Apollo Global Management Investor Day Presentation Deck

Portfolio Spotlight: Alternative Investments

●

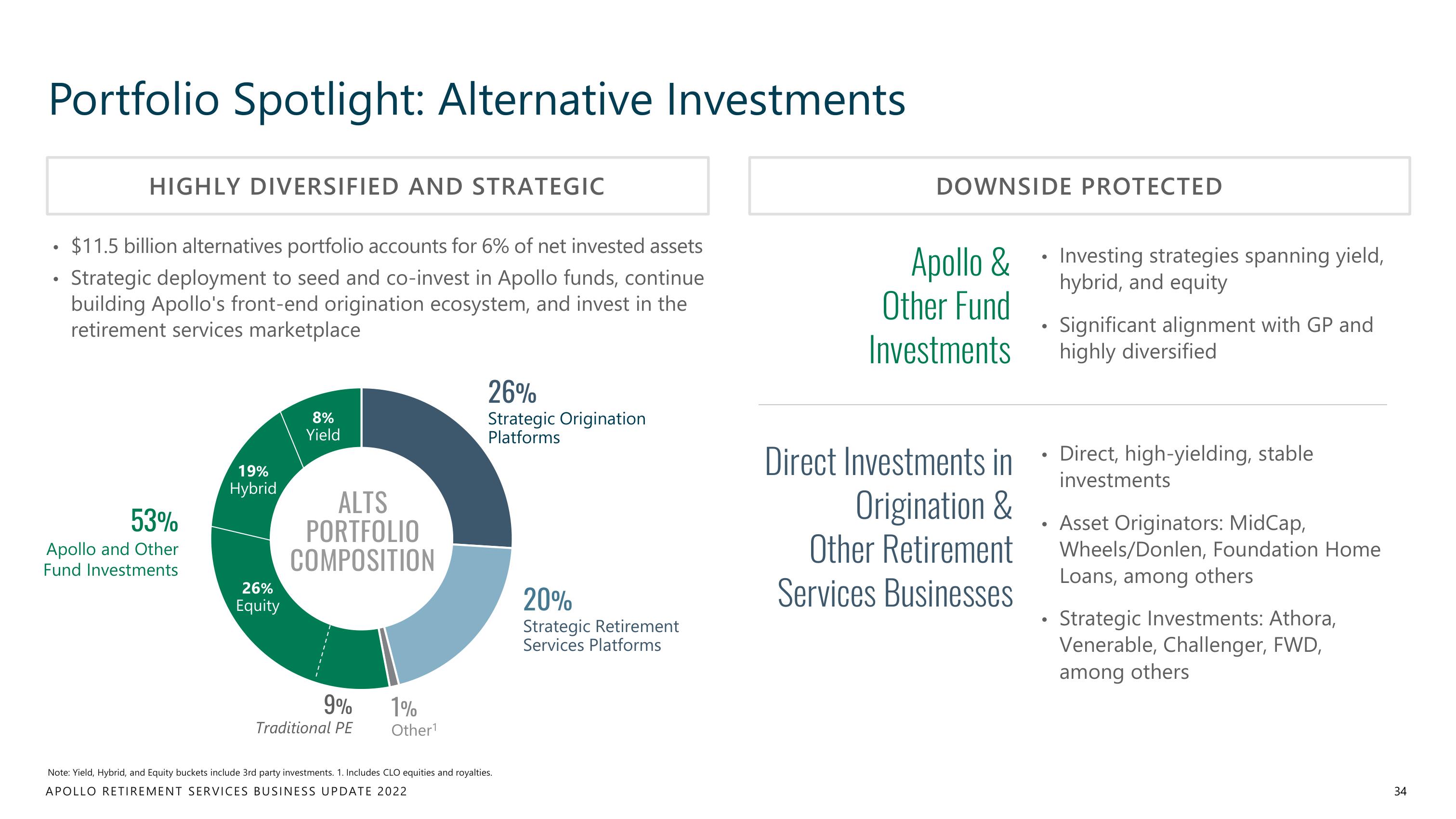

HIGHLY DIVERSIFIED AND STRATEGIC

$11.5 billion alternatives portfolio accounts for 6% of net invested assets

Strategic deployment to seed and co-invest in Apollo funds, continue

building Apollo's front-end origination ecosystem, and invest in the

retirement services marketplace

53%

Apollo and Other

Fund Investments

19%

Hybrid

26%

Equity

8%

Yield

ALTS

PORTFOLIO

COMPOSITION

9%

Traditional PE

1%

Other¹

26%

Strategic Origination

Platforms

Note: Yield, Hybrid, and Equity buckets include 3rd party investments. 1. Includes CLO equities and royalties.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

20%

Strategic Retirement

Services Platforms

DOWNSIDE PROTECTED

Apollo &

Other Fund

Investments

Direct Investments in

Origination &

Other Retirement

Services Businesses

●

• Significant alignment with GP and

highly diversified

●

Investing strategies spanning yield,

hybrid, and equity

●

Direct, high-yielding, stable

investments

Asset Originators: MidCap,

Wheels/Donlen, Foundation Home

Loans, among others

Strategic Investments: Athora,

Venerable, Challenger, FWD,

among others

34View entire presentation