JFL Equity Investors VI, L.P Recommendation Report

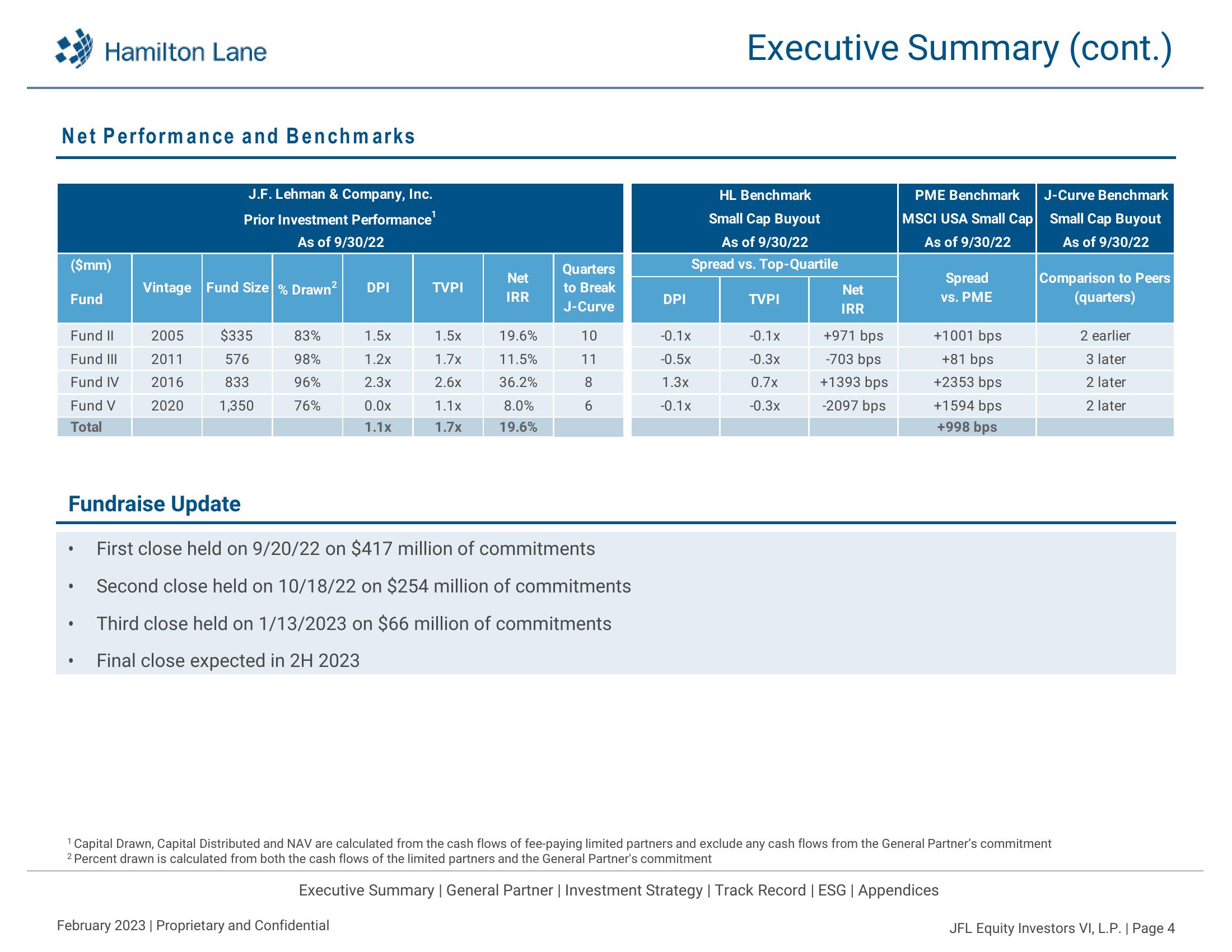

Net Performance and Benchmarks

($mm)

Fund

Hamilton Lane

Fund II

Fund III

Fund IV

Fund V

Total

●

●

●

J.F. Lehman & Company, Inc.

Prior Investment Performance¹

As of 9/30/22

Vintage Fund Size % Drawn²

2005

2011

2016

2020

$335

576

833

1,350

83%

98%

96%

76%

DPI

1.5x

1.2x

2.3x

0.0x

1.1x

TVPI

February 2023 | Proprietary and Confidential

1.5x

1.7x

2.6x

1.1x

1.7x

Net

IRR

Fundraise Update

First close held on 9/20/22 on $417 million of commitments

Second close held on 10/18/22 on $254 million of commitments

Third close held on 1/13/2023 on $66 million of commitments

Final close expected in 2H 2023

19.6%

11.5%

36.2%

8.0%

19.6%

Quarters

to Break

J-Curve

10

11

8

6

DPI

Executive Summary (cont.)

HL Benchmark

Small Cap Buyout

As of 9/30/22

Spread vs. Top-Quartile

-0.1x

-0.5x

1.3x

-0.1x

TVPI

-0.1x

-0.3x

0.7x

-0.3x

Net

IRR

+971 bps

-703 bps

+1393 bps

-2097 bps

PME Benchmark

MSCI USA Small Cap

As of 9/30/22

Spread

vs. PME

+1001 bps

+81 bps

+2353 bps

+1594 bps

+998 bps

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

J-Curve Benchmark

Small Cap Buyout

As of 9/30/22

¹ Capital Drawn, Capital Distributed and NAV are calculated from the cash flows of fee-paying limited partners and exclude any cash flows from the General Partner's commitment

2 Percent drawn is calculated from both the cash flows of the limited partners and the General Partner's commitment

Comparison to Peers

(quarters)

2 earlier

3 later

2 later

2 later

JFL Equity Investors VI, L.P. | Page 4View entire presentation