Paysafe Results Presentation Deck

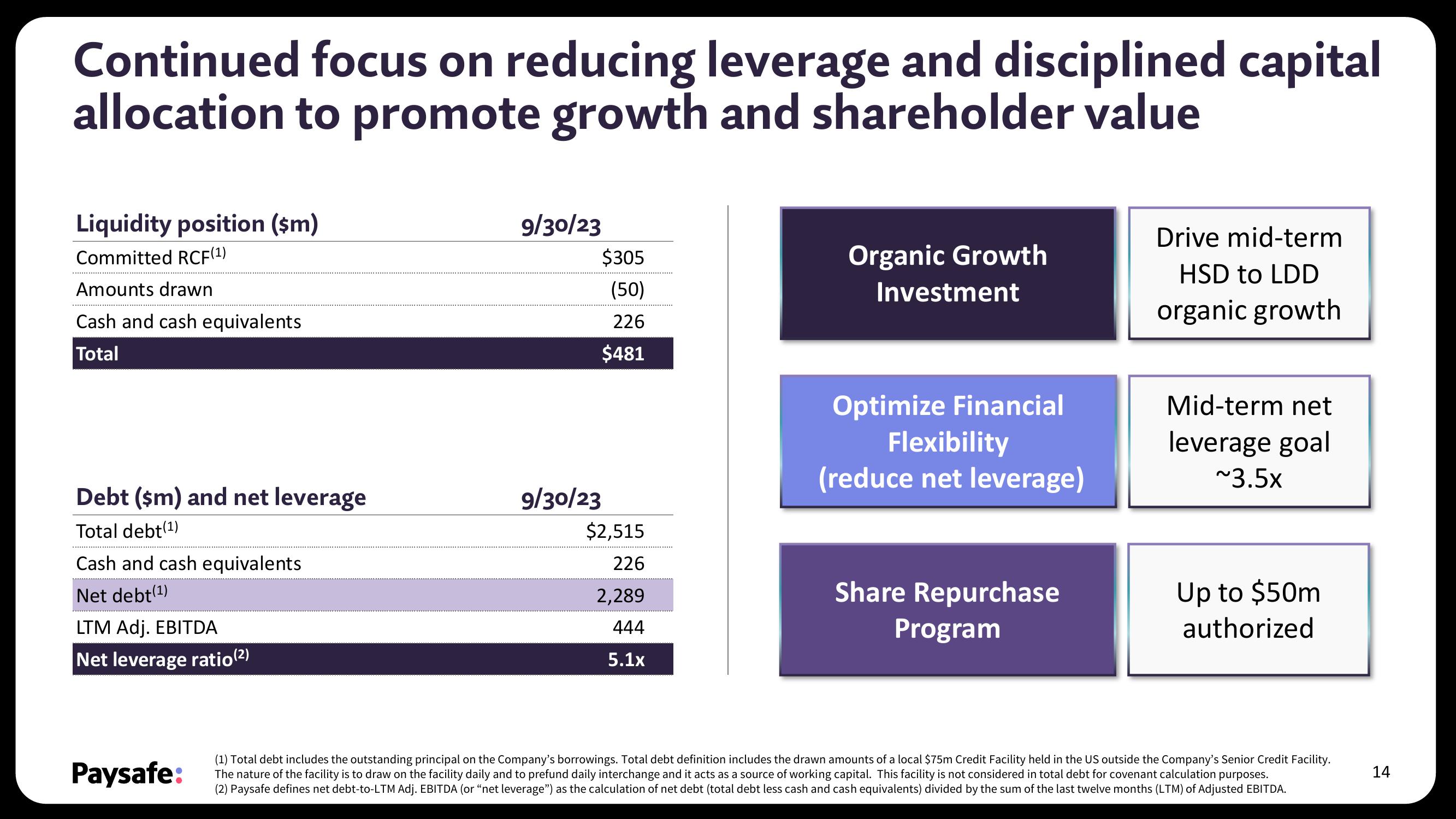

Continued focus on reducing leverage and disciplined capital

allocation to promote growth and shareholder value

Liquidity position (sm)

Committed RCF(¹)

Amounts drawn

Cash and cash equivalents

Total

Debt (sm) and net leverage

Total debt(1)

Cash and cash equivalents

Net debt(¹)

LTM Adj. EBITDA

Net leverage ratio (²)

Paysafe:

9/30/23

$305

(50)

226

$481

9/30/23

$2,515

226

2,289

444

5.1x

Organic Growth

Investment

Optimize Financial

Flexibility

(reduce net leverage)

Share Repurchase

Program

Drive mid-term

HSD to LDD

organic growth

Mid-term net

leverage goal

~3.5x

Up to $50m

authorized

(1) Total debt includes the outstanding principal on the Company's borrowings. Total debt definition includes the drawn amounts of a local $75m Credit Facility held in the US outside the Company's Senior Credit Facility.

The nature of the facility is to draw on the facility daily and to prefund daily interchange and it acts as a source of working capital. This facility is not considered in total debt for covenant calculation purposes.

(2) Paysafe defines net debt-to-LTM Adj. EBITDA (or "net leverage") as the calculation of net debt (total debt less cash and cash equivalents) divided by the sum of the last twelve months (LTM) of Adjusted EBITDA.

14View entire presentation