2Q YTD Cash Flow Summary

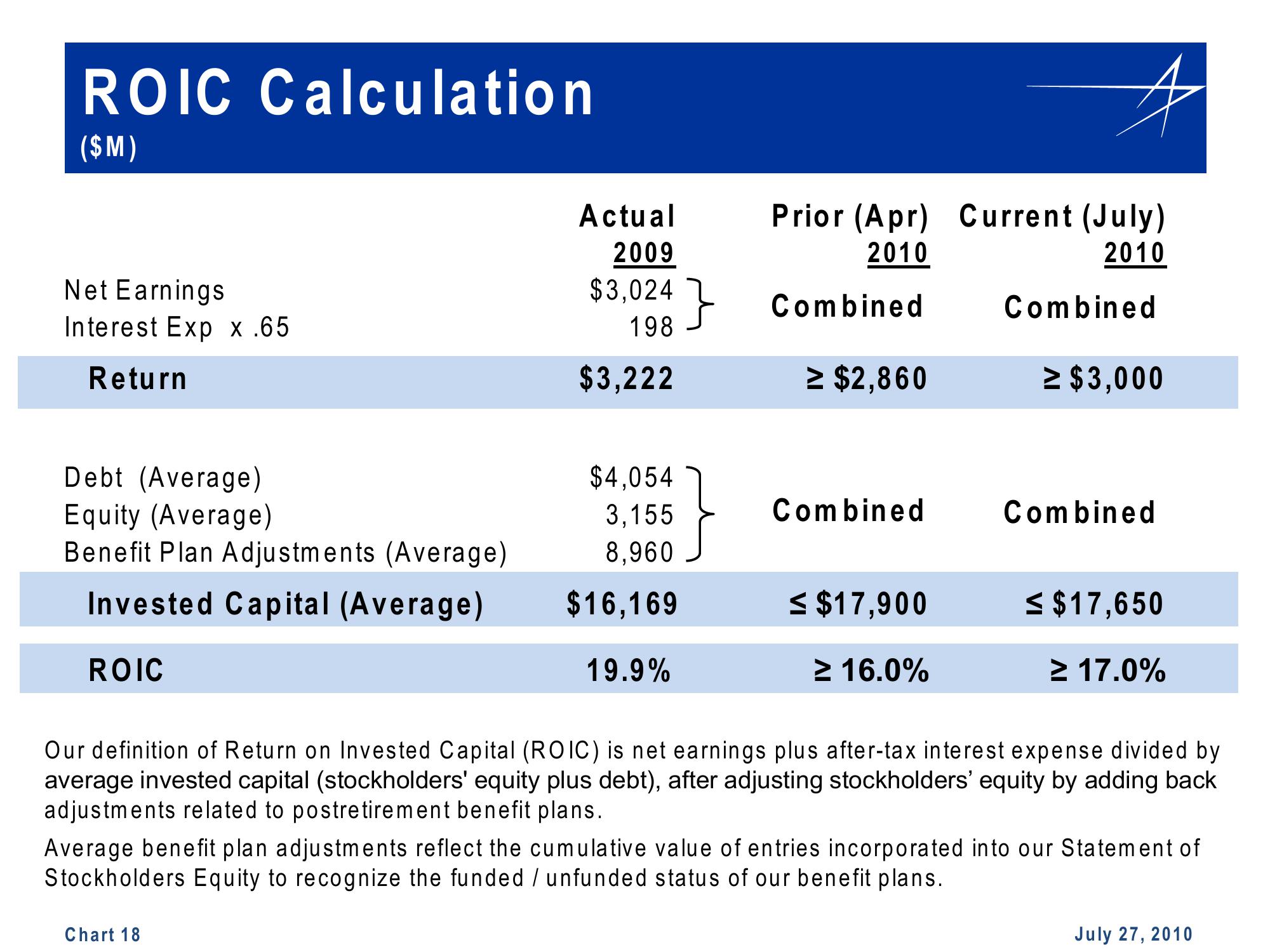

ROIC Calculation

($M)

Net Earnings

Interest Exp x .65

Return

Debt (Average)

Equity (Average)

Benefit Plan Adjustments (Average)

Invested Capital (Average)

ROIC

Actual

2009

$3,024}

198

$3,222

Chart 18

$4,054

3,155

8,960

$16,169

19.9%

Prior (Apr) Current (July)

2010

2010

Combined

≥ $2,860

Combined

4

≤ $17,900

≥ 16.0%

Combined

≥ $3,000

Combined

≤ $17,650

≥ 17.0%

Our definition of Return on Invested Capital (ROIC) is net earnings plus after-tax interest expense divided by

average invested capital (stockholders' equity plus debt), after adjusting stockholders' equity by adding back

adjustments related to postretirement benefit plans.

Average benefit plan adjustments reflect the cumulative value of entries incorporated into our Statement of

Stockholders Equity to recognize the funded / unfunded status of our benefit plans.

July 27, 2010View entire presentation