Morgan Stanley Investment Banking Pitch Book

Project Roosevelt

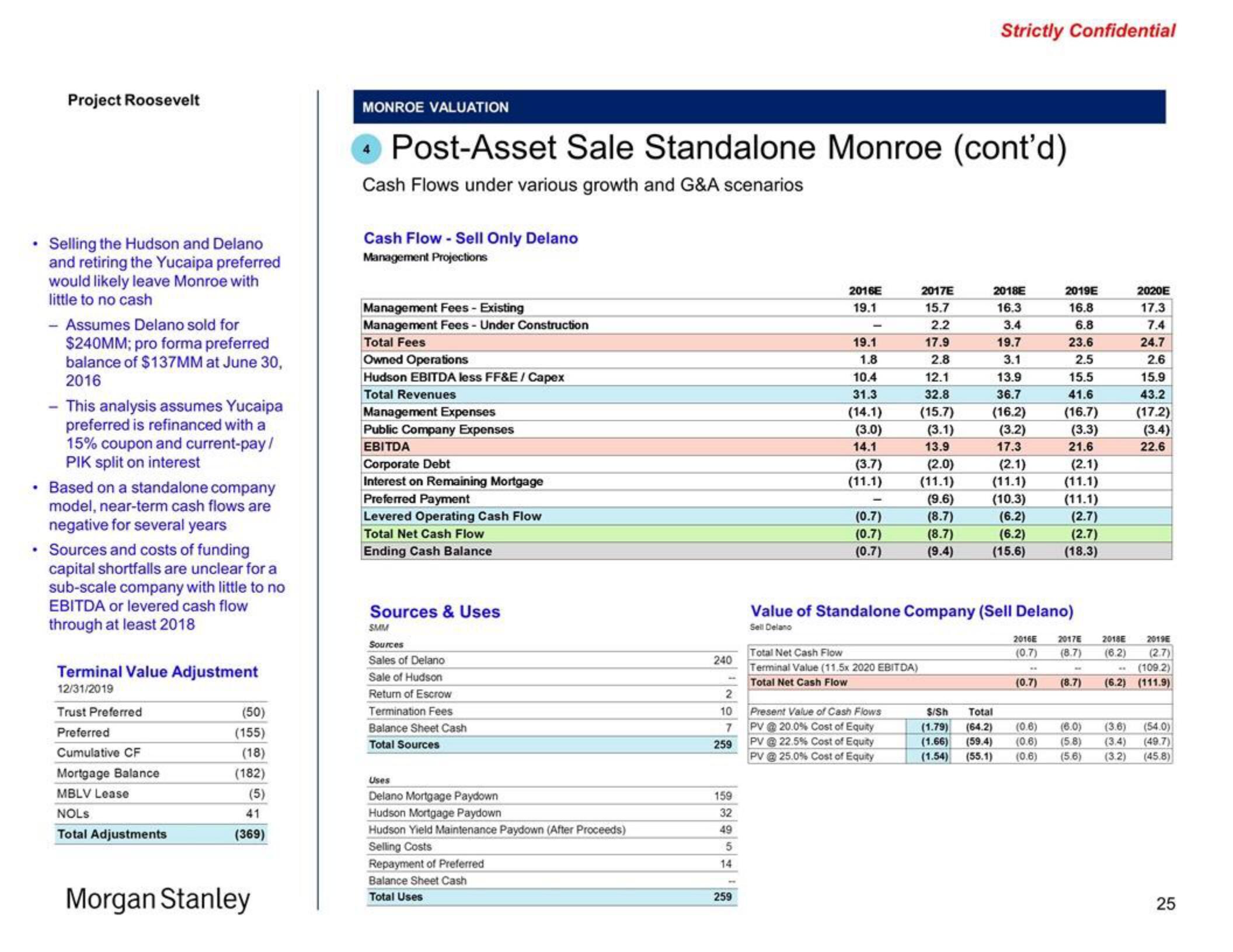

• Selling the Hudson and Delano

and retiring the Yucaipa preferred

would likely leave Monroe with

little to no cash

.

- Assumes Delano sold for

$240MM; pro forma preferred

balance of $137MM at June 30,

2016

- This analysis assumes Yucaipa

preferred is refinanced with a

15% coupon and current-pay/

PIK split on interest

Based on a standalone company

model, near-term cash flows are

negative for several years

Sources and costs of funding

capital shortfalls are unclear for a

sub-scale company with little to no

EBITDA or levered cash flow

through at least 2018

Terminal Value Adjustment

12/31/2019

Trust Preferred

Preferred

Cumulative CF

Mortgage Balance

MBLV Lease

NOLS

Total Adjustments

(50)

(155)

(18)

(182)

(5)

41

(369)

Morgan Stanley

MONROE VALUATION

Post-Asset Sale Standalone Monroe (cont'd)

Cash Flows under various growth and G&A scenarios

Cash Flow - Sell Only Delano

Management Projections

Management Fees - Existing

Management Fees- Under Construction

Total Fees

Owned Operations

Hudson EBITDA less FF&E / Capex

Total Revenues

Management Expenses

Public Company Expenses

EBITDA

Corporate Debt

Interest on Remaining Mortgage

Preferred Payment

Levered Operating Cash Flow

Total Net Cash Flow

Ending Cash Balance

Sources & Uses

SMM

Sources

Sales of Delano

Sale of Hudson

Return of Escrow

Termination Fees

Balance Sheet Cash

Total Sources

Uses

Delano Mortgage Paydown

Hudson Mortgage Paydown

Hudson Yield Maintenance Paydown (After Proceeds)

Selling Costs

Repayment of Preferred

Balance Sheet Cash

Total Uses

240

2

10

7

259

159

32

49

5

14

259

2016E

19.1

19.1

1.8

10.4

31.3

(14.1)

(3.0)

14.1

(3.7)

(11.1)

(0.7)

(0.7)

(0.7)

Total Net Cash Flow

Terminal Value (11.5x 2020 EBITDA)

Total Net Cash Flow

2017E

15.7

2.2

17.9

2.8

12.1

32.8

(15.7)

(3.1)

13.9

Present Value of Cash Flows

[email protected]% Cost of Equity

PV @ 22.5% Cost of Equity

[email protected] % Cost of Equity

(2.0)

(11.1)

(9.6)

(8.7)

(8.7)

(9.4)

Strictly Confidential

2018E

16.3

3.4

19.7

3.1

13.9

36.7

(16.2)

(3.2)

17.3

(2.1)

(11.1)

(10.3)

(6.2)

(6.2)

(15.6)

Value of Standalone Company (Sell Delano)

Sell Delano

$/Sh Total

(1.79) (64.2)

(1.66) (59.4)

(1.54) (55.1)

2019E

16.8

6.8

23.6

2.5

15.5

41.6

(16.7)

(3.3)

21.6

(2.1)

(11.1)

(11.1)

(2.7)

(2.7)

(18.3)

(0.7) (8.7)

2018E

2019E

2016E 2017E

(0.7) (8.7) (6.2) (2.7)

(0.6) (6.0)

(0.6) (5.8)

(0.6) (5.6)

2020E

17.3

7.4

24.7

2.6

15.9

43.2

(17.2)

(3.4)

22.6

«..

(109.2)

(6.2) (111.9)

(3.6) (54.0)

(3.4) (49.7)

(3.2) (45.8)

25View entire presentation