LSE Mergers and Acquisitions Presentation Deck

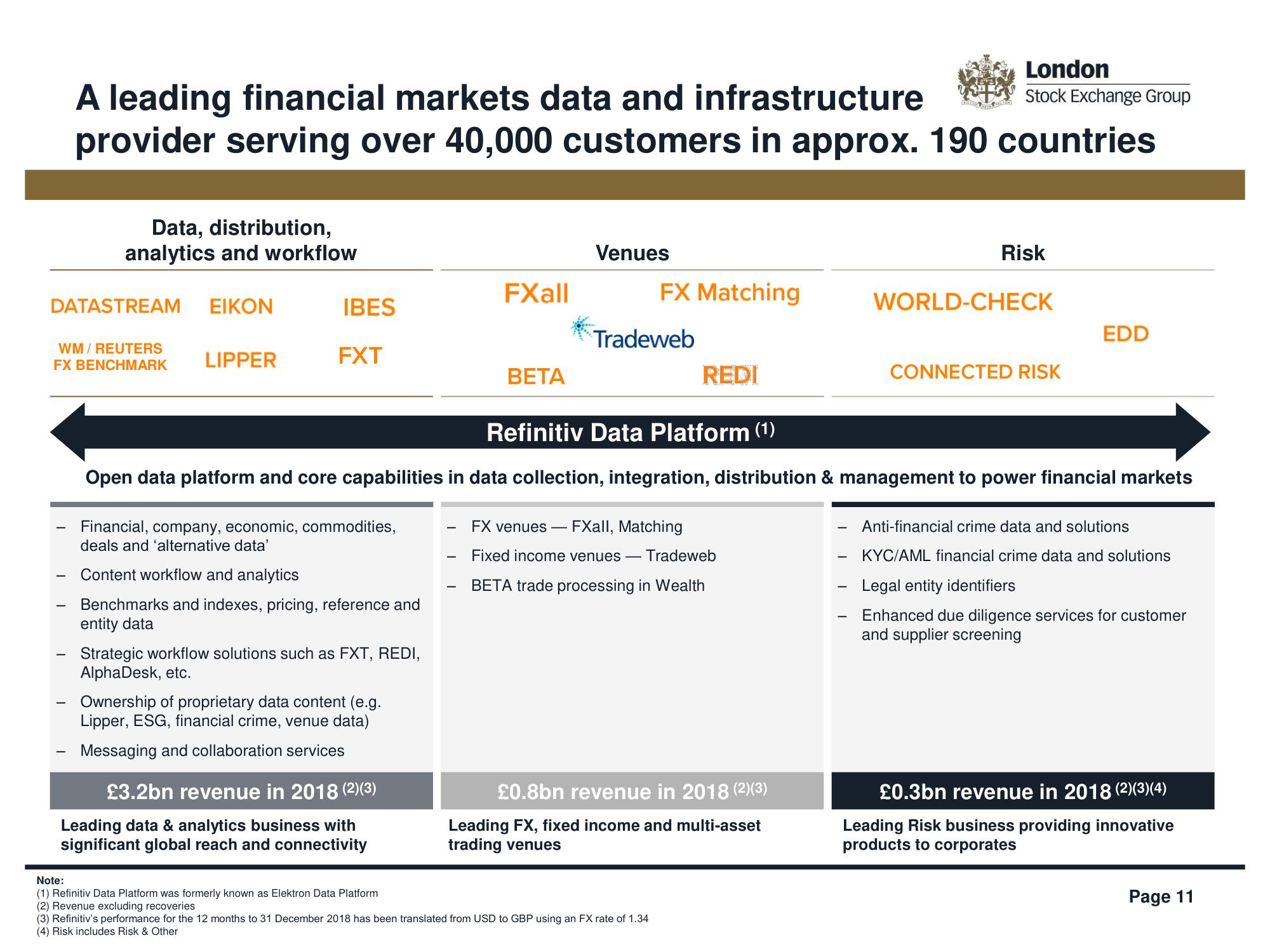

A leading financial markets data and infrastructure

provider serving over 40,000 customers in approx. 190 countries

Data, distribution,

analytics and workflow

DATASTREAM ΕΙΚΟΝ

WM/ REUTERS

FX BENCHMARK

LIPPER

IBES

FXT

Financial, company, economic, commodities,

deals and 'alternative data'

Content workflow and analytics

Benchmarks and indexes, pricing, reference and

entity data

Strategic workflow solutions such as FXT, REDI,

Alpha Desk, etc.

Ownership of proprietary data content (e.g.

Lipper, ESG, financial crime, venue data)

Messaging and collaboration services

£3.2bn revenue in 2018 (2)(3)

Leading data & analytics business with

significant global reach and connectivity

-

-

FXall

-

BETA

Venues

FX Matching

Tradeweb

Refinitiv Data Platform (1)

Open data platform and core capabilities in data collection, integration, distribution & management to power financial markets

REDI

FX venues - FXall, Matching

Fixed income venues - Tradeweb

BETA trade processing in Wealth

Note:

(1) Refinitiv Data Platform was formerly known as Elektron Data Platform

(2) Revenue excluding recoveries

(3) Refinitiv's performance for the 12 months to 31 December 2018 has been translated from USD to GBP using an FX rate of 1.34

(4) Risk includes Risk & Other

£0.8bn revenue in 2018 (2)(3)

Leading FX, fixed income and multi-asset

trading venues

London

Stock Exchange Group

-

Risk

WORLD-CHECK

CONNECTED RISK

EDD

Anti-financial crime data and solutions

KYC/AML financial crime data and solutions

Legal entity identifiers

Enhanced due diligence services for customer

and supplier screening

£0.3bn revenue in 2018 (2)(3)(4)

Leading Risk business providing innovative

products to corporates

Page 11View entire presentation