Altus Power SPAC Presentation Deck

Capital Structure Overview

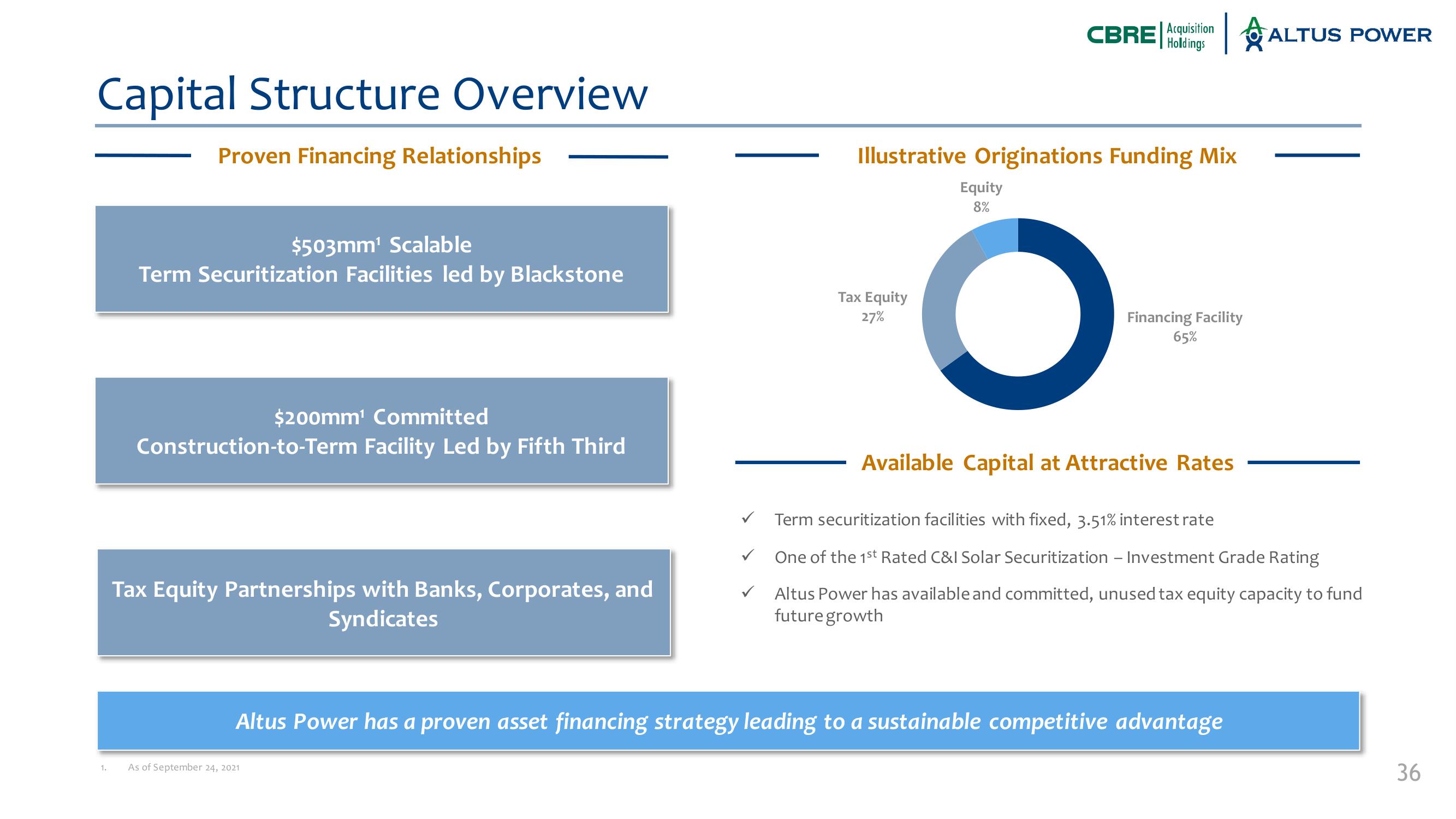

Proven Financing Relationships

1.

$503mm¹ Scalable

Term Securitization Facilities led by Blackstone

$200mm¹ Committed

Construction-to-Term Facility Led by Fifth Third

Tax Equity Partnerships with Banks, Corporates, and

Syndicates

✓

As of September 24, 2021

CBRE Acquisition ALTUS POWER

Holdings

Illustrative Originations Funding Mix

Tax Equity

27%

Equity

8%

O

Financing Facility

65%

Available Capital at Attractive Rates

Term securitization facilities with fixed, 3.51% interest rate

One of the 1st Rated C&I Solar Securitization - Investment Grade Rating

Altus Power has available and committed, unused tax equity capacity to fund

future growth

Altus Power has a proven asset financing strategy leading to a sustainable competitive advantage

36View entire presentation