Crocs Investor Presentation Deck

NON-GAAP RECONCILIATION (CONT'D)

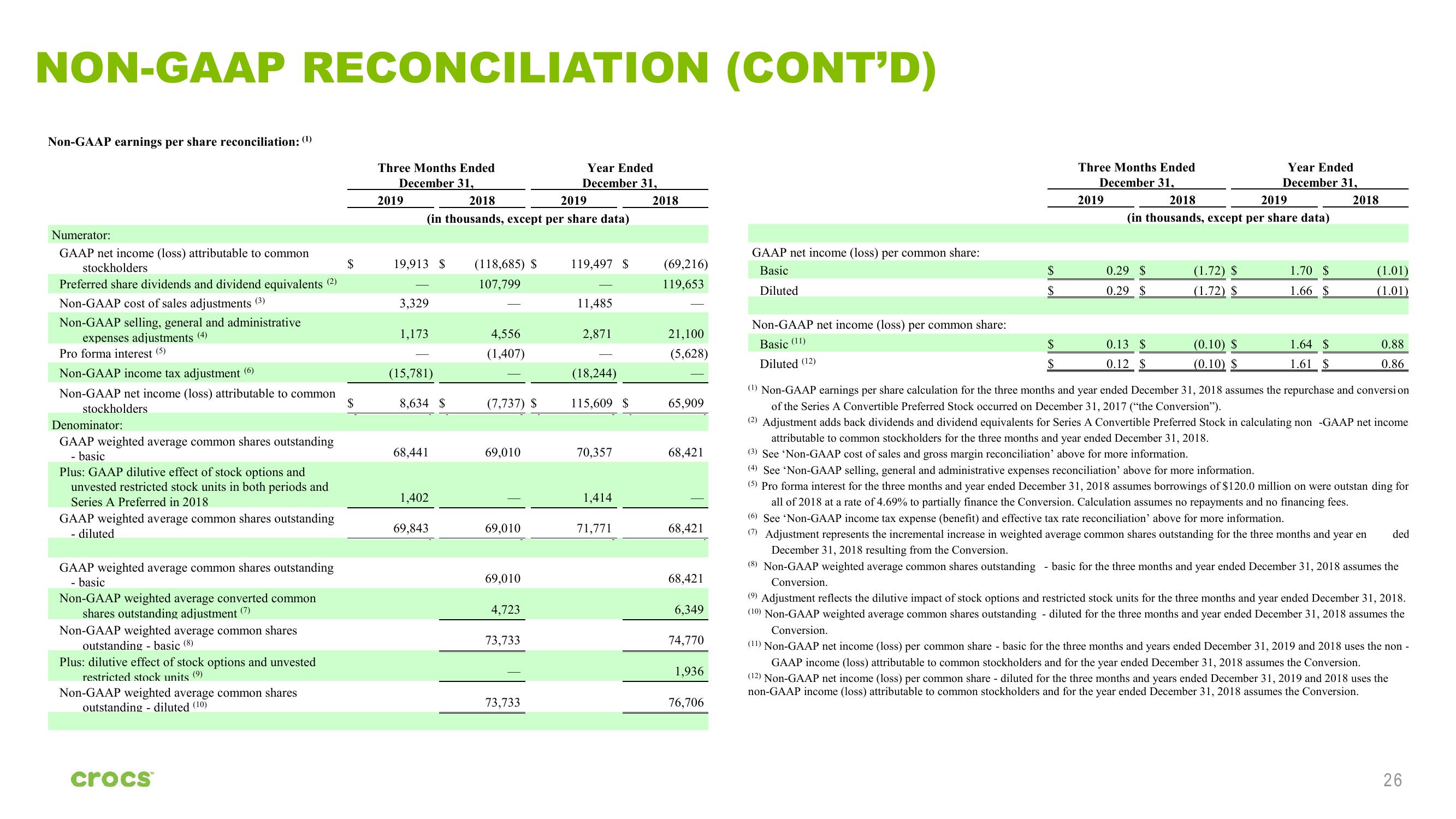

Non-GAAP earnings per share reconciliation: (¹)

