zSpace SPAC

Transaction Overview - zSpace X

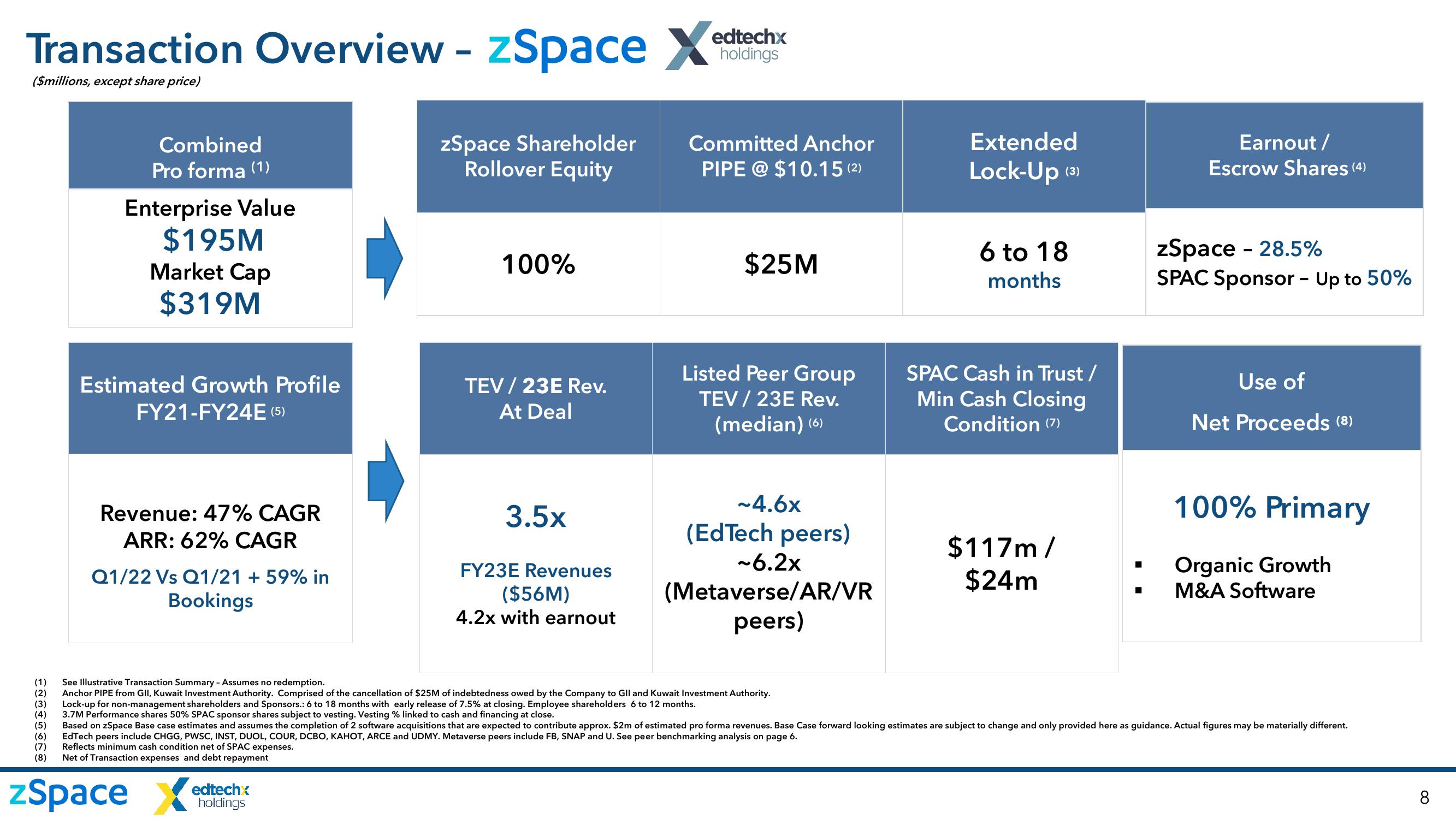

($millions, except share price)

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

Combined

Pro forma (1)

Enterprise Value

$195M

Market Cap

$319M

Estimated Growth Profile

FY21-FY24E (5)

Revenue: 47% CAGR

ARR: 62% CAGR

Q1/22 Vs Q1/21 +59% in

Bookings

zSpace Shareholder

Rollover Equity

zSpace X

100%

edtechx

holdings

TEV/23E Rev.

At Deal

3.5x

FY23E Revenues

($56M)

4.2x with earnout

edtechx

holdings

Committed Anchor

PIPE @ $10.15 (²)

$25M

Listed Peer Group

TEV / 23E Rev.

(median) (6)

See Illustrative Transaction Summary - Assumes no redemption.

Anchor PIPE from GII, Kuwait Investment Authority. Comprised of the cancellation of $25M of indebtedness owed by the Company to GIl and Kuwait Investment Authority.

Lock-up for non-management shareholders and Sponsors.: 6 to 18 months with early release of 7.5% at closing. Employee shareholders 6 to 12 months.

3.7M Performance shares 50% SPAC sponsor shares subject to vesting. Vesting % linked to cash and financing at close.

~4.6x

(EdTech peers)

~6.2x

(Metaverse/AR/VR

peers)

Extended

Lock-Up (3)

6 to 18

months

SPAC Cash in Trust /

Min Cash Closing

Condition (7)

$117m/

$24m

Earnout/

Escrow Shares (4)

zSpace - 28.5%

SPAC Sponsor - Up to 50%

Use of

Net Proceeds (8)

Based on zSpace Base case estimates and assumes the completion of 2 software acquisitions that are expected to contribute approx. $2m of estimated pro forma revenues. Base Case forward looking estimates are subject to change and only provided here as guidance. Actual figures may be materially different.

EdTech peers include CHGG, PWSC, INST, DUOL, COUR, DCBO, KAHOT, ARCE and UDMY. Metaverse peers include FB, SNAP and U. See peer benchmarking analysis on page 6.

Reflects minimum cash condition net of SPAC expenses.

Net of Transaction expenses and debt repayment

100% Primary

Organic Growth

M&A Software

8View entire presentation