GMS Results Presentation Deck

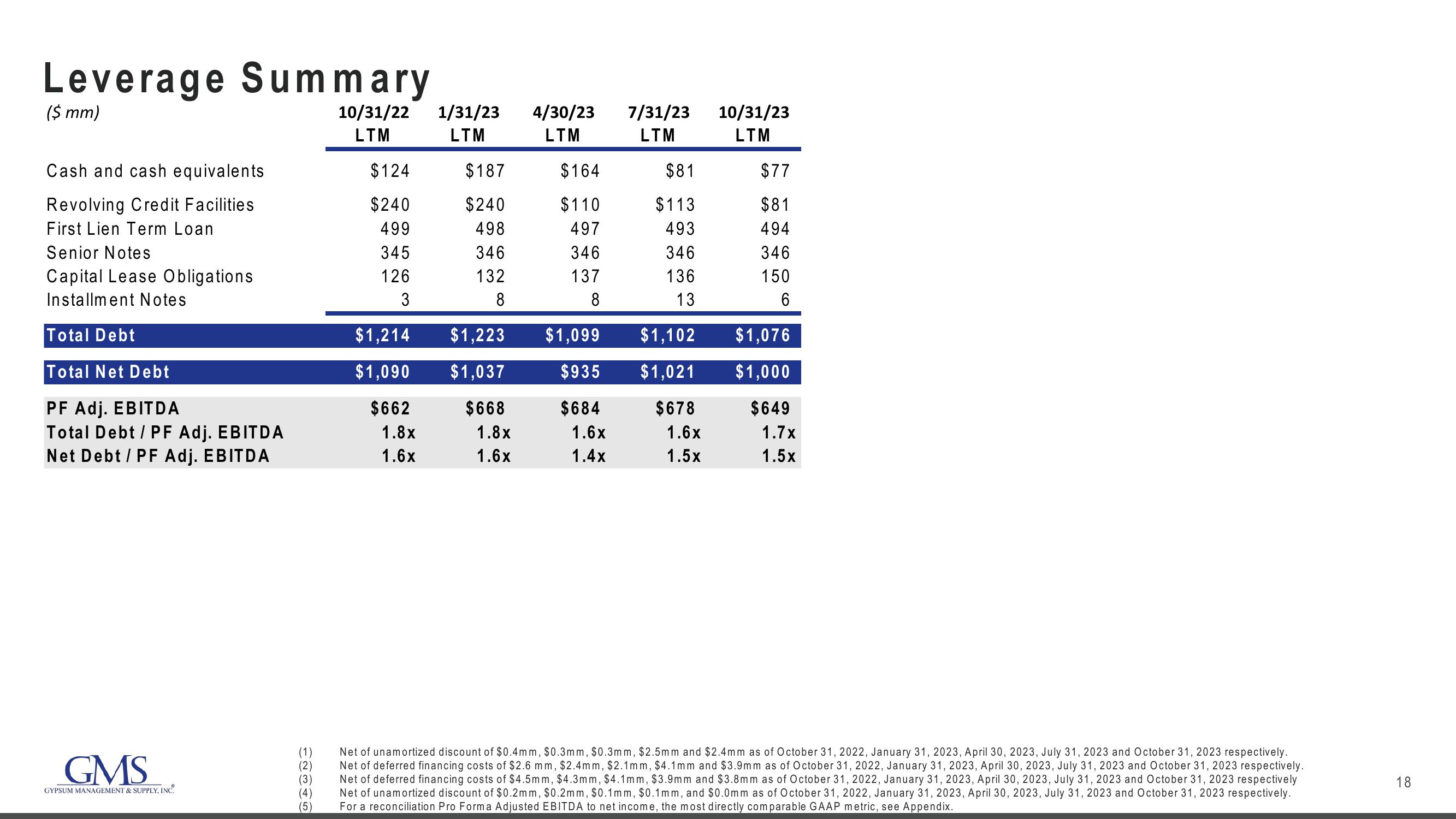

Leverage Summary

($ mm)

Cash and cash equivalents

Revolving Credit Facilities

First Lien Term Loan

Senior Notes

Capital Lease Obligations

Installment Notes

Total Debt

Total Net Debt

PF Adj. EBITDA

Total Debt / PF Adj. EBITDA

Net Debt / PF Adj. EBITDA

GMS

GYPSUM MANAGEMENT & SUPPLY, INC.

(1)

(2)

(3)

(4)

(5)

10/31/22 1/31/23 4/30/23 7/31/23 10/31/23

LTM

LTM

LTM

LTM

LTM

$124

$240

499

345

126

3

$1,214

$1,090

$662

1.8x

1.6x

$187

$240

498

346

132

8

$1,223

$1,037

$668

1.8x

1.6x

$164

$110

497

346

137

8

$1,099

$935

$684

1.6x

1.4x

$81

$113

493

346

136

13

$77

$81

494

346

150

6

$1,102

$1,076

$1,021 $1,000

$678

$649

1.6x

1.5x

1.7x

1.5x

Net of unamortized discount of $0.4mm, $0.3mm, $0.3mm, $2.5mm and $2.4mm as of October 31, 2022, January 31, 2023, April 30, 2023, July 31, 2023 and October 31, 2023 respectively.

Net of deferred financing costs of $2.6 mm, $2.4mm, $2.1mm, $4.1mm and $3.9mm as of October 31, 2022, January 31, 2023, April 30, 2023, July 31, 2023 and October 31, 2023 respectively.

Net of deferred financing costs of $4.5mm, $4.3mm, $4.1mm, $3.9mm and $3.8mm as of October 31, 2022, January 31, 2023, April 30, 2023, July 31, 2023 and October 31, 2023 respectively

Net of unamortized discount of $0.2mm, $0.2mm, $0.1mm, $0.1mm, and $0.0mm as of October 31, 2022, January 31, 2023, April 30, 2023, July 31, 2023 and October 31, 2023 respectively.

For a reconciliation Pro Forma Adjusted EBITDA to net income, the most directly comparable GAAP metric, see Appendix.

18View entire presentation