SoftBank Investor Presentation Deck

SVF1

SVF2

DRIVING FUTURE SUCCESS

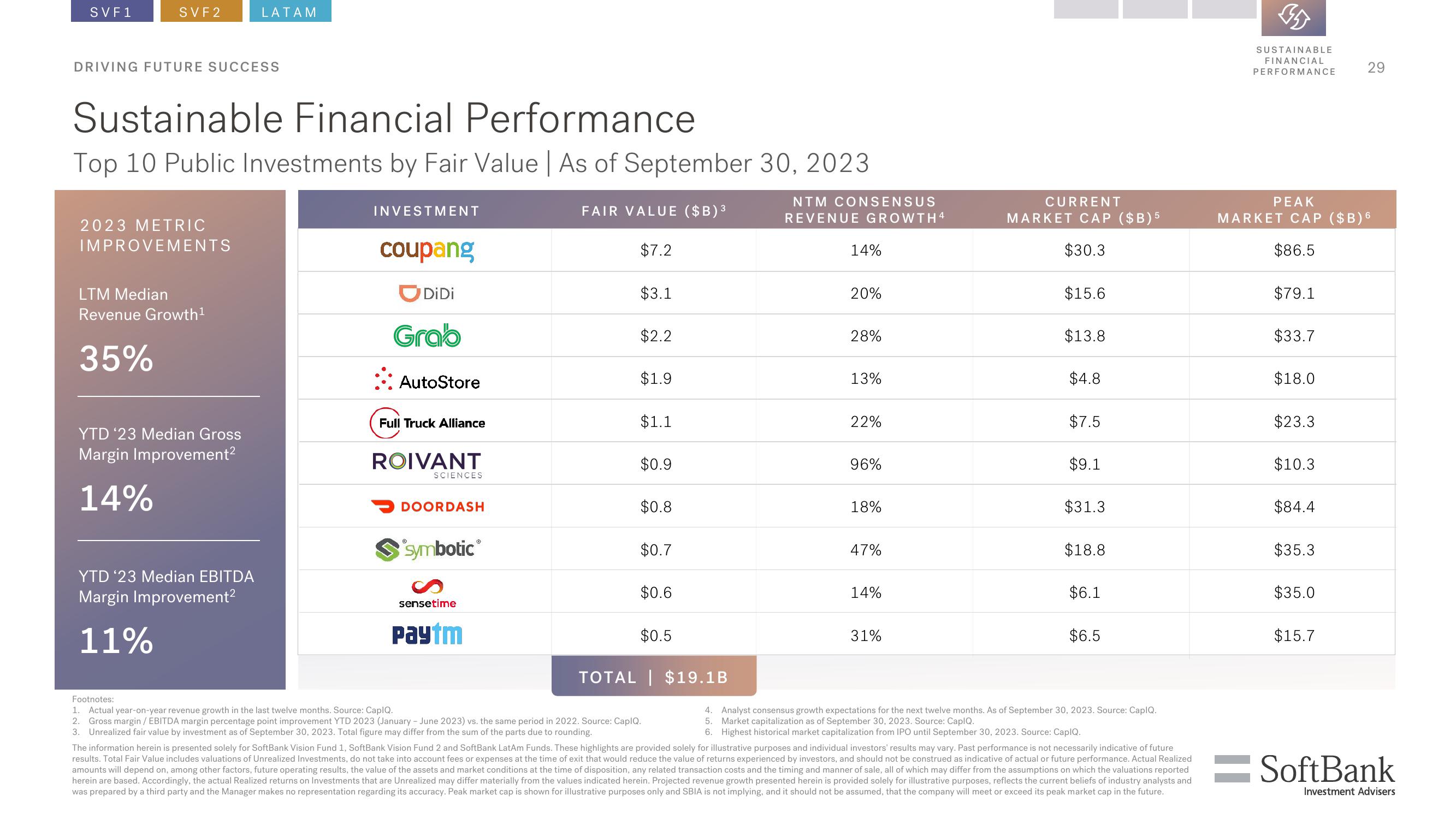

Sustainable Financial Performance

Top 10 Public Investments by Fair Value | As of September 30, 2023

2023 METRIC

IMPROVEMENTS

LTM Median

Revenue Growth¹

35%

LATAM

YTD '23 Median Gross

Margin Improvement²

14%

YTD '23 Median EBITDA

Margin Improvement²

11%

INVESTMENT

coupang

DiDi

Grab

AutoStore

Full Truck Alliance

ROIVANT

SCIENCES

DOORDASH

symbotic®

sensetime

Paytm

FAIR VALUE ($B) ³

$7.2

$3.1

$2.2

$1.9

$1.1

$0.9

$0.8

$0.7

$0.6

$0.5

TOTAL | $19.1B

NTM CONSENSUS

REVENUE GROWTH4

14%

20%

28%

13%

22%

96%

18%

47%

14%

31%

CURRENT

MARKET CAP ($B) 5

$30.3

$15.6

$13.8

$4.8

$7.5

$9.1

$31.3

$18.8

$6.1

$6.5

Footnotes:

1. Actual year-on-year revenue growth in the last twelve months. Source: CapIQ.

2. Gross margin / EBITDA margin percentage point improvement YTD 2023 (January - June 2023) vs. the same period in 2022. Source: CapIQ.

3. Unrealized fair value by investment as of September 30, 2023. Total figure may differ from the sum of the parts due to rounding.

The information herein is presented solely for SoftBank Vision Fund 1, SoftBank Vision Fund 2 and SoftBank LatAm Funds. These highlights are provided solely for illustrative purposes and individual investors' results may vary. Past performance is not necessarily indicative of future

results. Total Fair Value includes valuations of Unrealized Investments, do not take into account fees or expenses at the time of exit that would reduce the value of returns experienced by investors, and should not be construed as indicative of actual or future performance. Actual Realized

amounts will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions on which the valuations reported

herein are based. Accordingly, the actual Realized returns on Investments that are Unrealized may differ materially from the values indicated herein. Projected revenue growth presented herein is provided solely for illustrative purposes, reflects the current beliefs of industry analysts and

was prepared by a third party and the Manager makes no representation regarding its accuracy. Peak market cap is shown for illustrative purposes only and SBIA is not implying, and it should not be assumed, that the company will meet or exceed its peak market cap in the future.

4. Analyst consensus growth expectations for the next twelve months. As of September 30, 2023. Source: CapIQ.

5. Market capitalization as of September 30, 2023. Source: CapIQ.

6. Highest historical market capitalization from IPO until September 30, 2023. Source: CapIQ.

35

SUSTAINABLE

FINANCIAL

PERFORMANCE

ΡΕΑΚ

MARKET CAP ($B)6

$86.5

$79.1

$33.7

$18.0

$23.3

$10.3

$84.4

$35.3

$35.0

29

$15.7

SoftBank

Investment AdvisersView entire presentation