Credit Suisse Results Presentation Deck

Group Overview

Rev.

PCL/Costs

Profitability

Balance

Sheet

14

Credit Suisse Group in CHF mn

Net revenues

Adjusted net revenues

Provision for credit losses

Adjusted provision for credit losses

Operating expenses

Adjusted operating expenses

Pre-tax income/(loss)

Adjusted pre-tax income/(loss)

Income tax expense

Net income/(loss)

attributable to shareholders

Return on tangible equity+

Cost/income ratio

CET1 ratio

Risk-weighted assets in CHF bn

Leverage exposure in CHF bn

Liquidity coverage ratio¹

4Q22 3Q22

3,060

2,964

41

41

4,334

3,938

(1,315)

(1,015)

82

14.1%

251

651

144%

4Q21 A 4021

21

21

3,804 4,582 (33)% 14,921

3,798 4,384 (32)% 15,164

(20)

(15)

4,125 6,266

3,869

4,071

(342) (1,664)

(92)

3,698

328

416

(1,393)

(4,034) (2,085)

(13.5) % (38.3)% (20.9)%

142%

108%

137%

203%

2022

n/m

12.6% 14.4%

274

268

(6)%

837

889 (27)%

192%

16

4,205

171 (102)

18,163 19,091

(31)%

(3)% 16,242 16,047

2021 A 2021

n/m (3,258) (600)

(1,249) 6,599

4,048 1,026

n/m

(7,293)

(1,650)

(17.6)% (4.2)%

122%

84%

22,696 (34)%

22,544 (33)%

14.1%

251

651

14.4%

268

889

(5)%

1%

n/m

n/m

n/m

(6) %

(27)%

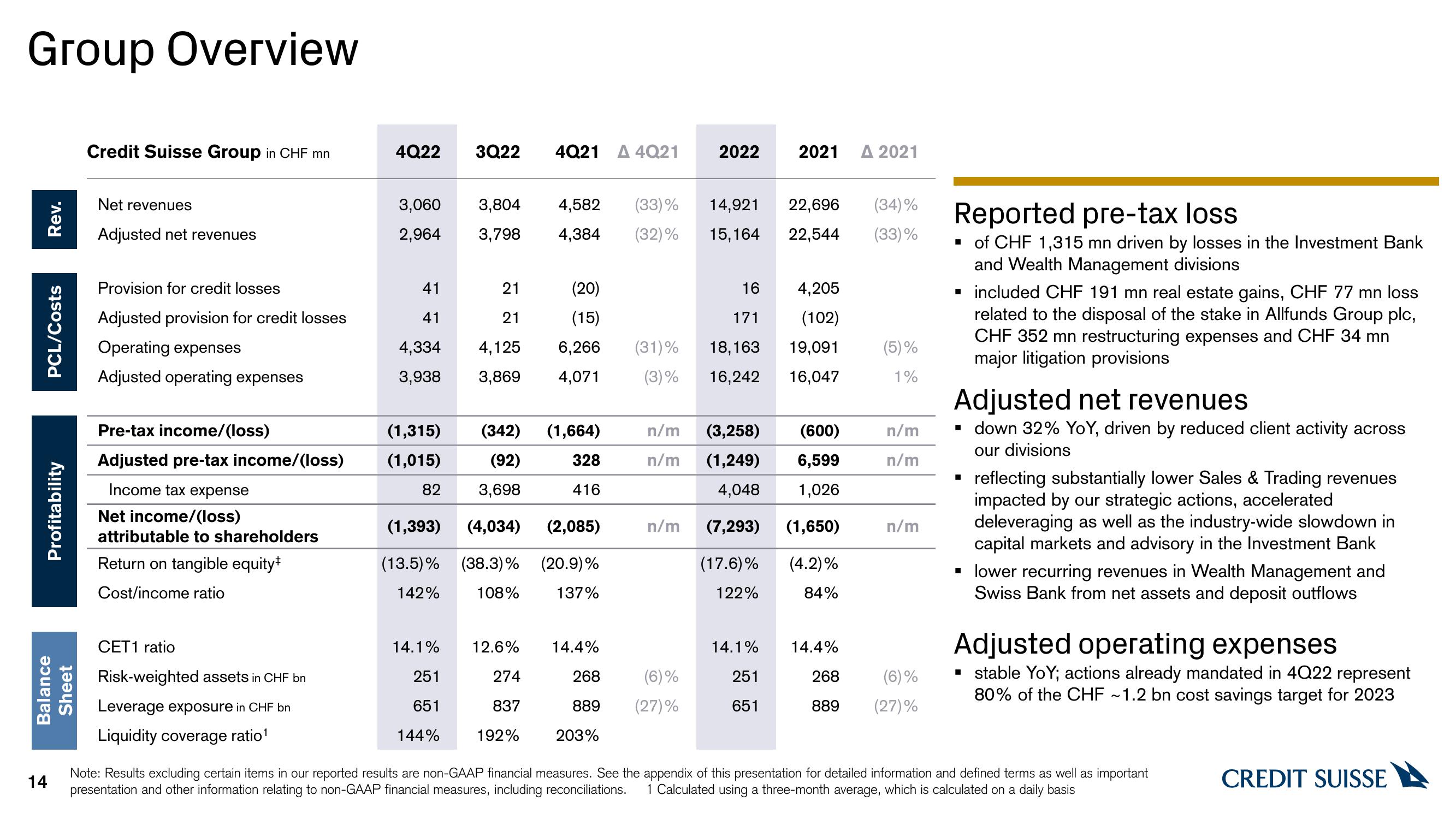

Reported pre-tax loss

▪of CHF 1,315 mn driven by losses in the Investment Bank

and Wealth Management divisions

▪ included CHF 191 mn real estate gains, CHF 77 mn loss

related to the disposal of the stake in Allfunds Group plc,

CHF 352 mn restructuring expenses and CHF 34 mn

major litigation provisions

Adjusted net revenues

▪ down 32% YoY, driven by reduced client activity across

our divisions

■

reflecting substantially lower Sales & Trading revenues

impacted by our strategic actions, accelerated

deleveraging as well as the industry-wide slowdown in

capital markets and advisory in the Investment Bank

▪ lower recurring revenues in Wealth Management and

Swiss Bank from net assets and deposit outflows

Adjusted operating expenses

▪ stable YoY; actions already mandated in 4Q22 represent

80% of the CHF ~1.2 bn cost savings target for 2023

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Calculated using a three-month average, which is calculated on a daily basis

CREDIT SUISSEView entire presentation