Marketplace

GP %

Management

GP %

Total Gross Profit

GP%

Operating Expenses

% of Revenue

EBITDA (1)

EBITDA %

Note: See slide 43: Financial Model Assumptions

(1) 2020A and 2021A represent Adjusted EBITDA figures; see slide 46: EBITDA Reconciliation

2020A

$2,133

898

$3,031

8,661

5,573

3,960

$18,193

$2,569

$1,653

$1,175

$5,396

$1,668

$25,258

$28,289

$1,519

50.1%

$12,567

49.8%

$14,086

49.8%

13,159

46.5%

$927

3.3%

2021A

$3,438

2,700

$6,138

7,426

5,017

3,702

$16,145

$2,224

$1,296

$793

$4,313

$1,514

$21,973

$28,111

$3,197

52.1%

$9,839

44.8%

$13,035

46.4%

12,836

45.7%

$199

0.7%

2022E

$6,292

12,719

$19,010

6,613

7,757

3,892

$18,262

$2,644

$2,848

$1,125

$6,617

$1,412

$26,292

$45,302

$13,037

68.6%

$11,044

42.0%

$24,081

53.2%

19,861

43.8%

$4,220

9.3%

4

Appreciate

2023E

$23,721

31,896

$55,618

11,313

21,506

8,471

$41,289

$5,965

$5,003

$3,703

$14,672

$1,513

$57,473

$113,091

$36,465

65.6%

$27,672

48.1%

$64,137

56.7%

41,509

36.7%

$22,627

20.0%

44View entire presentation