Bird SPAC Presentation Deck

BIRD

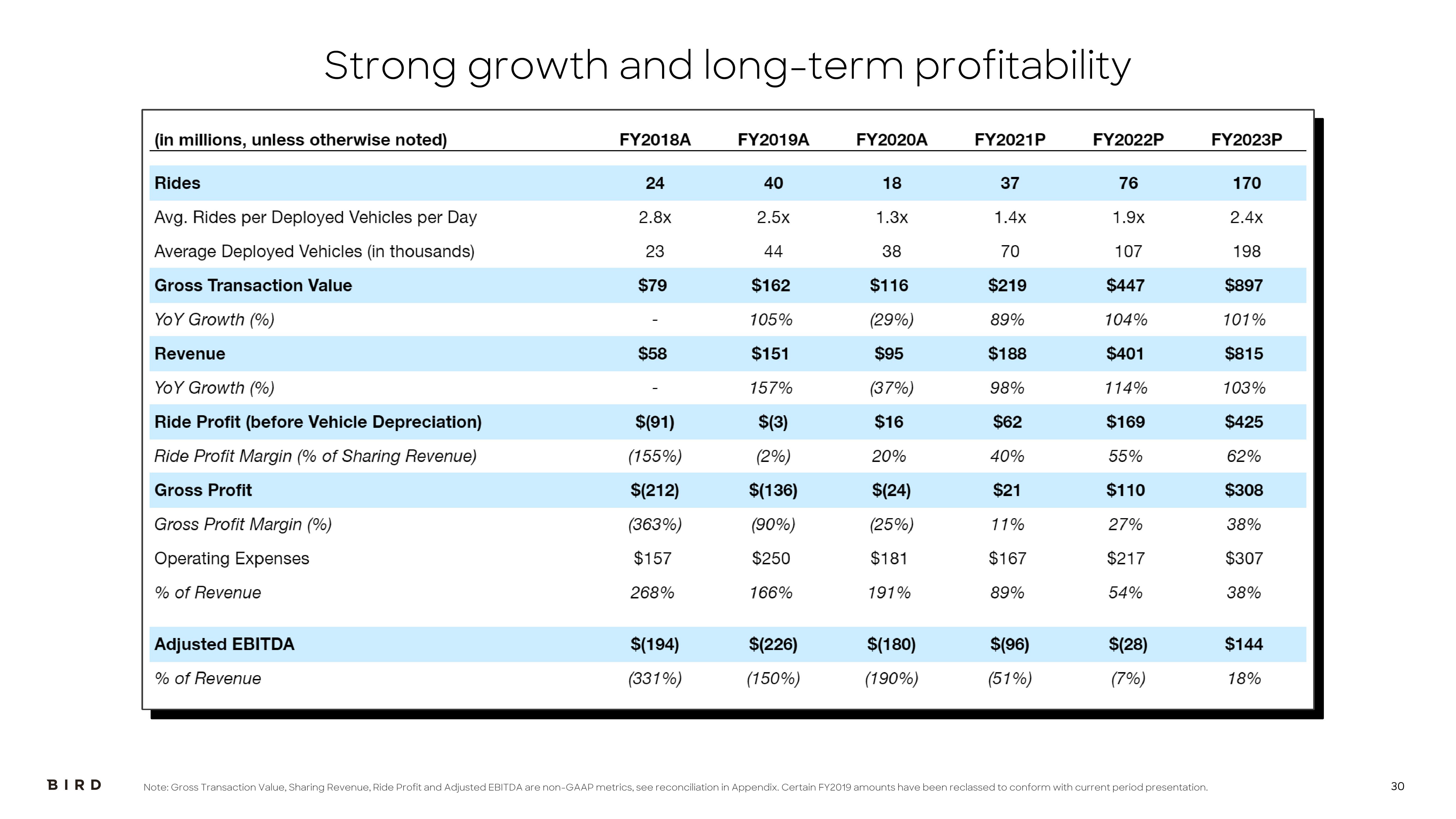

Strong growth and long-term profitability

(in millions, unless otherwise noted)

Rides

Avg. Rides per Deployed Vehicles per Day

Average Deployed Vehicles (in thousands)

Gross Transaction Value

YOY Growth (%)

Revenue

YOY Growth (%)

Ride Profit (before Vehicle Depreciation)

Ride Profit Margin (% of Sharing Revenue)

Gross Profit

Gross Profit Margin (%)

Operating Expenses

% of Revenue

Adjusted EBITDA

% of Revenue

FY2018A

24

2.8x

23

$79

$58

$(91)

(155%)

$(212)

(363%)

$157

268%

$(194)

(331%)

FY2019A

40

2.5x

44

$162

105%

$151

157%

$(3)

(2%)

$(136)

(90%)

$250

166%

$(226)

(150%)

FY2020A

18

1.3x

38

$116

(29%)

$95

(37%)

$16

20%

$(24)

(25%)

$181

191%

$(180)

(190%)

FY2021P

37

1.4x

70

$219

89%

$188

98%

$62

40%

$21

11%

$167

89%

$(96)

(51%)

FY2022P

76

1.9x

107

$447

104%

$401

114%

$169

55%

$110

27%

$217

54%

$(28)

(7%)

Note: Gross Transaction Value, Sharing Revenue, Ride Profit and Adjusted EBITDA are non-GAAP metrics, see reconciliation in Appendix. Certain FY2019 amounts have been reclassed to conform with current period presentation.

FY2023P

170

2.4x

198

$897

101%

$815

103%

$425

62%

$308

38%

$307

38%

$144

18%

30View entire presentation