Numerator:

GAAP net income (loss) attributable to common

stockholders

$

Preferred share dividends and dividend equivalents (2)

Non-GAAP cost of sales adjustments (3)

Non-GAAP selling, general and administrative

expenses adjustments (4)

Pro forma interest (5)

Non-GAAP income tax adjustment (6)

Non-GAAP net income (loss) attributable to common

stockholders

Denominator:

GAAP weighted average common shares outstanding

- basic

Plus: GAAP dilutive effect of stock options and

unvested restricted stock units in both periods and

Series A Preferred in 2018

GAAP weighted average common shares outstanding

- diluted

GAAP weighted average common shares outstanding

- basic

Non-GAAP weighted average converted common

shares outstanding adjustment (7)

Non-GAAP weighted average common shares

outstanding basic (8)

Plus: dilutive effect of stock options and unvested

restricted stock units (9)

Non-GAAP weighted average common shares

outstanding diluted (10)

crocs™

$

Three Months Ended

December 31,

2019

2019

2018

(in thousands, except per share data)

19,913 $ (118,685) $

107,799

3,329

1,173

(15,781)

8,634 $

68,441

1,402

69,843

4,556

(1,407)

(7,737) $

69,010

69,010

69,010

4,723

73,733

Year Ended

December 31,

73,733

119,497 $

11,485

2,871

(18,244)

115,609 $

70,357

1,414

71,771

2018

(69,216)

119,653

21,100

(5,628)

65,909

68,421

68,421

68,421

6,349

74,770

1,936

76,706

GAAP net income (loss) per common share:

Basic

Diluted

Non-GAAP net income (loss) per common share:

Basic (11)

Diluted (12)

$

$

$

$

Three Months Ended

December 31,

2019

2018

2019

(in thousands, except per share data)

0.29 S

0.29 $

0.13 $

0.12 $

(1.72) $

(1.72) $

Year Ended

December 31,

2018

(0.10) $

(0.10) $

1.70 $

1.66 $

1.64 $

1.61 $

(1.01)

(1.01)

0.88

0.86

(¹) Non-GAAP earnings per share calculation for the three months and year ended December 31, 2018 assumes the repurchase and conversion

of the Series A Convertible Preferred Stock occurred on December 31, 2017 ("the Conversion").

(2) Adjustment adds back dividends and dividend equivalents for Series A Convertible Preferred Stock in calculating non -GAAP net income

attributable to common stockholders for the three months and year ended December 31, 2018.

(3) See 'Non-GAAP cost of sales and gross margin reconciliation' above for more information.

(4) See 'Non-GAAP selling, general and administrative expenses reconciliation' above for more information.

(5) Pro forma interest for the three months and year ended December 31, 2018 assumes borrowings of $120.0 million on were outstan ding for

all of 2018 at a rate of 4.69% to partially finance the Conversion. Calculation assumes no repayments and no financing fees.

(6) See 'Non-GAAP income tax expense (benefit) and effective tax rate reconciliation' above for more information.

(7) Adjustment represents the incremental increase in weighted average common shares outstanding for the three months and year en ded

December 31, 2018 resulting from the Conversion.

(8) Non-GAAP weighted average common shares outstanding - basic for the three months and year ended December 31, 2018 assumes the

Conversion.

(9) Adjustment reflects the dilutive impact of stock options and restricted stock units for the three months and year ended December 31, 2018.

(10) Non-GAAP weighted average common shares outstanding - diluted for the three months and year ended December 31, 2018 assumes the

Conversion.

(11) Non-GAAP net income (loss) per common share - basic for the three months and years ended December 31, 2019 and 2018 uses the non-

GAAP income (loss) attributable to common stockholders and for the year ended December 31, 2018 assumes the Conversion.

(12) Non-GAAP net income (loss) per common share - diluted for the three months and years ended December 31, 2019 and 2018 uses the

non-GAAP income (loss) attributable to common stockholders and for the year ended December 31, 2018 assumes the Conversion.

26View entire presentation