TPG Results Presentation Deck

Distributable Earnings

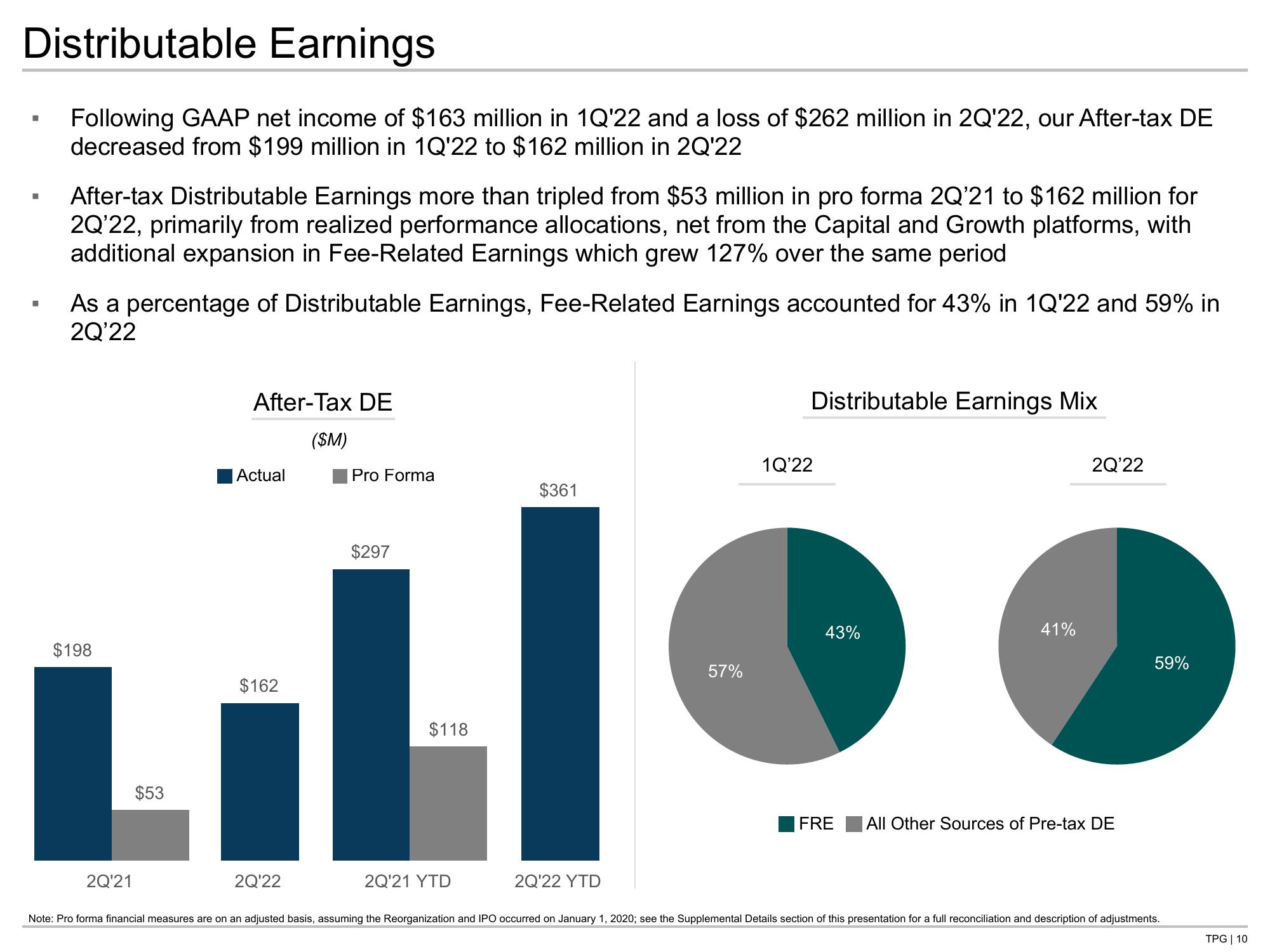

Following GAAP net income of $163 million in 1Q'22 and a loss of $262 million in 2Q'22, our After-tax DE

decreased from $199 million in 1Q'22 to $162 million in 2Q'22

■

■

■

After-tax Distributable Earnings more than tripled from $53 million in pro forma 2Q'21 to $162 million for

2Q'22, primarily from realized performance allocations, net from the Capital and Growth platforms, with

additional expansion in Fee-Related Earnings which grew 127% over the same period

As a percentage of Distributable Earnings, Fee-Related Earnings accounted for 43% in 1Q'22 and 59% in

2Q'22

$198

After-Tax DE

($M)

2Q'21

Actual

Pro Forma

$297

$162

Lill

$118

$53

2Q'22

$361

2Q'21 YTD

2Q'22 YTD

57%

Distributable Earnings Mix

1Q'22

43%

FRE

41%

2Q'22

All Other Sources of Pre-tax DE

59%

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020; see the Supplemental Details section of this presentation for a full reconciliation and description of adjustments.

TPG | 10View entire presentation