Clover Health SPAC Presentation Deck

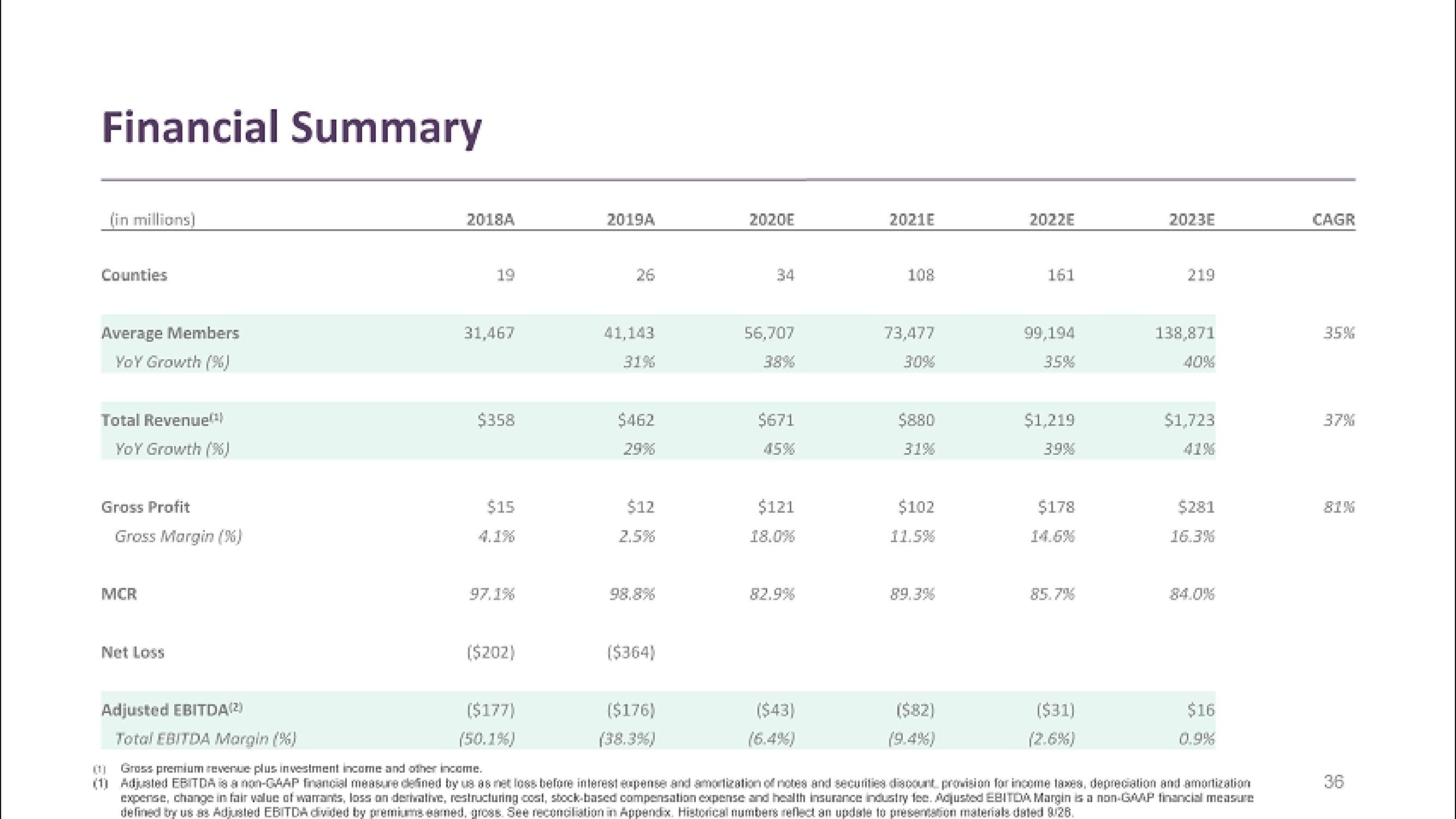

Financial Summary

(in millions)

Counties

Average Members

YOY Growth (%)

Total Revenue(¹)

YOY Growth (%)

Gross Profit

Gross Margin (%)

MCR

Net Loss

Adjusted EBITDA (2)

Total EBITDA Margin (%)

2018A

19

31,467

$358

$15

97.1%

($202)

($177)

(50.1%)

2019A

41,143

31%

$462

29%

$12

($364)

($176)

2020E

34

56,707

$671

$121

18.0%

82.9%

($43)

2021E

108

73,477

30%

$880

31%

$102

11.5%

89.3%

($82)

(9.4%)

2022E

161

99,194

35%

$1,219

39%

$178

($31)

2023E

219

138,871

40%

$1,723

41%

$281

16.3%

$16

0.9%

(01)

Gross premium revenue plus investment income and other income.

(1) Adjusted EBITDA is a non-GAAP financial measure defined by us as net loss before interest expense and amortization of notes and securities discount, provision for income taxes, depreciation and amortization

expense, change in fair value of warrants, loss on derivative, restructuring cost, stock-based compensation expense and health insurance industry fee. Adjusted EBITDA Margin is a non-GAAP financial measure

defined by us as Adjusted EBITDA divided by premiums esmed, gross. See reconciliation in Appendix. Historical numbers reflect an update to presentation materials dated 9/28.

CAGR

35%

37%

81%

36View entire presentation