LionTree Investment Banking Pitch Book

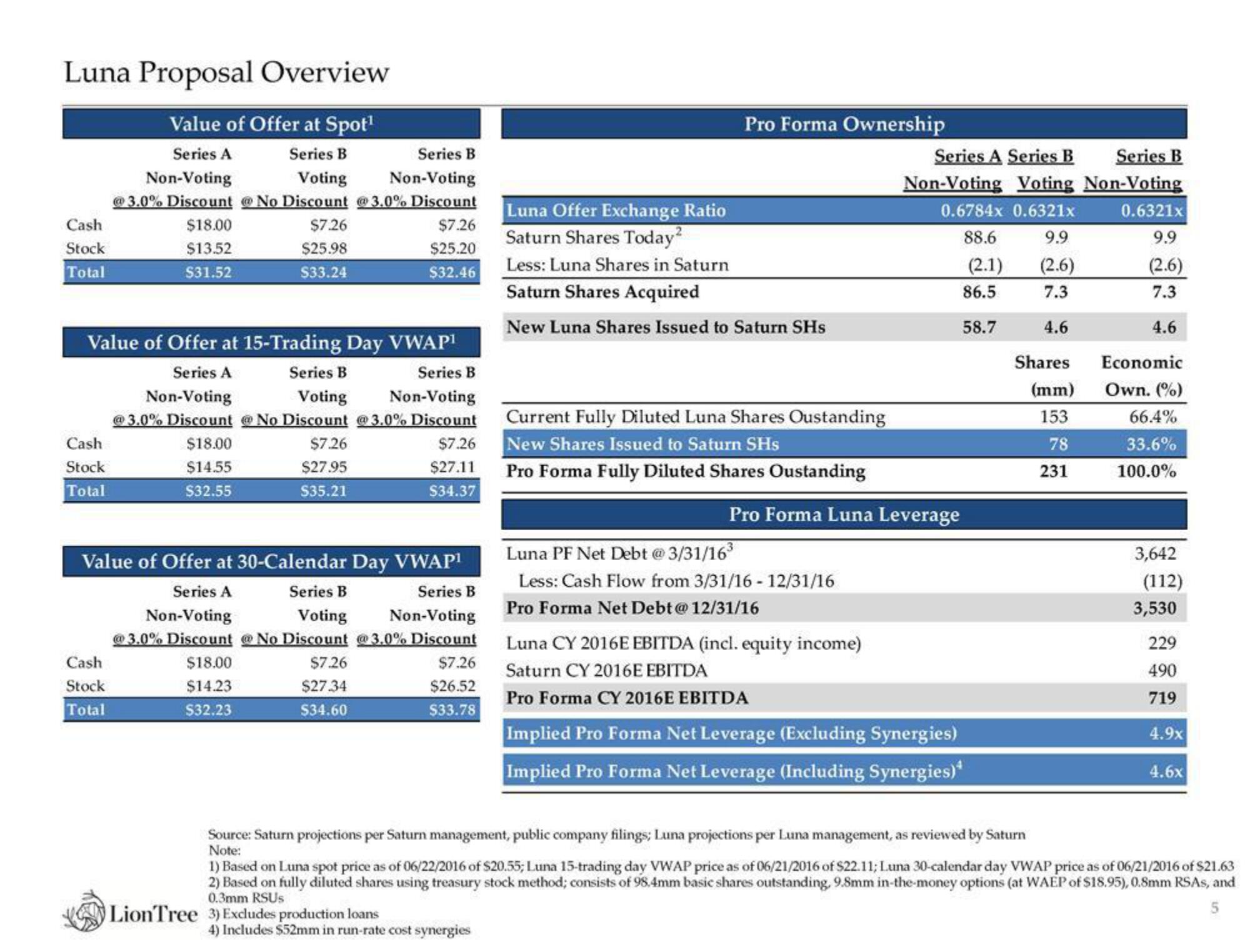

Luna Proposal Overview

Value of Offer at Spot¹

Series A

Series B

Series B

Non-Voting

Voting

Non-Voting

@3.0% Discount @ No Discount @3.0% Discount

Cash

Stock

Total

Cash

Stock

Total

$18.00

$13.52

$31.52

Value of Offer at 15-Trading Day VWAP¹

Series B

Series A

Series B

Non-Voting

Voting Non-Voting

@3.0% Discount @ No Discount @3.0% Discount

$7.26

$18.00

$7.26

$14.55

$27.95

$27.11

$32.55

$35.21

$34.37

Cash

Stock

Total

$7.26

$25.98

$33.24

Value of Offer at 30-Calendar Day VWAP¹

Series A

Series B

Series B

Non-Voting

Voting Non-Voting

@3.0% Discount @ No Discount @3.0% Discount

$18.00

$14.23

$32.23

$7.26

$25.20

$32.46

$7.26

$27.34

$34.60

$7.26

$26.52

$33.78

LionTree 3) Excludes production loans

Pro Forma Ownership

Luna Offer Exchange Ratio

Saturn Shares Today²

Less: Luna Shares in Saturn

Saturn Shares Acquired

New Luna Shares Issued to Saturn SHs

4) Includes $52mm in run-rate cost synergies

Current Fully Diluted Luna Shares Oustanding

New Shares Issued to Saturn SHs

Pro Forma Fully Diluted Shares Oustanding

Pro Forma Luna Leverage

Luna PF Net Debt @ 3/31/16³

Less: Cash Flow from 3/31/16 - 12/31/16

Pro Forma Net Debt@ 12/31/16

Series B

Series A Series B

Non-Voting Voting Non-Voting

0.6321x

0.6784x 0.6321x

88.6

9.9

(2.1)

(2.6)

7.3

4.6

Luna CY 2016E EBITDA (incl. equity income)

Saturn CY 2016E EBITDA

Pro Forma CY 2016E EBITDA

86.5

58.7

Implied Pro Forma Net Leverage (Excluding Synergies)

Implied Pro Forma Net Leverage (Including Synergies)*

Source: Saturn projections per Saturn management, public company filings; Luna projections per Luna management, as reviewed by Saturn

Note:

9.9

(2.6)

7.3

4.6

Shares

(mm)

153

78

231

Economic

Own. (%)

66.4%

33.6%

100.0%

3,642

(112)

3,530

229

490

719

4.9x

1) Based on Luna spot price as of 06/22/2016 of $20.55; Luna 15-trading day VWAP price as of 06/21/2016 of $22.11; Luna 30-calendar day VWAP price as of 06/21/2016 of $21.63

2) Based on fully diluted shares using treasury stock method; consists of 98,4mm basic shares outstanding, 9.8mm in-the-money options (at WAEP of $18.95), 0.8mm RSAs, and

0.3mm RSUs

5

4.6xView entire presentation