Solid Power SPAC Presentation Deck

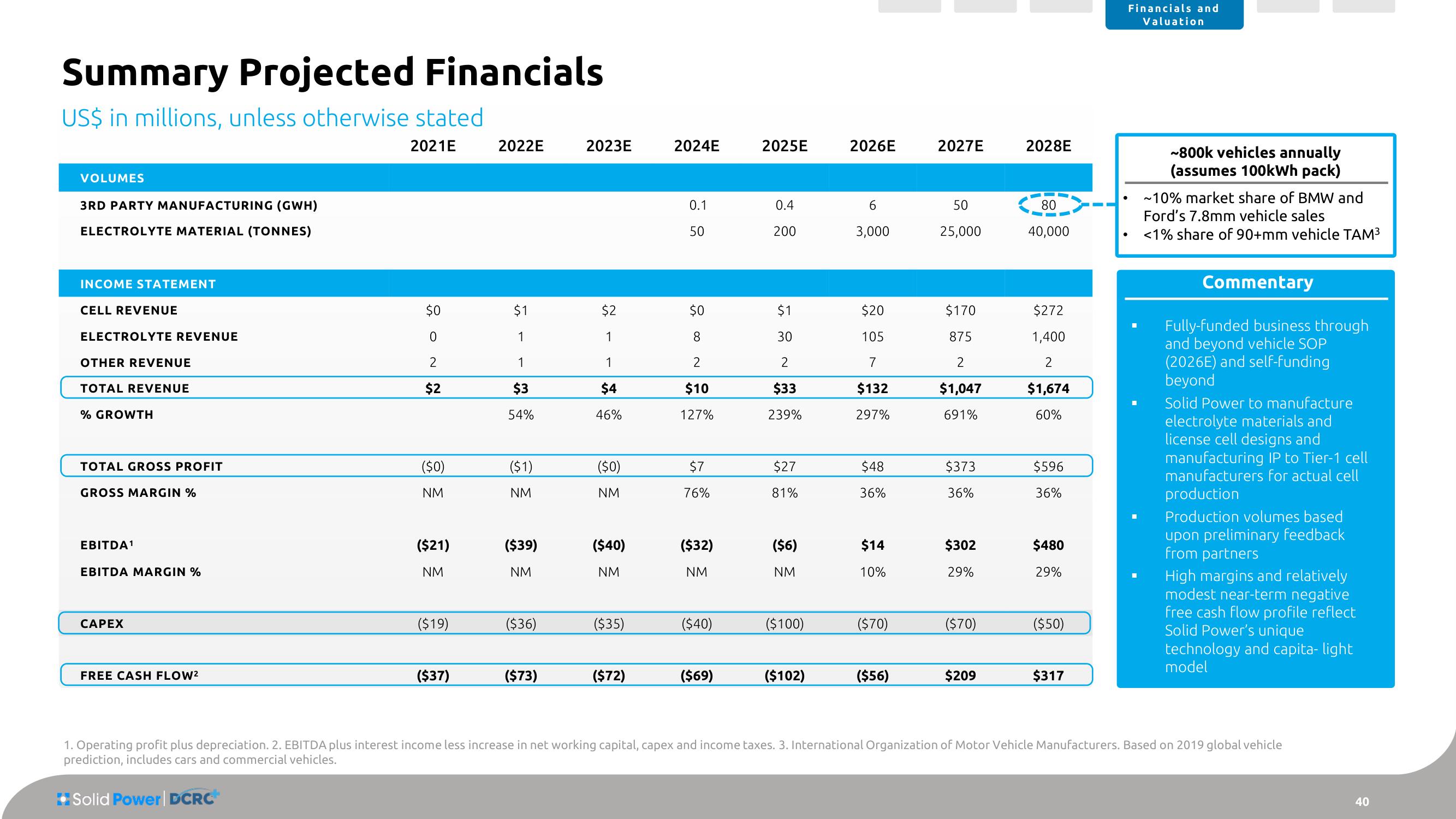

Summary Projected Financials

US$ in millions, unless otherwise stated

2021E

VOLUMES

3RD PARTY MANUFACTURING (GWH)

ELECTROLYTE MATERIAL (TONNES)

INCOME STATEMENT

CELL REVENUE

ELECTROLYTE REVENUE

OTHER REVENUE

TOTAL REVENUE

% GROWTH

TOTAL GROSS PROFIT

GROSS MARGIN %

EBITDA¹

EBITDA MARGIN %

CAPEX

FREE CASH FLOW²

$0

0

2

$2

($0)

NM

($21)

NM

($19)

($37)

2022E

$1

1

1

$3

54%

($1)

NM

($39)

NM

($36)

($73)

2023E

$2

1

1

$4

46%

($0)

NM

($40)

NM

($35)

($72)

2024E

0.1

50

0 8

$0

2

$10

127%

$7

76%

($32)

NM

($40)

($69)

2025E

0.4

200

$1

30

2

$33

239%

$27

81%

($6)

NM

($100)

($102)

2026E

6

3,000

$20

105

7

$132

297%

$48

36%

$14

10%

($70)

($56)

2027E

50

25,000

$170

875

2

$1,047

691%

$373

36%

$302

29%

($70)

$209

2028E

80

40,000

$272

1,400

2

$1,674

60%

$596

36%

$480

29%

($50)

$317

Financials and

Valuation

●

~800k vehicles annually

(assumes 100kWh pack)

~10% market share of BMW and

Ford's 7.8mm vehicle sales

<1% share of 90+mm vehicle TAM³

Commentary

Fully-funded business through

and beyond vehicle SOP

(2026E) and self-funding

beyond

Solid Power to manufacture

electrolyte materials and

license cell designs and

manufacturing IP to Tier-1 cell

manufacturers for actual cell

production

Production volumes based

upon preliminary feedback

from partners

High margins and relatively

modest near-term negative

free cash flow profile reflect

Solid Power's unique

technology and capita- light

model

1. Operating profit plus depreciation. 2. EBITDA plus interest income less increase in net working capital, capex and income taxes. 3. International Organization of Motor Vehicle Manufacturers. Based on 2019 global vehicle

prediction, includes cars and commercial vehicles.

Solid Power | DCRC

40View entire presentation