J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

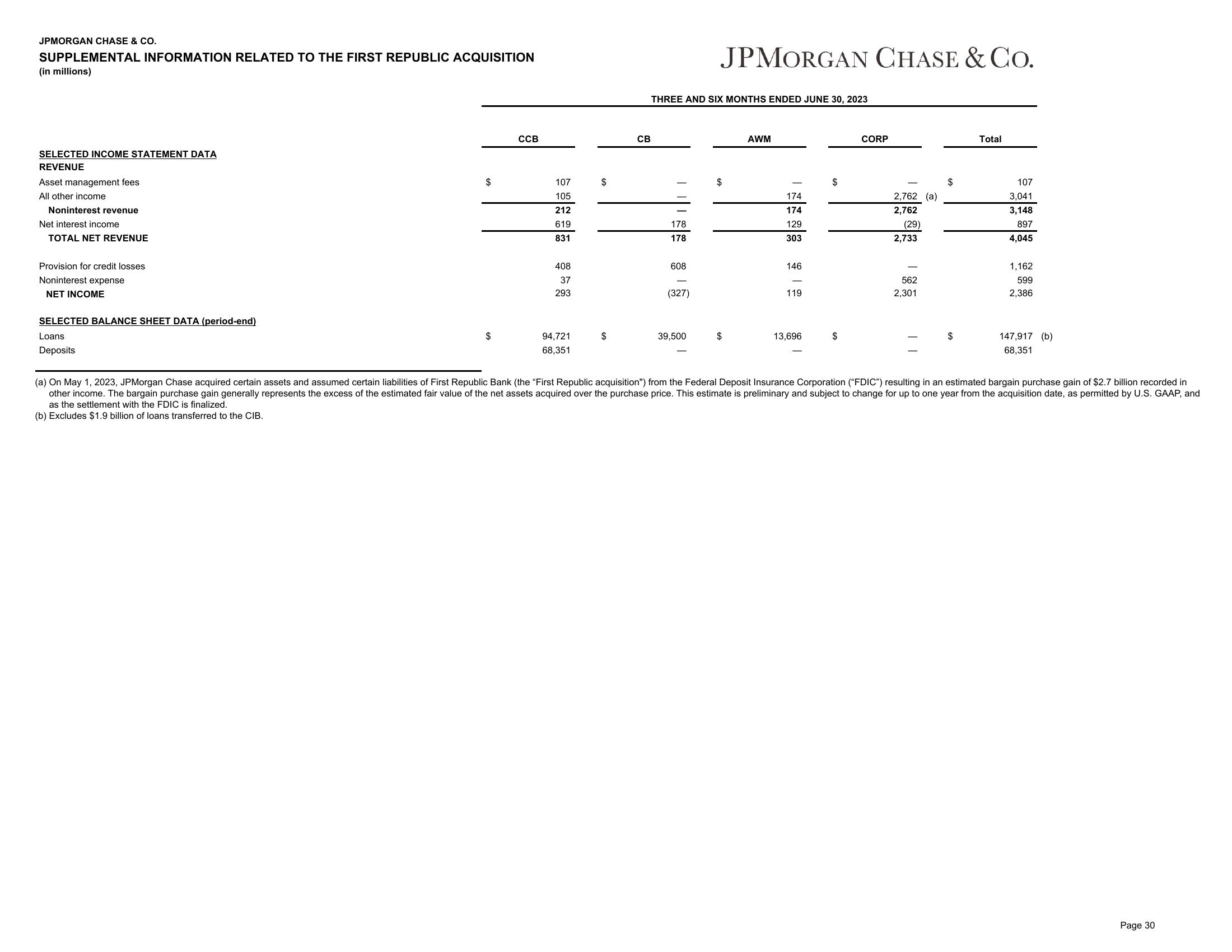

SUPPLEMENTAL INFORMATION RELATED TO THE FIRST REPUBLIC ACQUISITION

(in millions)

SELECTED INCOME STATEMENT DATA

REVENUE

Asset management fees

All other income

Noninterest revenue

Net interest income

TOTAL NET REVENUE

Provision for credit losses

Noninterest expense

NET INCOME

SELECTED BALANCE SHEET DATA (period-end)

Loans

Deposits

$

$

CCB

107

105

212

619

831

408

37

293

94,721

68,351

$

$

THREE AND SIX MONTHS ENDED JUNE 30, 2023

CB

178

178

608

(327)

JPMORGAN CHASE & Co.

39,500

$

$

AWM

174

174

129

303

146

119

13,696

$

$

CORP

2,762 (a)

2,762

(29)

2,733

562

2,301

$

$

Total

107

3,041

3,148

897

4,045

1,162

599

2,386

147,917 (b)

68,351

(a) On May 1, 2023, JPMorgan Chase acquired certain assets and assumed certain liabilities of First Republic Bank (the "First Republic acquisition") from the Federal Deposit Insurance Corporation ("FDIC") resulting in an estimated bargain purchase gain of $2.7 billion recorded in

other income. The bargain purchase gain generally represents the excess of the estimated fair value of the net assets acquired over the purchase price. This estimate is preliminary and subject to change for up to one year from the acquisition date, as permitted by U.S. GAAP, and

as the settlement with the FDIC is finalized.

(b) Excludes $1.9 billion of loans transferred to the CIB.

Page 30View entire presentation