Paysafe Results Presentation Deck

2021 full year financial highlights

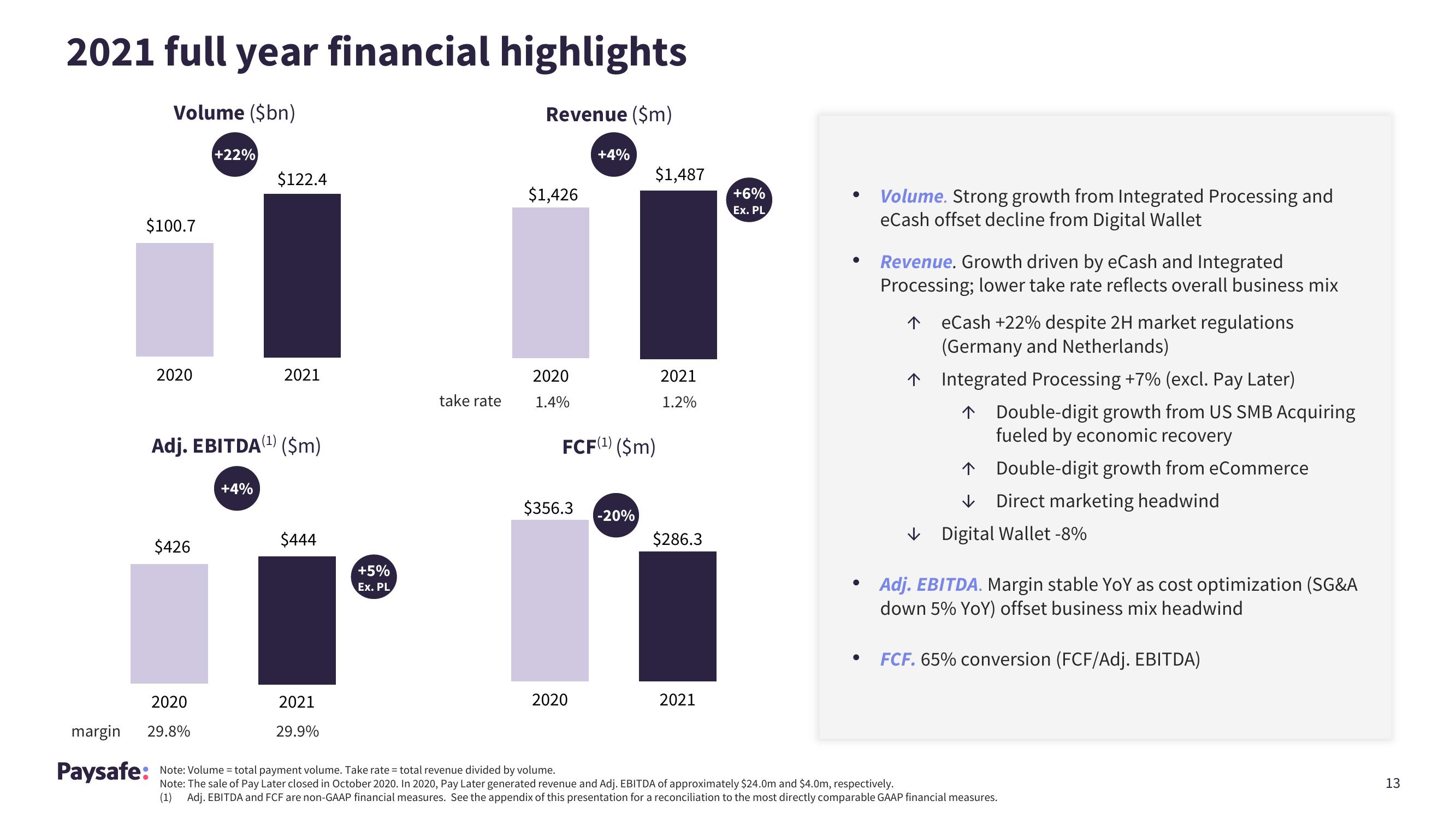

Volume ($bn)

Revenue ($m)

$100.7

2020

$426

+22%

2020

margin 29.8%

Adj. EBITDA (¹) ($m)

$122.4

+4%

2021

$444

2021

29.9%

+5%

Ex. PL

take rate

$1,426

2020

1.4%

$356.3

2020

Paysafe: Note: Volume = total payment volume. Take rate= total revenue divided by volume.

+4%

FCF(¹) ($m)

$1,487

-20%

2021

1.2%

$286.3

2021

+6%

Ex. PL

●

●

●

Volume. Strong growth from Integrated Processing and

eCash offset decline from Digital Wallet

Revenue. Growth driven by eCash and Integrated

Processing; lower take rate reflects overall business mix

个

eCash +22% despite 2H market regulations

(Germany and Netherlands)

↑ Integrated Processing +7% (excl. Pay Later)

↑ Double-digit growth from US SMB Acquiring

fueled by economic recovery

个 Double-digit growth from eCommerce

✓ Direct marketing headwind

Digital Wallet -8%

Adj. EBITDA. Margin stable YoY as cost optimization (SG&A

down 5% YoY) offset business mix headwind

FCF. 65% conversion (FCF/Adj. EBITDA)

Note: The sale of Pay Later closed in October 2020. In 2020, Pay Later generated revenue and Adj. EBITDA of approximately $24.0m and $4.0m, respectively.

(1) Adj. EBITDA and FCF are non-GAAP financial measures. See the appendix of this presentation for a reconciliation to the most directly comparable GAAP financial measures.

13View entire presentation