OSP Value Fund IV LP Q4 2022

($ BILLIONS)

60

50

40

30

20

10

0

Source: FDIC, NBER

Loan Type

Jun 98

Jun 99

Jun 00

Jun 01

Jun 02

Jun 03

Jun 04

Jun 05

Performing

Performing/

Non-performing

Non-performing

Total

1990-2020

Quarterly Net

Charge-Offs

Non-Current Loans

Book $

Value

$18,181

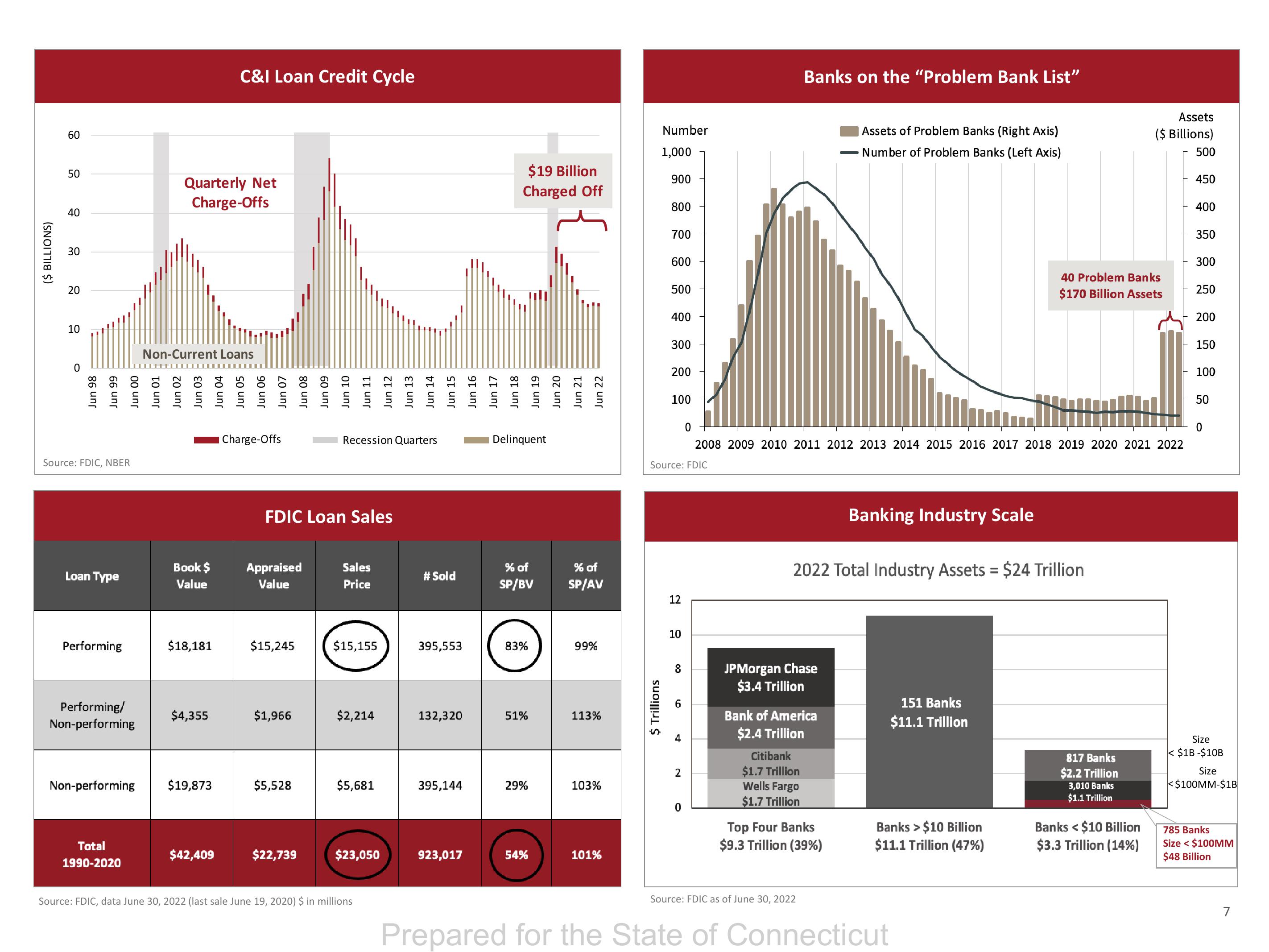

C&I Loan Credit Cycle

$4,355

$19,873

$42,409

90 unr

Jun 07

Jun 08

Charge-Offs

Appraised

Value

$15,245

$1,966

FDIC Loan Sales

$5,528

60 unr

$22,739

Jun 10

Recession Quarters

Jun 11

Jun 12

Jun 13

Jun 14

Jun 15

Jun 16

Jun 17

Jun 18

Jun 19

Jun 20

Sales

Price

$15,155

$2,214

$5,681

$23,050

Source: FDIC, data June 30, 2022 (last sale June 19, 2020) $ in millions

# Sold

395,553

132,320

395,144

$19 Billion

Charged Off

923,017

Delinquent

% of

SP/BV

83%

51%

29%

54%

Jun 21

Jun 22

% of

SP/AV

99%

113%

103%

101%

Number

1,000

$ Trillions

900

800

700

600

500

400

300

200

100

12

10

0

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: FDIC

co

6

4

2

0

Banks on the "Problem Bank List"

JPMorgan Chase

$3.4 Trillion

Bank of America

$2.4 Trillion

Citibank

$1.7 Trillion

Wells Fargo

$1.7 Trillion

2022 Total Industry Assets = $24 Trillion

Assets of Problem Banks (Right Axis)

- Number of Problem Banks (Left Axis)

Top Four Banks

$9.3 Trillion (39%)

Source: FDIC as of June 30, 2022

Banking Industry Scale

151 Banks

$11.1 Trillion

Banks > $10 Billion

$11.1 Trillion (47%)

Prepared for the State of Connecticut

40 Problem Banks

$170 Billion Assets

Assets

($ Billions)

500

817 Banks

$2.2 Trillion

3,010 Banks

$1.1 Trillion

Banks <$10 Billion

$3.3 Trillion (14%)

450

400

350

300

250

200

150

100

50

0

Size

< $1B-$10B

Size

<$100MM-$1B

785 Banks

Size < $100MM

$48 Billion

7View entire presentation