Recommendation Report

Hamilton Lane

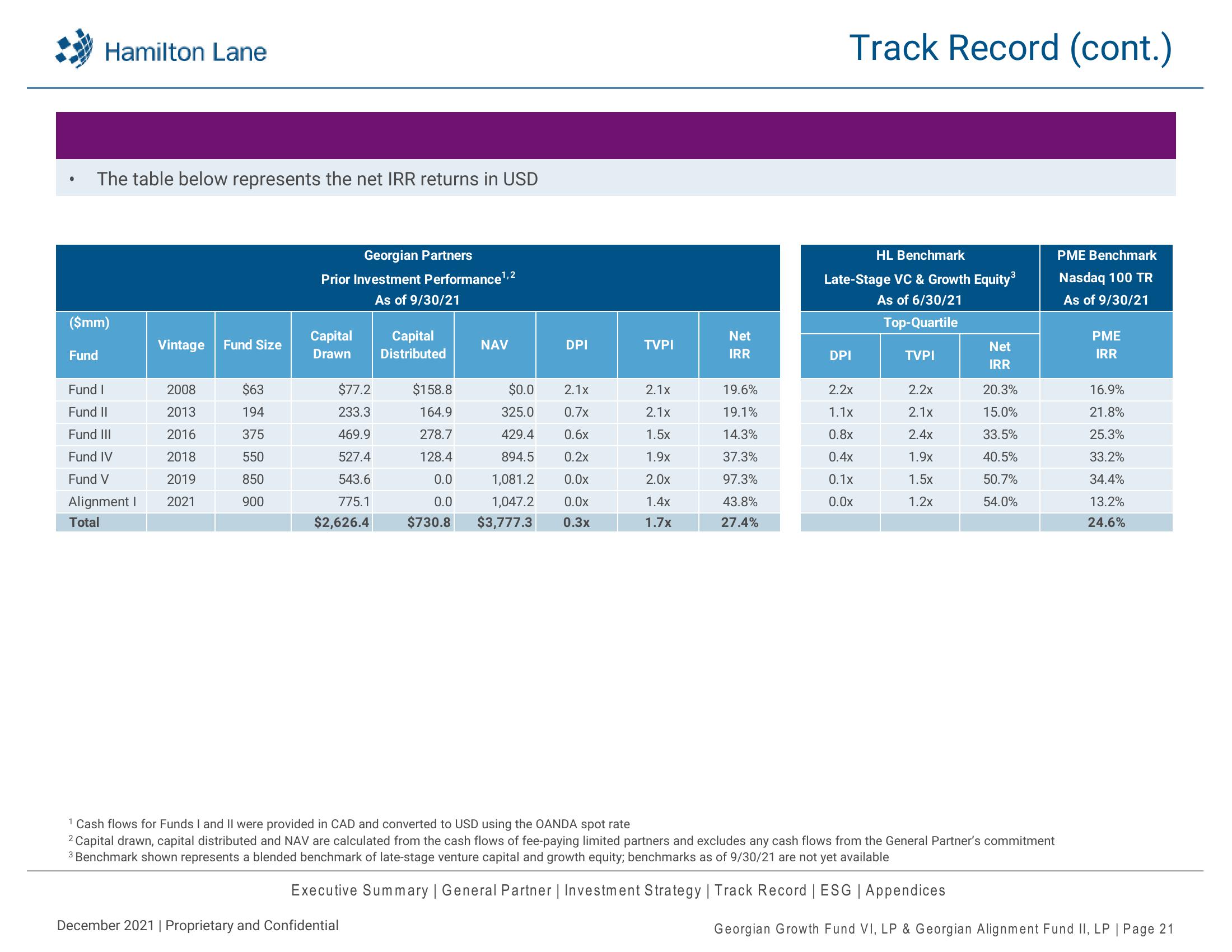

The table below represents the net IRR returns in USD

($mm)

Fund

Fund I

Fund II

Fund III

Fund IV

Fund V

Alignment I

Total

Vintage Fund Size

2008

2013

2016

2018

2019

2021

$63

194

375

550

850

900

Georgian Partners

Prior Investment Performance ¹,2

As of 9/30/21

Capital

Drawn

$77.2

233.3

469.9

527.4

543.6

775.1

$2,626.4

Capital

Distributed

December 2021 | Proprietary and Confidential

$158.8

164.9

278.7

128.4

0.0

0.0

$730.8

NAV

DPI

$0.0 2.1x

325.0

0.7x

429.4 0.6x

0.2x

894.5

1,081.2 0.0x

1,047.2 0.0x

$3,777.3 0.3x

TVPI

2.1x

2.1x

1.5x

1.9x

2.0x

1.4x

1.7x

Net

IRR

19.6%

19.1%

14.3%

37.3%

97.3%

43.8%

27.4%

Track Record (cont.)

HL Benchmark

Late-Stage VC & Growth Equity³

As of 6/30/21

Top-Quartile

DPI

2.2x

1.1x

0.8x

0.4x

0.1x

0.0x

TVPI

2.2x

2.1x

2.4x

1.9x

1.5x

1.2x

Net

IRR

20.3%

15.0%

33.5%

40.5%

50.7%

54.0%

1 Cash flows for Funds I and II were provided in CAD and converted to USD using the OANDA spot rate

2 Capital drawn, capital distributed and NAV are calculated from the cash flows of fee-paying limited partners and excludes any cash flows from the General Partner's commitment

3 Benchmark shown represents a blended benchmark of late-stage venture capital and growth equity; benchmarks as of 9/30/21 are not yet available

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

PME Benchmark

Nasdaq 100 TR

As of 9/30/21

PME

IRR

16.9%

21.8%

25.3%

33.2%

34.4%

13.2%

24.6%

Georgian Growth Fund VI, LP & Georgian Alignment Fund II, LP | Page 21View entire presentation