Melrose Mergers and Acquisitions Presentation Deck

Key point 4: Potential profit recovery remaining

Melrose

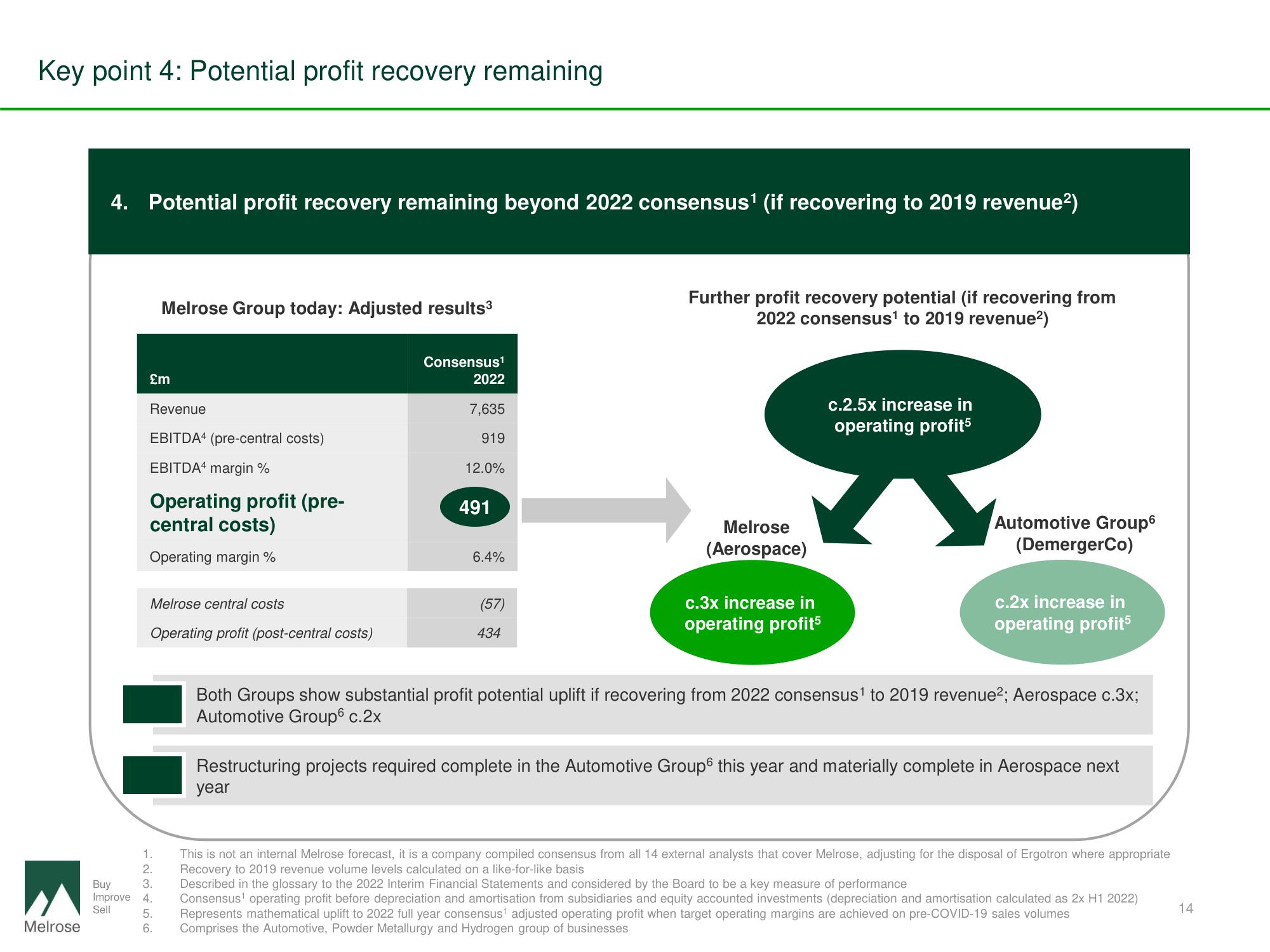

4. Potential profit recovery remaining beyond 2022 consensus¹ (if recovering to 2019 revenue²)

Melrose Group today: Adjusted results³

£m

Revenue

EBITDA4 (pre-central costs)

EBITDA4 margin %

Operating profit (pre-

central costs)

Operating margin %

Melrose central costs

Operating profit (post-central costs)

1.

2.

Buy

3.

Improve 4.

Sell

5.

6.

Consensus¹

2022

7,635

919

year

12.0%

491

6.4%

(57)

434

Further profit recovery potential (if recovering from

2022 consensus¹ to 2019 revenue²)

Melrose

(Aerospace)

c.3x increase in

operating profit5

c.2.5x increase in

operating profit5

Automotive Group6

(DemergerCo)

c.2x increase in

operating profit5

Both Groups show substantial profit potential uplift if recovering from 2022 consensus¹ to 2019 revenue²; Aerospace c.3x;

Automotive Group6 c.2x

Restructuring projects required complete in the Automotive Group this year and materially complete in Aerospace next

This is not an internal Melrose forecast, it is a company compiled consensus from all 14 external analysts that cover Melrose, adjusting for the disposal of Ergotron where appropriate

Recovery to 2019 revenue volume levels calculated on a like-for-like basis

Described in the glossary to the 2022 Interim Financial Statements and considered by the Board to be a key measure of performance

: H1 2022)

Consensus¹ operating profit before depreciation and amortisation from subsidiaries and equity accounted investments (depreciation and amortisation calculated as

Represents mathematical uplift to 2022 full year consensus¹ adjusted operating profit when target operating margins are achieved on pre-COVID-19 sales volumes

Comprises the Automotive, Powder Metallurgy and Hydrogen group of businesses

14View entire presentation