Commercial Metals Company Results Presentation Deck

Rebar Consumption by End Market (% of 2021 Total)

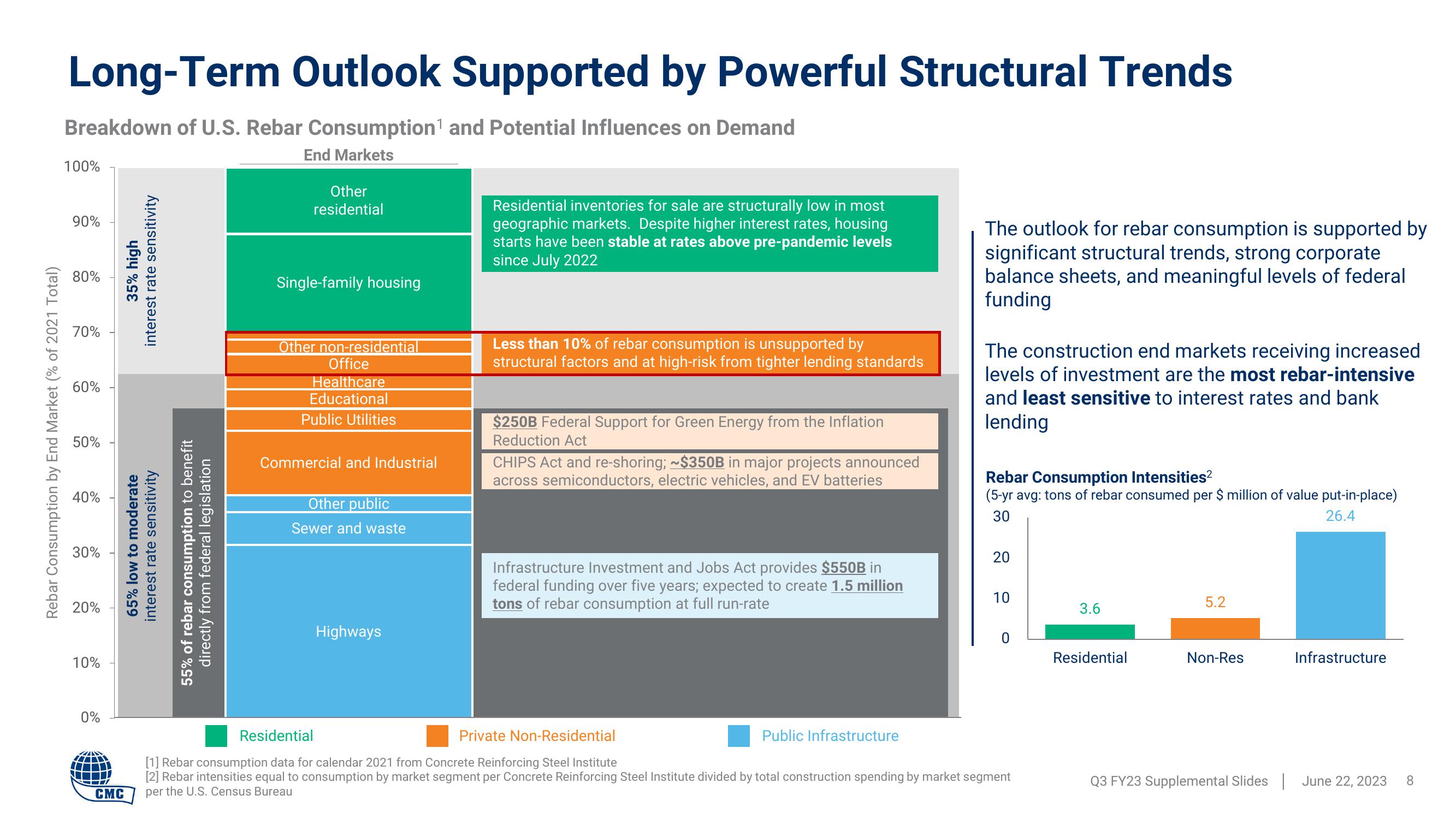

Long-Term Outlook Supported by Powerful Structural Trends

Breakdown of U.S. Rebar Consumption¹ and Potential Influences on Demand

End Markets

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

T

CMC

35% high

interest rate sensitivity

65% low to moderate

interest rate sensitivity

55% of rebar consumption to benefit

directly from federal legislation

Other

residential

Single-family housing

Other non-residential

Office

Healthcare

Educational

Public Utilities

Commercial and Industrial

Other public

Sewer and waste

Highways

Residential inventories for sale are structurally low in most

geographic markets. Despite higher interest rates, housing

starts have been stable at rates above pre-pandemic levels

since July 2022

Less than 10% of rebar consumption is unsupported by

structural factors and at high-risk from tighter lending standards

$250B Federal Support for Green Energy from the Inflation

Reduction Act

CHIPS Act and re-shoring; ~$350B in major projects announced

across semiconductors, electric vehicles, and EV batteries

Infrastructure Investment and Jobs Act provides $550B in

federal funding over five years; expected to create 1.5 million

tons of rebar consumption at full run-rate

Public Infrastructure

The outlook for rebar consumption is supported by

significant structural trends, strong corporate

balance sheets, and meaningful levels of federal

funding

The construction end markets receiving increased

levels of investment are the most rebar-intensive

and least sensitive to interest rates and bank

lending

Rebar Consumption Intensities²

(5-yr avg: tons of rebar consumed per $ million of value put-in-place)

30

26.4

20

10

0

Residential

Private Non-Residential

[1] Rebar consumption data for calendar 2021 from Concrete Reinforcing Steel Institute

[2] Rebar intensities equal to consumption by market segment per Concrete Reinforcing Steel Institute divided by total construction spending by market segment

per the U.S. Census Bureau

3.6

Residential

5.2

Non-Res

Infrastructure

Q3 FY23 Supplemental Slides June 22, 2023

8View entire presentation