flyExclusive SPAC

V. FINANCIAL OVERVIEW

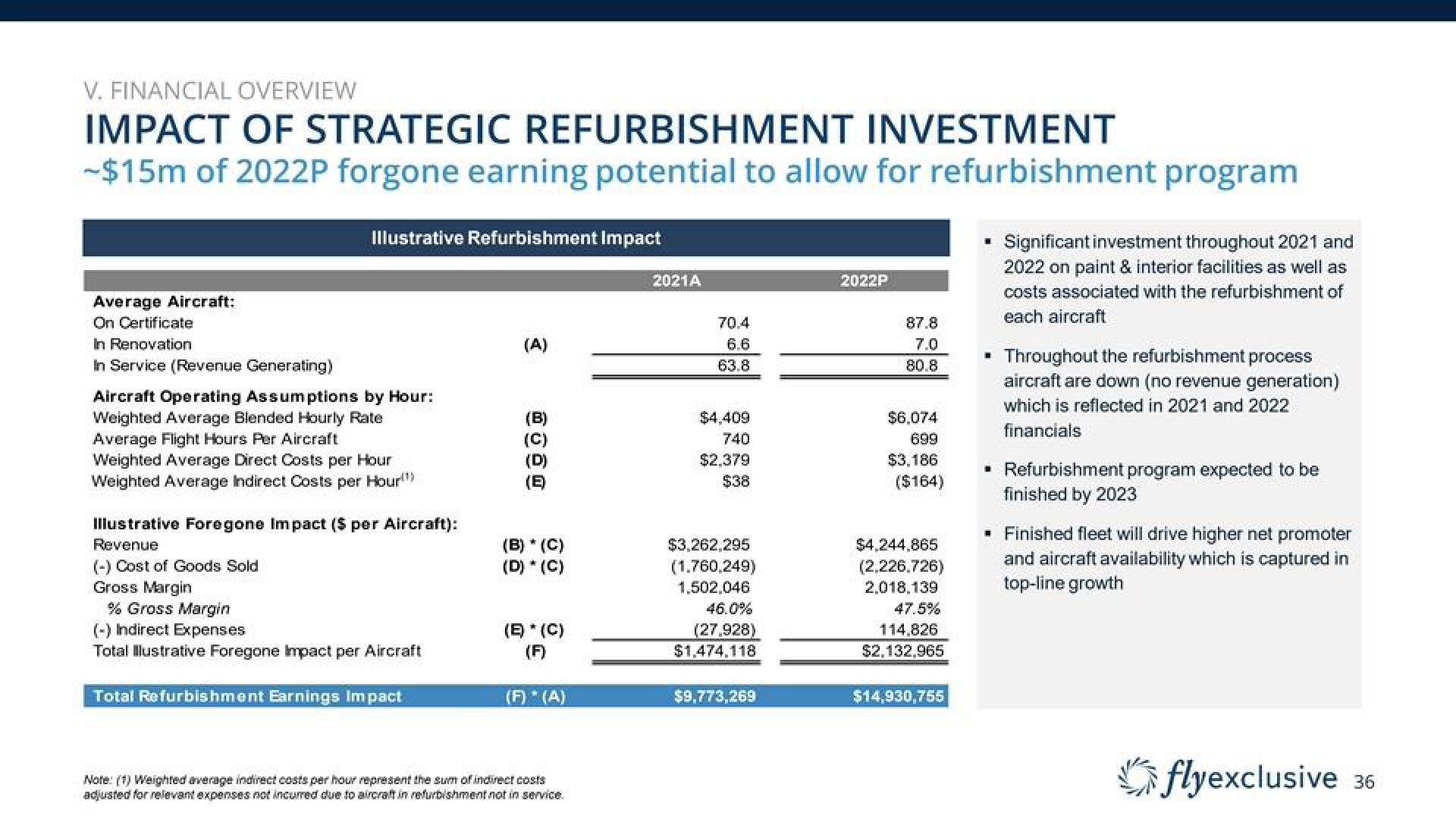

IMPACT OF STRATEGIC REFURBISHMENT INVESTMENT

-$15m of 2022P forgone earning potential to allow for refurbishment program

Average Aircraft:

On Certificate

In Renovation

In Service (Revenue Generating)

Illustrative Refurbishment Impact

Aircraft Operating Assumptions by Hour:

Weighted Average Blended Hourly Rate.

Average Flight Hours Per Aircraft

Weighted Average Direct Costs per Hour

Weighted Average Indirect Costs per Hour)

Illustrative Foregone Impact ($ per Aircraft):

Revenue

(-) Cost of Goods Sold

Gross Margin

% Gross Margin

(-) Indirect Expenses

Total Illustrative Foregone Impact per Aircraft

Total Refurbishment Earnings Impact

(A)

(B)

(D)

(B) * (C)

(D) * (C)

(E) * (C)

(F)

(F) * (A)

Note: (1) Weighted average indirect costs per hour represent the sum of indirect costs

adjusted for relevant expenses not incurred due to aircraft in refurbishment not in service.

2021A

70.4

6.6

63.8

$4,409

740

$2.379

$38

$3,262,295

(1.760,249)

1,502,046

46.0%

(27,928)

$1,474,118

$9,773,269

2022P

87.8

7.0

80.8

$6,074

699

$3,186

($164)

$4,244,865

(2,226,726)

2,018,139

47.5%

114,826

$2,132,965

$14,930,755

■

Significant investment throughout 2021 and

2022 on paint & interior facilities as well as

costs associated with the refurbishment of

each aircraft

▪ Throughout the refurbishment process

aircraft are down (no revenue generation)

which is reflected in 2021 and 2022

financials

■ Refurbishment program expected to be

finished by 2023

■ Finished fleet will drive higher net promoter

and aircraft availability which is captured in

top-line growth

flyexclusive 36View entire presentation