Sotheby's Investor Briefing

• Market for quality, high-end art rebounded from 2008

financial crisis and remains vigorous

Increased buyer's premium rates in March 2013

Spring 2013 auction season saw sales growth in

Impressionist, Modern, and Contemporary Art

.

STRONG BUSINESS FUNDAMENTALS

Just-completed record-setting Hong Kong sales, up over

100% from prior year. Positive outlook for upcoming Fall

season auctions

■

Strong competition for high-end consignments has

persisted, resulting in lower auction commission margins

from sellers, partially offsetting benefit of buyer's premium

increase

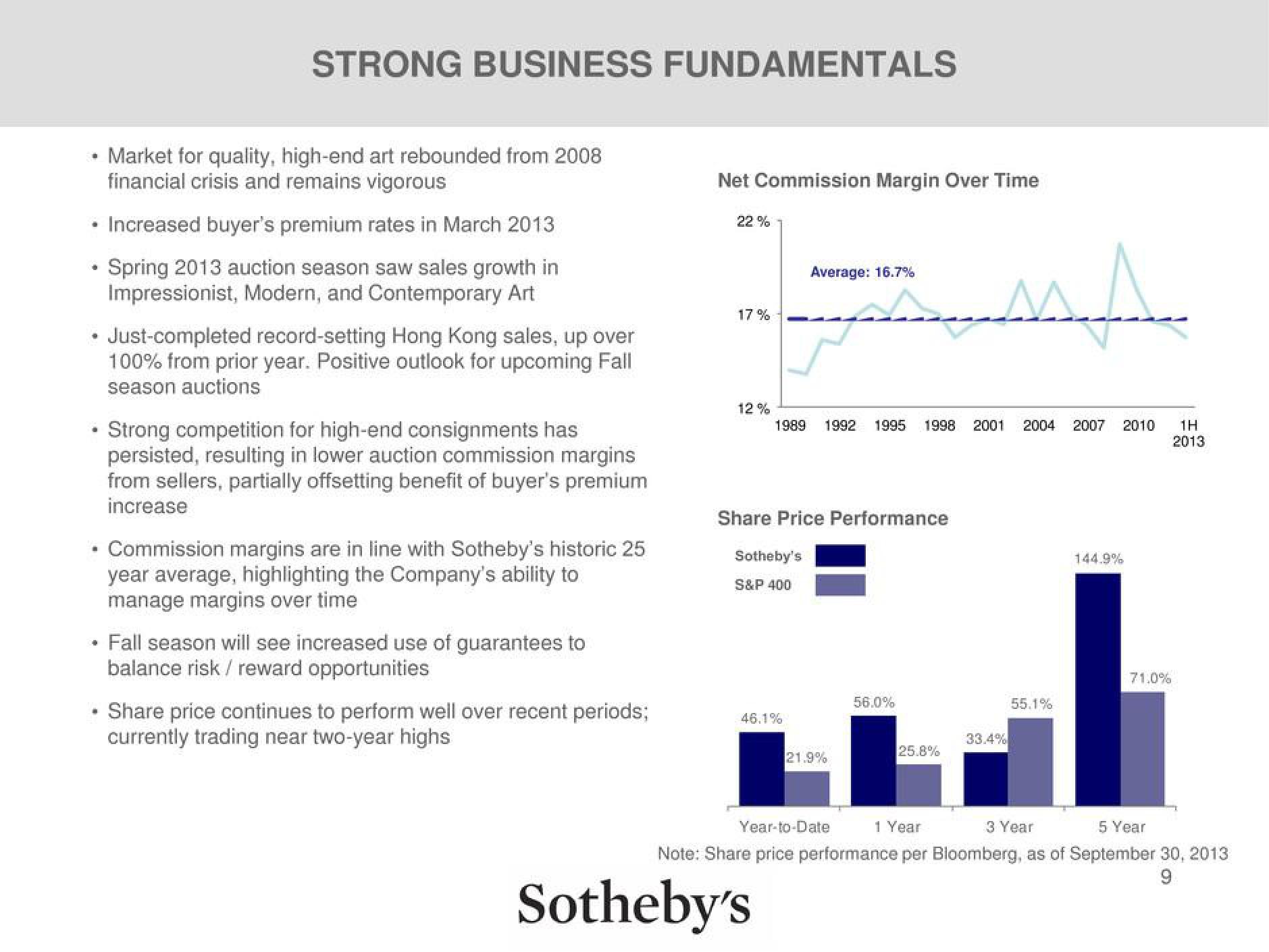

• Commission margins are in line with Sotheby's historic 25

year average, highlighting the Company's ability to

manage margins over time

• Fall season will see increased use of guarantees to

balance risk / reward opportunities

Share price continues to perform well over recent periods;

currently trading near two-year highs

Net Commission Margin Over Time

22%

17%

12%

Share Price Performance

Sotheby's

S&P 400

Average: 16.7%

1989 1992 1995 1998 2001

46.1%

Sotheby's

21.9%

56.0%

sa

25.8%

33.4%

2004 2007 2010 1H

2013

55.1%

144.9%

71.0%

Year-to-Date

1 Year

3 Year

5 Year

Note: Share price performance per Bloomberg, as of September 30, 2013

9View entire presentation