KKR Real Estate Finance Trust Investor Presentation Deck

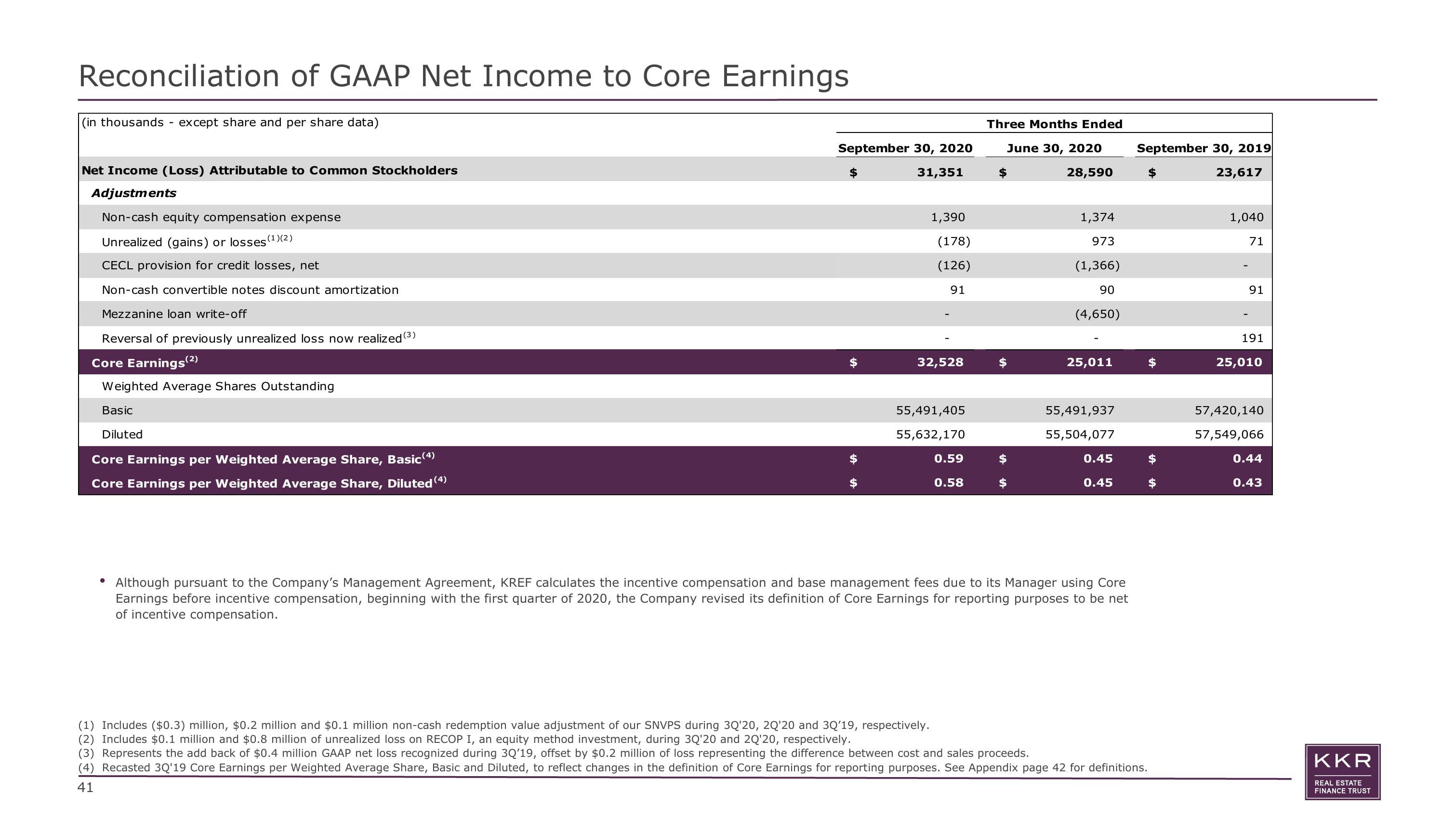

Reconciliation of GAAP Net Income to Core Earnings

(in thousands except share and per share data)

Net Income (Loss) Attributable to Common Stockholders

Adjustments

Non-cash equity compensation expense

Unrealized (gains) or losses

CECL provision for credit losses, net

Non-cash convertible notes discount amortization

Mezzanine loan write-off

Reversal of previously unrealized loss now realized (3)

Core Earnings (²)

Weighted Average Shares Outstanding

Basic

Diluted

(1)(2)

Core Earnings per Weighted Average Share, Basic (4)

Core Earnings per Weighted Average Share, Diluted (4)

September 30, 2020

31,351

1,390

(178)

(126)

91

32,528

55,491,405

55,632,170

0.59

0.58

Three Months Ended

June 30, 2020

28,590

1,374

973

(1,366)

90

(4,650)

25,011

55,491,937

55,504,077

0.45

0.45

• Although pursuant to the Company's Management Agreement, KREF calculates the incentive compensation and base management fees due to its Manager using Core

Earnings before incentive compensation, beginning with the first quarter of 2020, the Company revised its definition of Core Earnings for reporting purposes to be net

of incentive compensation.

September 30, 2019

23,617

(1) Includes ($0.3) million, $0.2 million and $0.1 million non-cash redemption value adjustment of our SNVPS during 3Q'20, 2Q'20 and 3Q'19, respectively.

(2) Includes $0.1 million and $0.8 million of unrealized loss on RECOP I, an equity method investment, during 3Q'20 and 2Q'20, respectively.

(3) Represents the add back of $0.4 million GAAP net loss recognized during 3Q'19, offset by $0.2 million of loss representing the difference between cost and sales proceeds.

(4) Recasted 3Q'19 Core Earnings per Weighted Average Share, Basic and Diluted, to reflect changes in the definition of Core Earnings for reporting purposes. See Appendix page 42 for definitions.

41

1,040

71

91

191

25,010

57,420,140

57,549,066

0.44

0.43

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation