Inovalon Results Presentation Deck

Covenant-Lite Debt Leverage

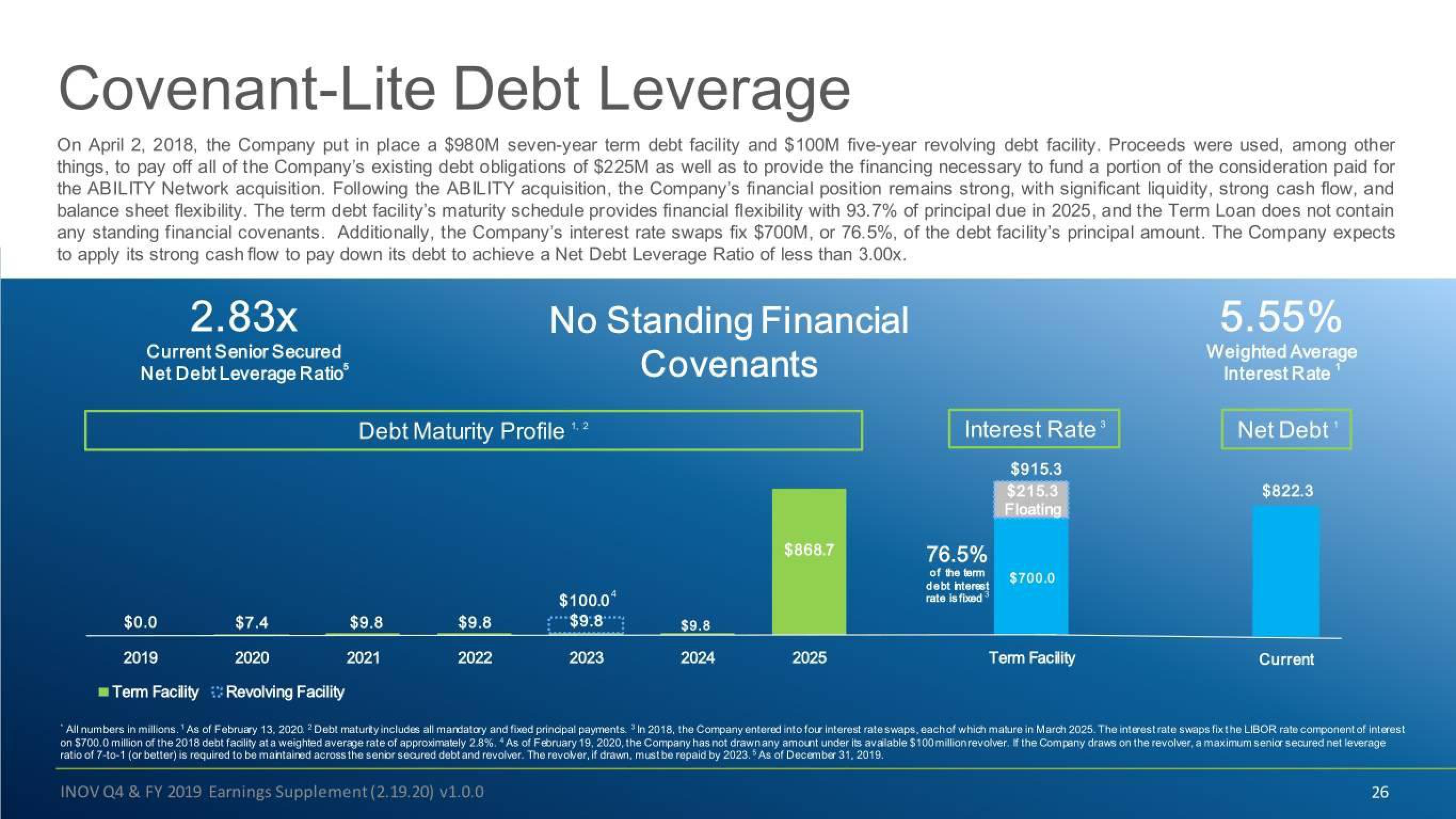

On April 2, 2018, the Company put in place a $980M seven-year term debt facility and $100M five-year revolving debt facility. Proceeds were used, among other

things, to pay off all of the Company's existing debt obligations of $225M as well as to provide the financing necessary to fund a portion of the consideration paid for

the ABILITY Network acquisition. Following the ABILITY acquisition, the Company's financial position remains strong, with significant liquidity, strong cash flow, and

balance sheet flexibility. The term debt facility's maturity schedule provides financial flexibility with 93.7% of principal due in 2025, and the Term Loan does not contain

any standing financial covenants. Additionally, the Company's interest rate swaps fix $700M, or 76.5%, of the debt facility's principal amount. The Company expects.

to apply its strong cash flow to pay down its debt to achieve a Net Debt Leverage Ratio of less than 3.00x.

2.83x

Current Senior Secured

Net Debt Leverage Ratio

Debt Maturity Profile ¹.2

$9.8

2021

No Standing Financial

Covenants

$9.8

2022

4

$100.0*

$9.8*

2023

$868.7

$9.8

2024

Interest Rate

2025

76.5%

of the term

debt interest

rate is fixed

$0.0

$7.4

2019

Term Facility

2020

Revolving Facility

*All numbers in millions. ' As of February 13, 2020. ² Debt maturity includes all mandatory and fixed principal payments. In 2018, the Company entered into four interest rate swaps, each of which mature in March 2025. The interest rate swaps fix the LIBOR rate component of interest

on $700.0 million of the 2018 debt facility at a weighted average rate of approximately 2.8%. *As of February 19, 2020, the Company has not drawn any amount under its available $100 million revolver. If the Company draws on the revolver, a maximum senior secured net leverage

ratio of 7-to-1 (or better) is required to be maintained across the senior secured debt and revolver. The revolver, if drawn, must be repaid by 2023.5 As of December 31, 2019.

INOV Q4 & FY 2019 Earnings Supplement (2.19.20) v1.0.0

$915.3

$215.3

Floating

$700.0

5.55%

Weighted Average

Interest Rate

Term Facility

Net Debt'

$822.3

Current

26View entire presentation