Astra SPAC Presentation Deck

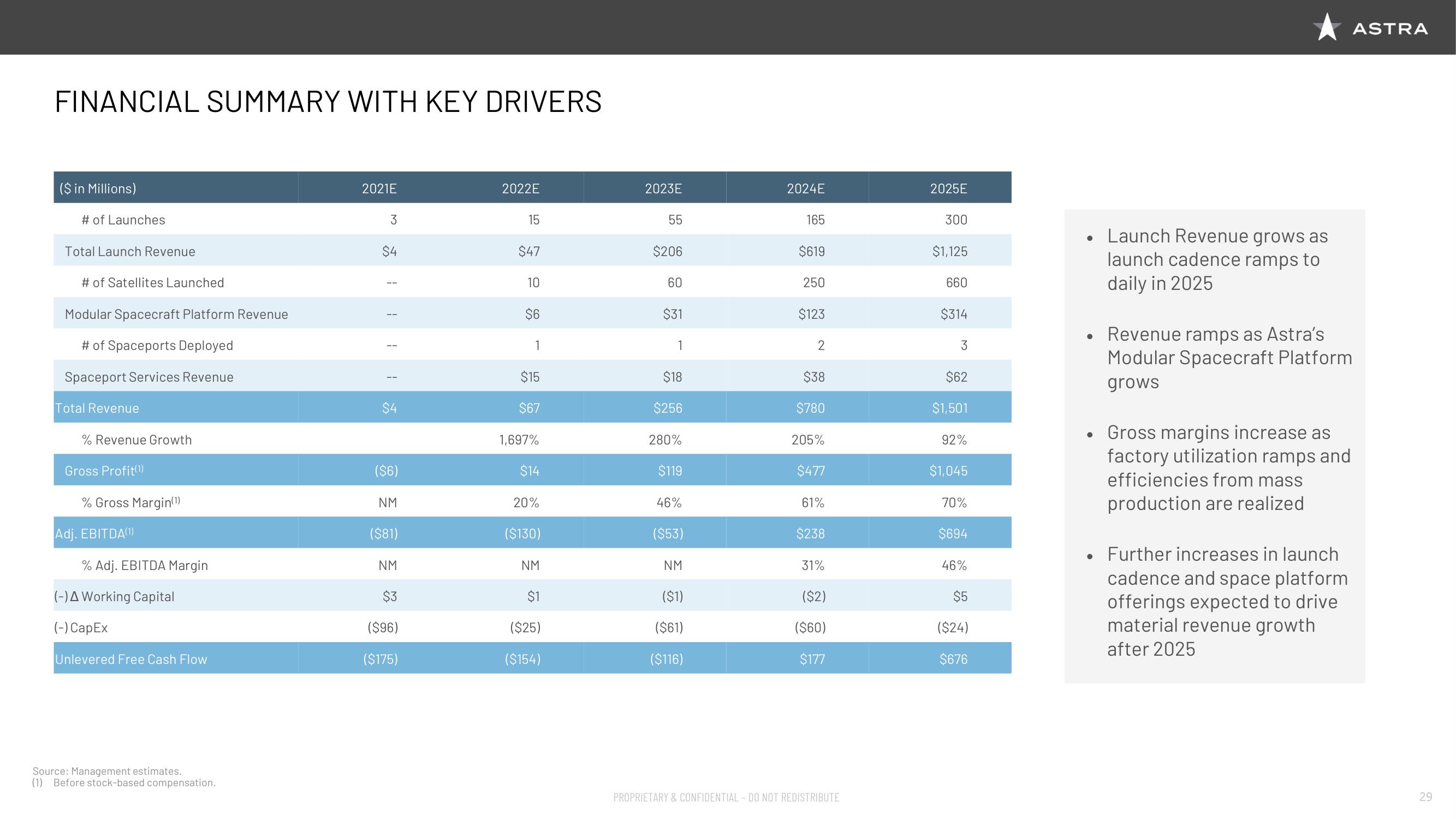

FINANCIAL SUMMARY WITH KEY DRIVERS

($ in Millions)

# of Launches

Total Launch Revenue

# of Satellites Launched

Modular Spacecraft Platform Revenue

# of Spaceports Deployed

Spaceport Services Revenue

Total Revenue

% Revenue Growth

Gross Profit(1)

% Gross Margin(1)

Adj. EBITDA(1)

% Adj. EBITDA Margin

(-) A Working Capital

(-) CapEx

Unlevered Free Cash Flow

Source: Management estimates.

(1) Before stock-based compensation.

2021E

3

$4

($6)

NM

($81)

NM

$3

($96)

($175)

2022E

15

$47

10

$6

1

$15

$67

1,697%

$14

20%

($130)

NM

$1

($25)

($154)

2023E

55

$206

60

$31

1

$18

$256

280%

$119

46%

($53)

NM

($1)

($61)

($116)

2024E

165

$619

250

$123

2

$38

$780

205%

$477

61%

$238

31%

($2)

($60)

$177

PROPRIETARY & CONFIDENTIAL - DO NOT REDISTRIBUTE

2025E

300

$1,125

660

$314

3

$62

$1,501

92%

$1,045

70%

$694

46%

$5

($24)

$676

• Launch Revenue grows as

launch cadence ramps to

daily in 2025

●

●

●

Revenue ramps as Astra's

Modular Spacecraft Platform

grows

Gross margins increase as

factory utilization ramps and

efficiencies from mass

production are realized

Further increases in launch

cadence and space platform

offerings expected to drive

material revenue growth

after 2025

ASTRA

29View entire presentation