Bed Bath & Beyond Results Presentation Deck

■

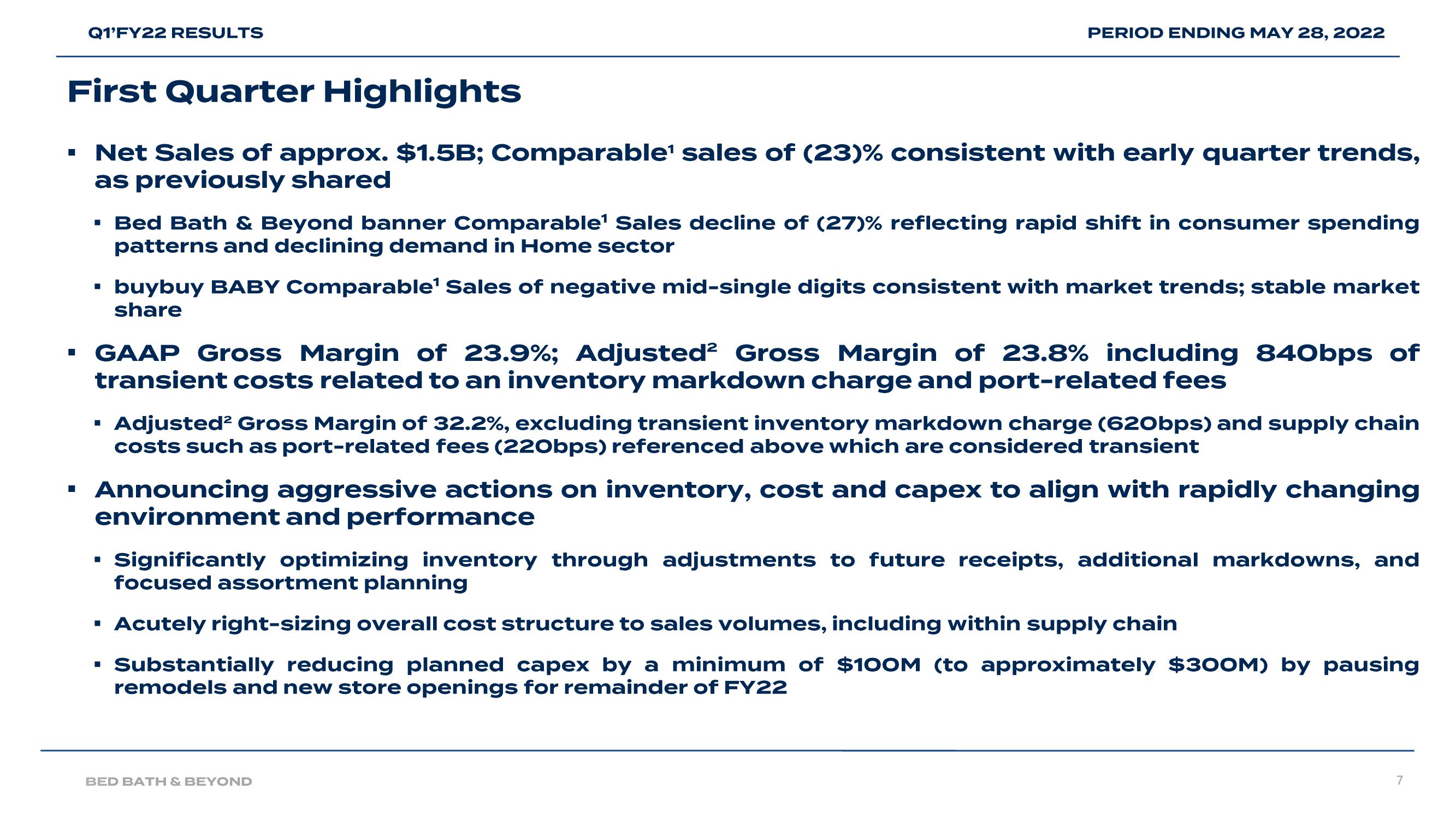

Q1'FY22 RESULTS

First Quarter Highlights

Net Sales of approx. $1.5B; Comparable¹ sales of (23)% consistent with early quarter trends,

as previously shared

■

PERIOD ENDING MAY 28, 2022

▪ Bed Bath & Beyond banner Comparable¹ Sales decline of (27)% reflecting rapid shift in consumer spending

patterns and declining demand in Home sector

▪ buybuy BABY Comparable¹ Sales of negative mid-single digits consistent with market trends; stable market

share

▪ GAAP Gross Margin of 23.9%; Adjusted² Gross Margin of 23.8% including 840bps of

transient costs related to an inventory markdown charge and port-related fees

■

Adjusted² Gross Margin of 32.2%, excluding transient inventory markdown charge (620bps) and supply chain

costs such as port-related fees (220bps) referenced above which are considered transient

Announcing aggressive actions on inventory, cost and capex to align with rapidly changing

environment and performance

▪ Significantly optimizing inventory through adjustments to future receipts, additional markdowns, and

focused assortment planning

▪ Acutely right-sizing overall cost structure to sales volumes, including within supply chain

▪ Substantially reducing planned capex by a minimum of $100M (to approximately $300M) by pausing

remodels and new store openings for remainder of FY22

BED BATH & BEYOND

7View entire presentation