Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

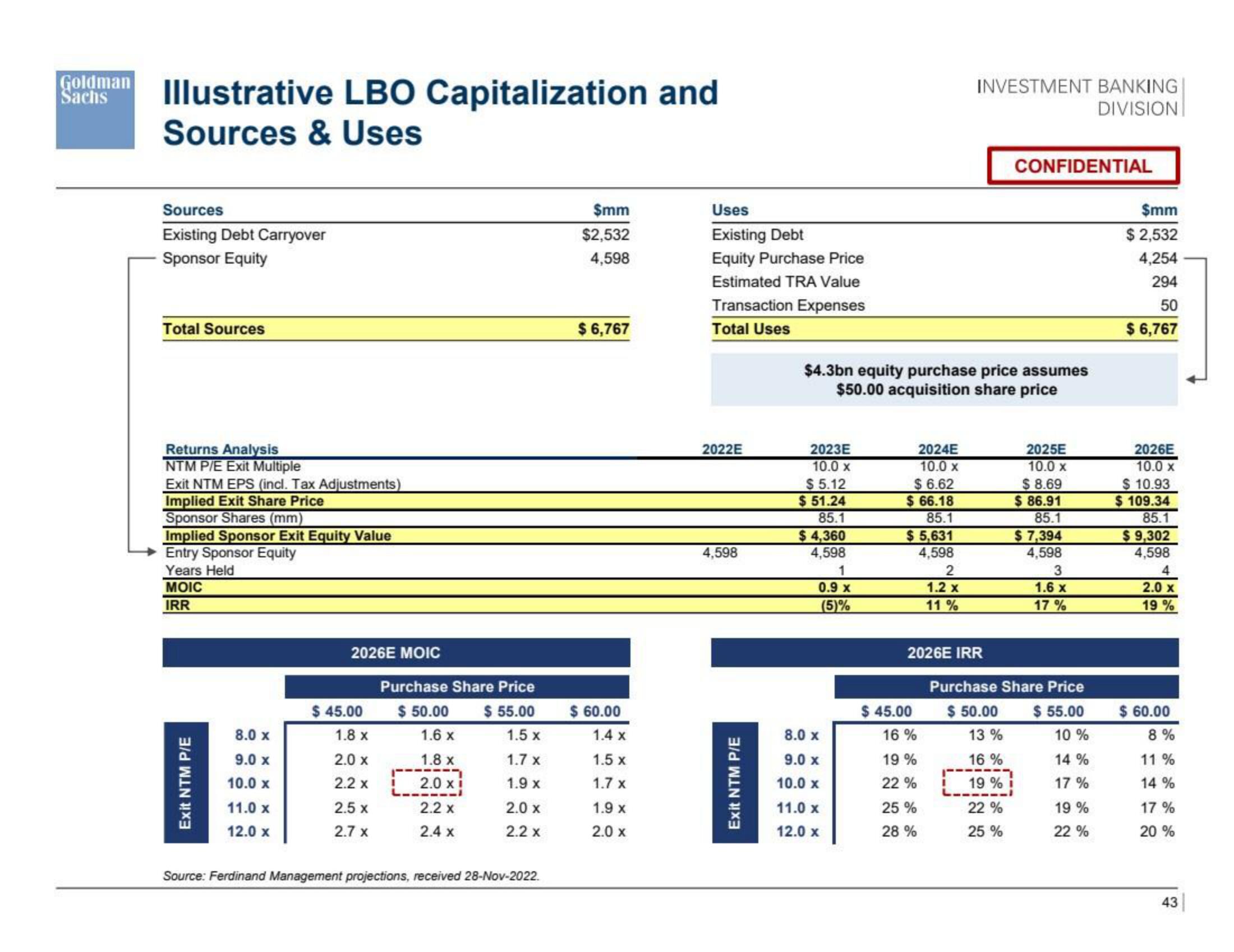

Illustrative LBO Capitalization and

Sources & Uses

Sources

Existing Debt Carryover

Sponsor Equity

Total Sources

Returns Analysis

NTM P/E Exit Multiple

Exit NTM EPS (incl. Tax Adjustments)

Implied Exit Share Price

Sponsor Shares (mm)

Implied Sponsor Exit Equity Value

Entry Sponsor Equity

Years Held

MOIC

IRR

Exit NTM P/E

8.0 x

9.0 x

10.0 x

11.0 x

12.0 x

2026E MOIC

$ 45.00

1.8 x

2.0 x

2.2 x

2.5 x

2.7 x

Purchase Share Price

$ 55.00

I

$ 50.00

1.6 x

1.8 x

2.0 xi

2.2 x

2.4 x

1.5 X

1.7 x

1.9 x

2.0 x

2.2 x

Source:Ferdinand Management projections, received 28-Nov-2022.

$mm

$2,532

4,598

$ 6,767

$ 60.00

1.4 x

1.5 x

1.7 x

1.9

x

2.0 x

Uses

Existing Debt

Equity Purchase Price

Estimated TRA Value

Transaction Expenses

Total Uses

2022E

4,598

Exit NTM P/E

2023E

10.0 X

$ 5.12

$51.24

85.1

$4,360

4,598

1

0.9 x

(5)%

$4.3bn equity purchase price assumes

$50.00 acquisition share price

8.0 x

9.0 x

10.0 X

11.0 x

12.0 x

2024E

10.0 x

$6.62

$66.18

85.1

$5,631

4,598

$ 45.00

16%

19%

22%

INVESTMENT BANKING

DIVISION

2

1.2 x

11%

2026E IRR

25 %

28%

CONFIDENTIAL

$ 50.00

13 %

16 %

19%

22%

25 %

2025E

10.0 x

$8.69

$ 86.91

85.1

$7,394

4,598

3

1.6 x

17%

Purchase Share Price

$ 55.00

10%

14 %

17%

19 %

22%

$mm

$ 2,532

4,254

294

50

$6,767

2026E

10.0 X

$10.93

$ 109.34

85.1

$ 9,302

4,598

4

2.0 x

19%

$ 60.00

8%

11 %

14%

17%

20%

43View entire presentation