Babylon Investor Presentation Deck

Transaction Overview

Transaction Overview

Transaction

Overview

Valuation

5

Earnout

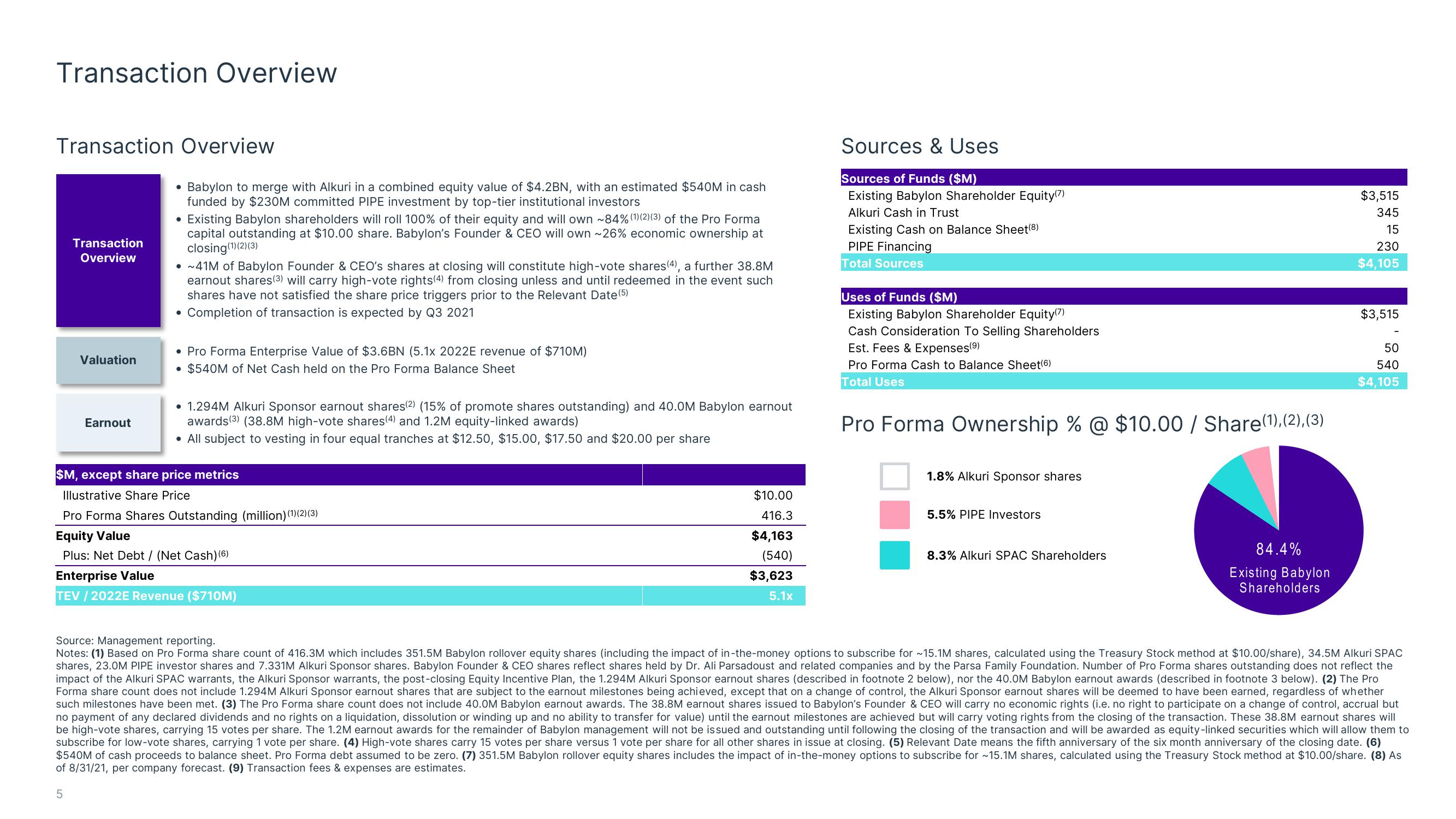

• Babylon to merge with Alkuri in a combined equity value of $4.2BN, with an estimated $540M in cash

funded by $230M committed PIPE investment by top-tier institutional investors

●

Existing Babylon shareholders will roll 100% of their equity and will own ~84% (1) (2) (3) of the Pro Forma

capital outstanding at $10.00 share. Babylon's Founder & CEO will own ~26% economic ownership at

closing(1) (2) (3)

