FY 2017 Second Quarter Earnings Call

Revenue - consolidated & unconsolidated

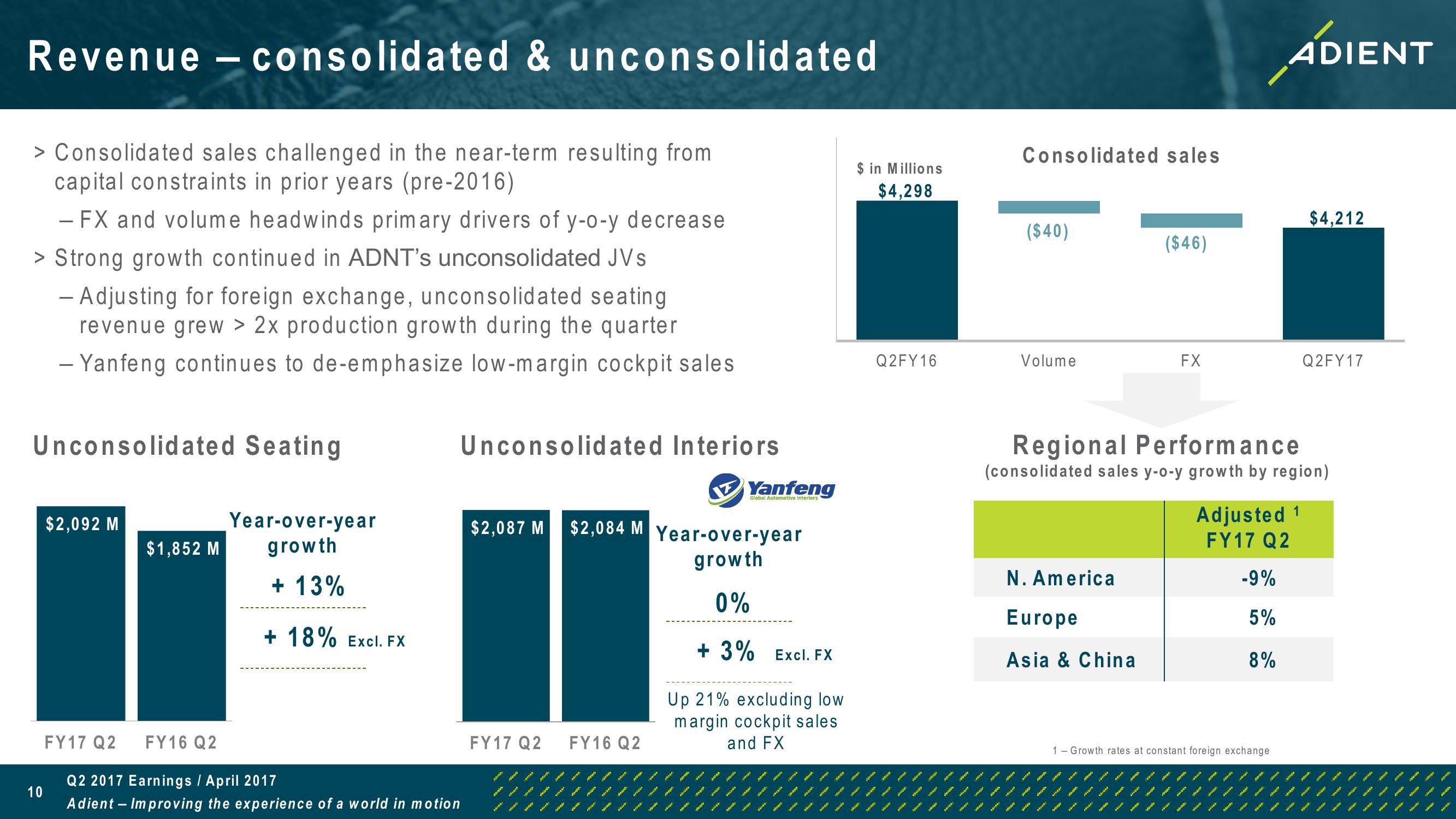

> Consolidated sales challenged in the near-term resulting from

capital constraints in prior years (pre-2016)

- FX and volume headwinds primary drivers of y-o-y decrease

> Strong growth continued in ADNT's unconsolidated JVs

- Adjusting for foreign exchange, unconsolidated seating

revenue grew > 2x production growth during the quarter

– Yanfeng continues to de-emphasize low-margin cockpit sales

-

Unconsolidated Seating

Unconsolidated Interiors

$ in Millions

$4,298

Yanfeng

Global Automotive Interiors

$2,092 M

$1,852 M

Year-over-year

growth

$2,087 M

$2,084 M Year-over-year

+ 13%

+ 18% Excl. FX

FY17 Q2 FY16 Q2

FY17 Q2 FY16 Q2

growth

0%

+ 3% Excl. FX

Up 21% excluding low

margin cockpit sales

and FX

Q2 2017 Earnings / April 2017

10

Adient - Improving the experience of a world in motion

Consolidated sales

ADIENT

$4,212

($40)

($46)

Q2FY16

Volume

FX

Q2FY17

Regional Performance

(consolidated sales y-o-y growth by region)

N. America

Adjusted 1

FY17 Q2

-9%

5%

Asia & China

8%

Europe

1 Growth rates at constant foreign exchangeView entire presentation