Booking Holdings Shareholder Engagement Presentation Deck

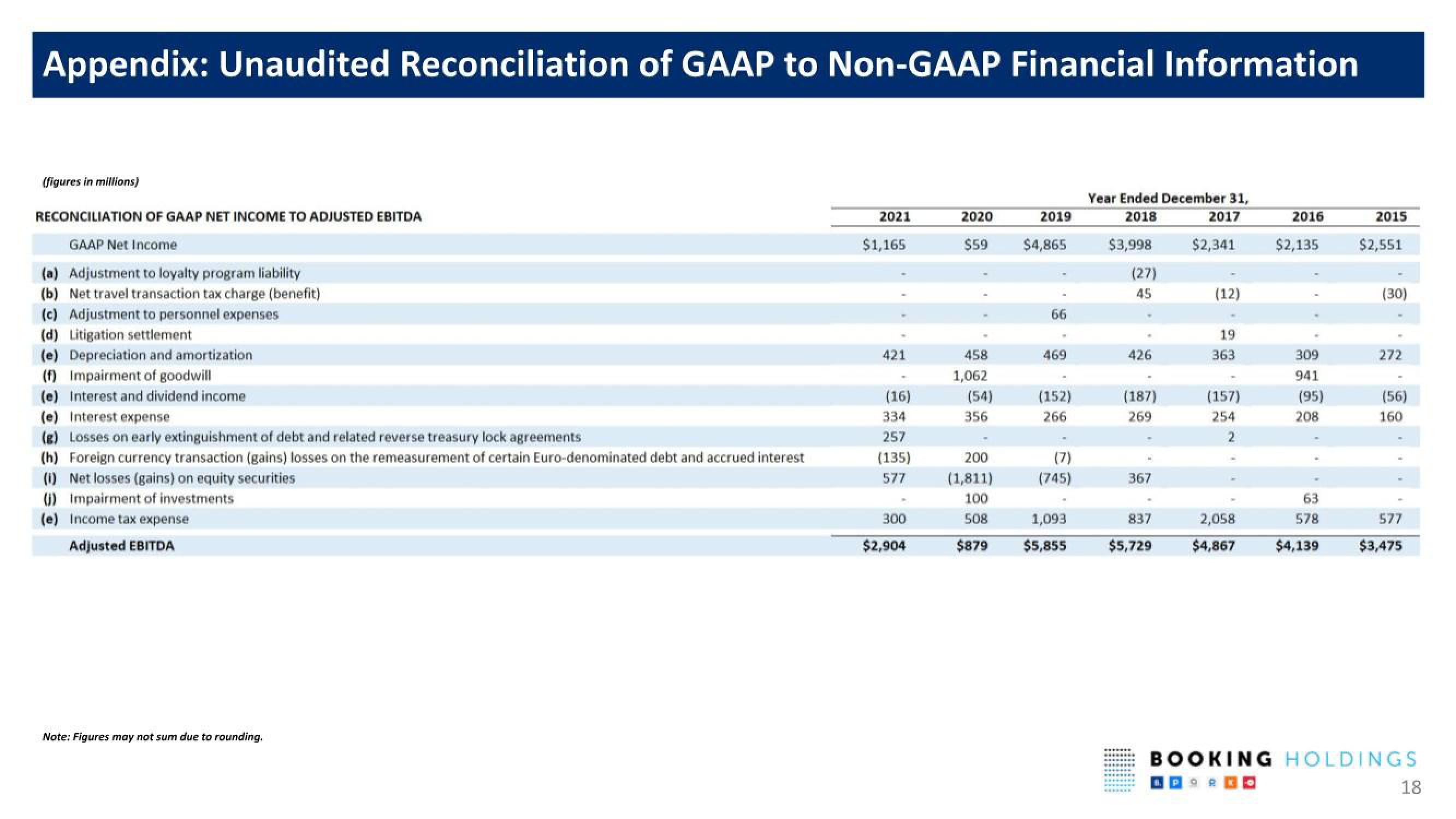

Appendix: Unaudited Reconciliation of GAAP to Non-GAAP Financial Information

(figures in millions)

RECONCILIATION OF GAAP NET INCOME TO ADJUSTED EBITDA

GAAP Net Income

(a) Adjustment to loyalty program liability

(b) Net travel transaction tax charge (benefit)

(c) Adjustment to personnel expenses

(d) Litigation settlement

(e) Depreciation and amortization

(f) Impairment of goodwill

(e) Interest and dividend income

(e) Interest expense

(g) Losses on early extinguishment of debt and related reverse treasury lock agreements

(h) Foreign currency transaction (gains) losses on the remeasurement of certain Euro-denominated debt and accrued interest

(i) Net losses (gains) on equity securities

(j) Impairment of investments

(e) Income tax expense

Adjusted EBITDA

Note: Figures may not sum due to rounding.

2021

$1,165

421

(16)

334

257

(135)

577

300

$2,904

2020

$59 $4,865

458

1,062

(54)

356

2019

200

(1,811)

100

508

66

469

(152)

266

(7)

(745)

1,093

$879 $5,855

Year Ended December 31,

2018

2017

$2,341

$3,998

(27)

45

426

(187)

269

367

837

$5,729

(12)

19

363

(157)

254

2

2,058

$4,867

2016

$2,135 $2,551

309

941

(95)

208

2015

63

578

$4,139

(30)

272

(56)

160

577

$3,475

BOOKING HOLDINGS

18View entire presentation