Melrose Results Presentation Deck

Structures: results

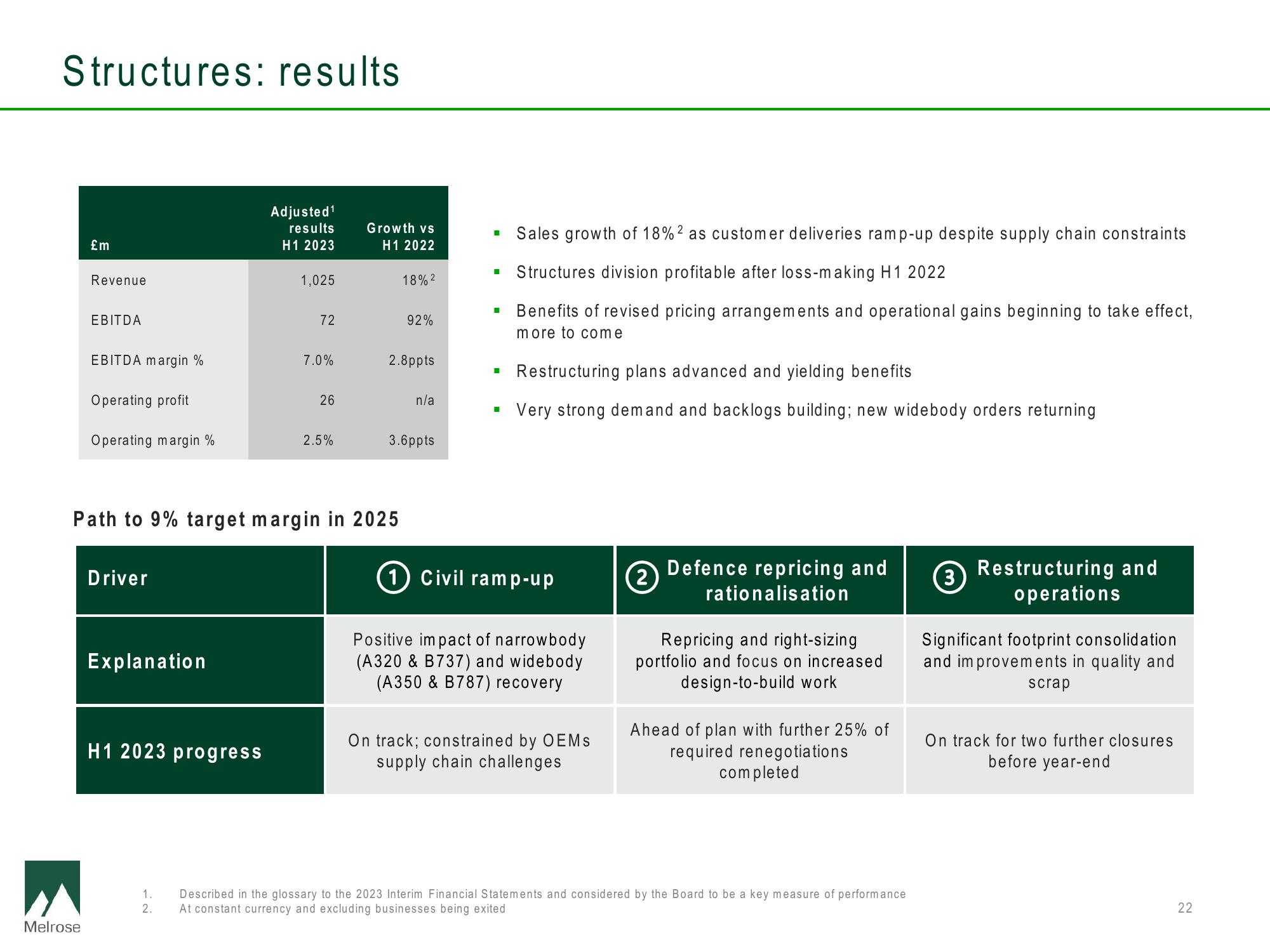

£m

Melrose

Revenue

EBITDA

EBITDA margin %

Operating profit

Operating margin %

Driver

Explanation

H1 2023 progress

Adjusted ¹

results

H1 2023

1.

2.

1,025

72

7.0%

26

Path to 9% target margin in 2025

2.5%

Growth vs

H1 2022

18% 2

2.8ppts

92%

1

3.6ppts

n/a

■

I

■

·

Sales growth of 18%2 as customer deliveries ramp-up despite supply chain constraints

Structures division profitable after loss-making H1 2022

Benefits of revised pricing arrangements and operational gains beginning to take effect,

more to come

Restructuring plans advanced and yielding benefits

Very strong demand and backlogs building; new widebody orders returning

Civil ramp-up

Positive impact of narrowbody

(A320 & B737) and widebody

(A350 & B787) recovery

On track; constrained by OEMs

supply chain challenges

(2)

Defence repricing and

rationalisation

Repricing and right-sizing

portfolio and focus on increased

design-to-build work

Ahead of plan with further 25% of

required renegotiations

completed

Described in the glossary to the 2023 Interim Financial Statements and considered by the Board to be a key measure of performance

At constant currency and excluding businesses being exited

3

Restructuring and

operations

Significant footprint consolidation

and improvements in quality and

scrap

On track for two further closures

before year-end

22View entire presentation