• ~41M of Babylon Founder & CEO's shares at closing will constitute high-vote shares (4), a further 38.8M

earnout shares (3) will carry high-vote rights (4) from closing unless and until redeemed in the event such

shares have not satisfied the share price triggers prior to the Relevant Date (5)

Completion of transaction is expected by Q3 2021

• Pro Forma Enterprise Value of $3.6BN (5.1x 2022E revenue of $710M)

• $540M of Net Cash held on the Pro Forma Balance Sheet

• 1.294M Alkuri Sponsor earnout shares(2) (15% of promote shares outstanding) and 40.0M Babylon earnout

awards (3) (38.8M high-vote shares (4) and 1.2M equity-linked awards)

• All subject to vesting in four equal tranches at $12.50, $15.00, $17.50 and $20.00 per share

$M, except share price metrics

Illustrative Share Price

Pro Forma Shares Outstanding (million) (1) (2) (3)

Equity Value

Plus: Net Debt / (Net Cash) (6)

Enterprise Value

TEV /2022E Revenue ($710M)

$10.00

416.3

$4,163

(540)

$3,623

5.1x

Sources & Uses

Sources of Funds ($M)

Existing Babylon Shareholder Equity(7)

Alkuri Cash in Trust

Existing Cash on Balance Sheet(8)

PIPE Financing

Total Sources

Uses of Funds ($M)

Existing Babylon Shareholder Equity(7)

Cash Consideration To Selling Shareholders

Est. Fees & Expenses (⁹)

Pro Forma Cash to Balance Sheet(6)

Total Uses

Pro Forma Ownership % @ $10.00 / Share(1), (2), (3)

1.8% Alkuri Sponsor shares

5.5% PIPE Investors

8.3% Alkuri SPAC Shareholders

84.4%

Existing Babylon

Shareholders

$3,515

345

15

230

$4,105

$3,515

50

540

$4,105

Source: Management reporting.

Notes: (1) Based on Pro Forma share count of 416.3M which includes 351.5M Babylon rollover equity shares (including the impact of in-the-money options to subscribe for ~15.1M shares, calculated using the Treasury Stock method at $10.00/share), 34.5M Alkuri SPAC

shares, 23.0M PIPE investor shares and 7.331M Alkuri Sponsor shares. Babylon Founder & CEO shares reflect shares held by Dr. Ali Parsadoust and related companies and by the Parsa Family Foundation. Number of Pro Forma shares outstanding does not reflect the

impact of the Alkuri SPAC warrants, the Alkuri Sponsor warrants, the post-closing Equity Incentive Plan, the 1.294M Alkuri Sponsor earnout shares (described in footnote 2 below), nor the 40.0M Babylon earnout awards (described in footnote 3 below). (2) The Pro

Forma share count does not include 1.294M Alkuri Sponsor earnout shares that are subject to the earnout milestones being achieved, except that on a change of control, the Alkuri Sponsor earnout shares will be deemed to have been earned, regardless of whether

such milestones have been met. (3) The Pro Forma share count does not include 40.0M Babylon earnout awards. The 38.8M earnout shares issued to Babylon's Founder & CEO will carry no economic rights (i.e. no right to participate on a change of control, accrual but

no payment of any declared dividends and no rights on a liquidation, dissolution or winding up and no ability to transfer for value) until the earnout milestones are achieved but will carry voting rights from the closing of the transaction. These 38.8M earnout shares will

be high-vote shares, carrying 15 votes per share. The 1.2M earnout awards for the remainder of Babylon management will not be issued and outstanding until following the closing of the transaction and will be awarded as equity-linked securities which will allow them to

subscribe for low-vote shares, carrying 1 vote per share. (4) High-vote shares carry 15 votes per share versus 1 vote per share for all other shares in issue at closing. (5) Relevant Date means the fifth anniversary of the six month anniversary of the closing date. (6)

$540M of cash proceeds to balance sheet. Pro Forma debt assumed to be zero. (7) 351.5M Babylon rollover equity shares includes the impact of in-the-money options to subscribe for ~15.1M shares, calculated using the Treasury Stock method at $10.00/share. (8) As

of 8/31/21, per company forecast. (9) Transaction fees & expenses are estimates.View entire presentation