Paysafe Results Presentation Deck

Q2 financial highlights

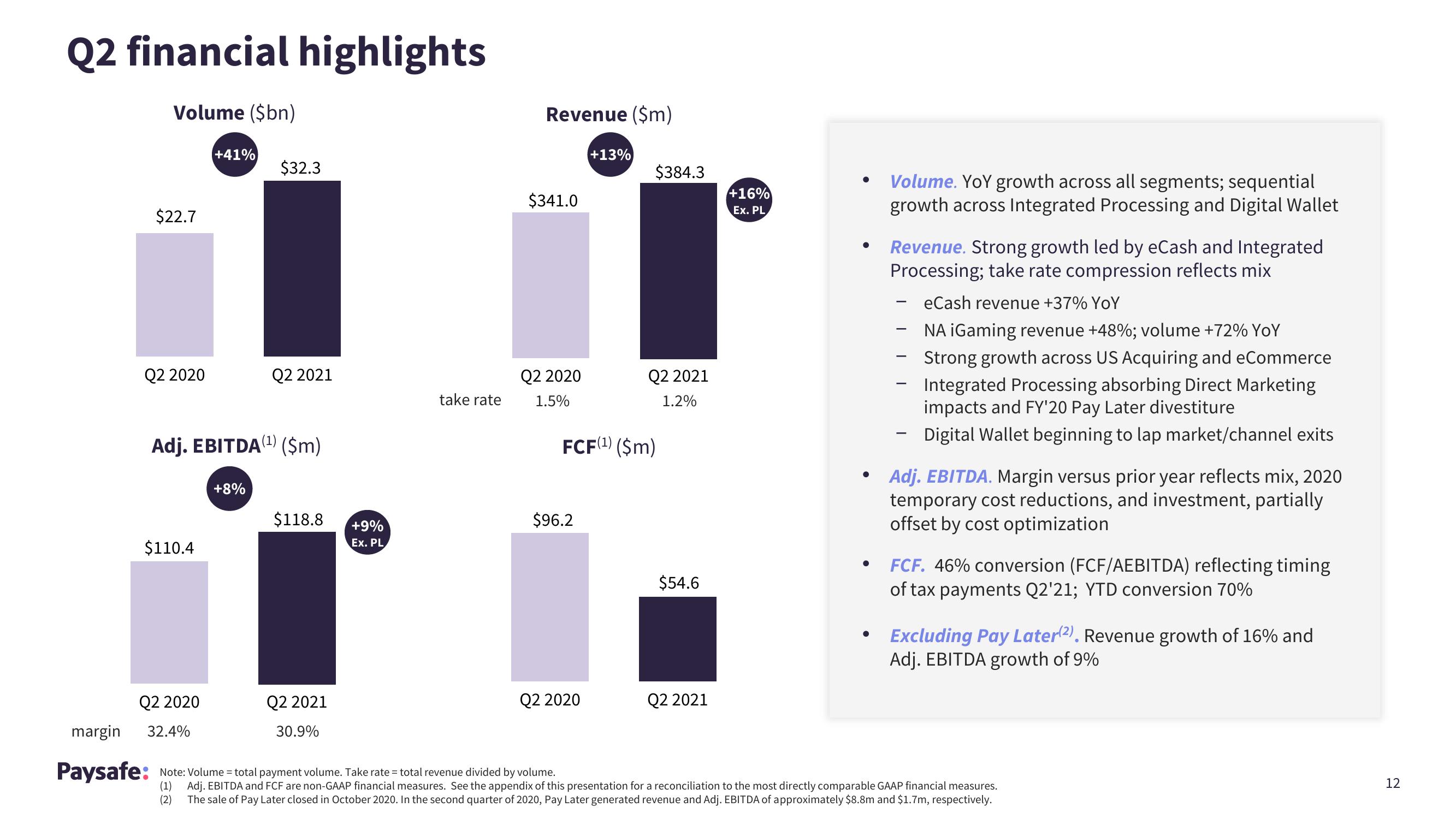

Volume ($bn)

$22.7

Q2 2020

$110.4

Paysafe:

Q2 2020

margin 32.4%

+41%

Adj. EBITDA (¹) ($m)

(1)

(2)

$32.3

+8%

Q2 2021

$118.8

Q2 2021

30.9%

+9%

Ex. PL

take rate

Revenue ($m)

$341.0

Q2 2020

1.5%

$96.2

+13%

Q2 2020

$384.3

FCF(¹) ($m)

Q2 2021

1.2%

$54.6

Q2 2021

+16%

Ex. PL

●

●

●

Volume. YoY growth across all segments; sequential

growth across Integrated Processing and Digital Wallet

Revenue. Strong growth led by eCash and Integrated

Processing; take rate compression reflects mix

eCash revenue +37% YoY

NA iGaming revenue +48%; volume +72% YoY

Strong growth across US Acquiring and eCommerce

Integrated Processing absorbing Direct Marketing

impacts and FY'20 Pay Later divestiture

Digital Wallet beginning to lap market/channel exits

-

-

Adj. EBITDA. Margin versus prior year reflects mix, 2020

temporary cost reductions, and investment, partially

offset by cost optimization

FCF. 46% conversion (FCF/AEBITDA) reflecting timing

of tax payments Q2'21; YTD conversion 70%

Excluding Pay Later(2). Revenue growth of 16% and

Adj. EBITDA growth of 9%

Note: Volume = total payment volume. Take rate = total revenue divided by volume.

Adj. EBITDA and FCF are non-GAAP financial measures. See the appendix of this presentation for a reconciliation to the most directly comparable GAAP financial measures.

The sale of Pay Later closed in October 2020. In the second quarter of 2020, Pay Later generated revenue and Adj. EBITDA of approximately $8.8m and $1.7m, respectively.

12View entire presentation