Melrose Results Presentation Deck

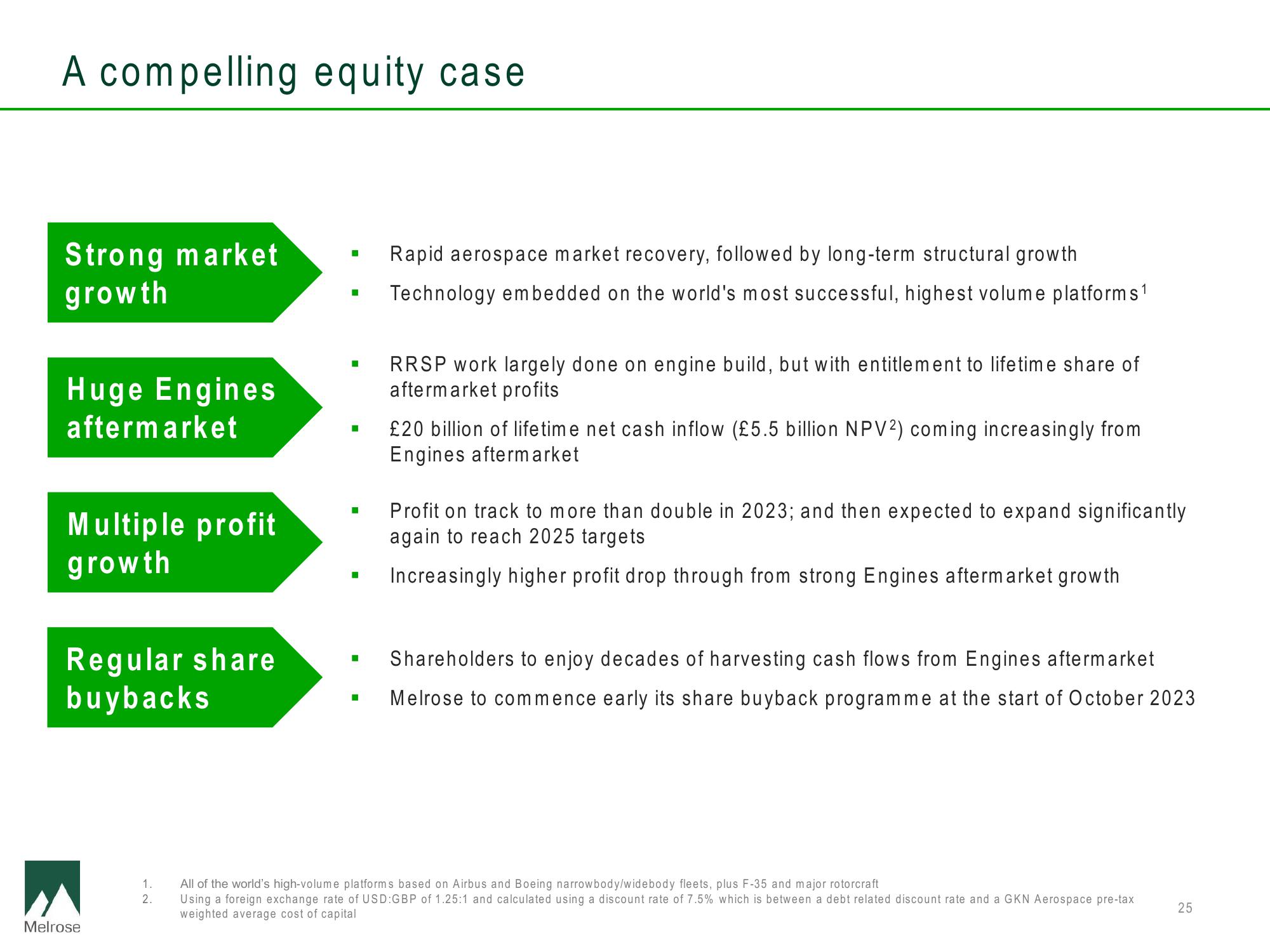

A compelling equity case

Strong market

growth

Huge Engines

aftermarket

Multiple profit

growth

Regular share

buybacks

Melrose

1.

2.

■

■

■

■

I

H

■

Rapid aerospace market recovery, followed by long-term structural growth

1

Technology embedded on the world's most successful, highest volume platforms ¹

RRSP work largely done on engine build, but with entitlement to lifetime share of

aftermarket profits

£20 billion of lifetime net cash inflow (£5.5 billion NPV2) coming increasingly from

Engines aftermarket

Profit on track to more than double in 2023; and then expected to expand significantly

again to reach 2025 targets

Increasingly higher profit drop through from strong Engines aftermarket growth

Shareholders to enjoy decades of harvesting cash flows from Engines aftermarket

Melrose to commence early its share buyback programme at the start of October 2023

All of the world's high-volume platforms based on Airbus and Boeing narrowbody/widebody fleets, plus F-35 and major rotorcraft

Using a foreign exchange rate of USD:GBP of 1.25:1 and calculated using a discount rate of 7.5% which is between a debt related discount rate and a GKN Aerospace pre-tax

weighted average cost of capital

25View entire presentation