Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

Description

Pros

Cons

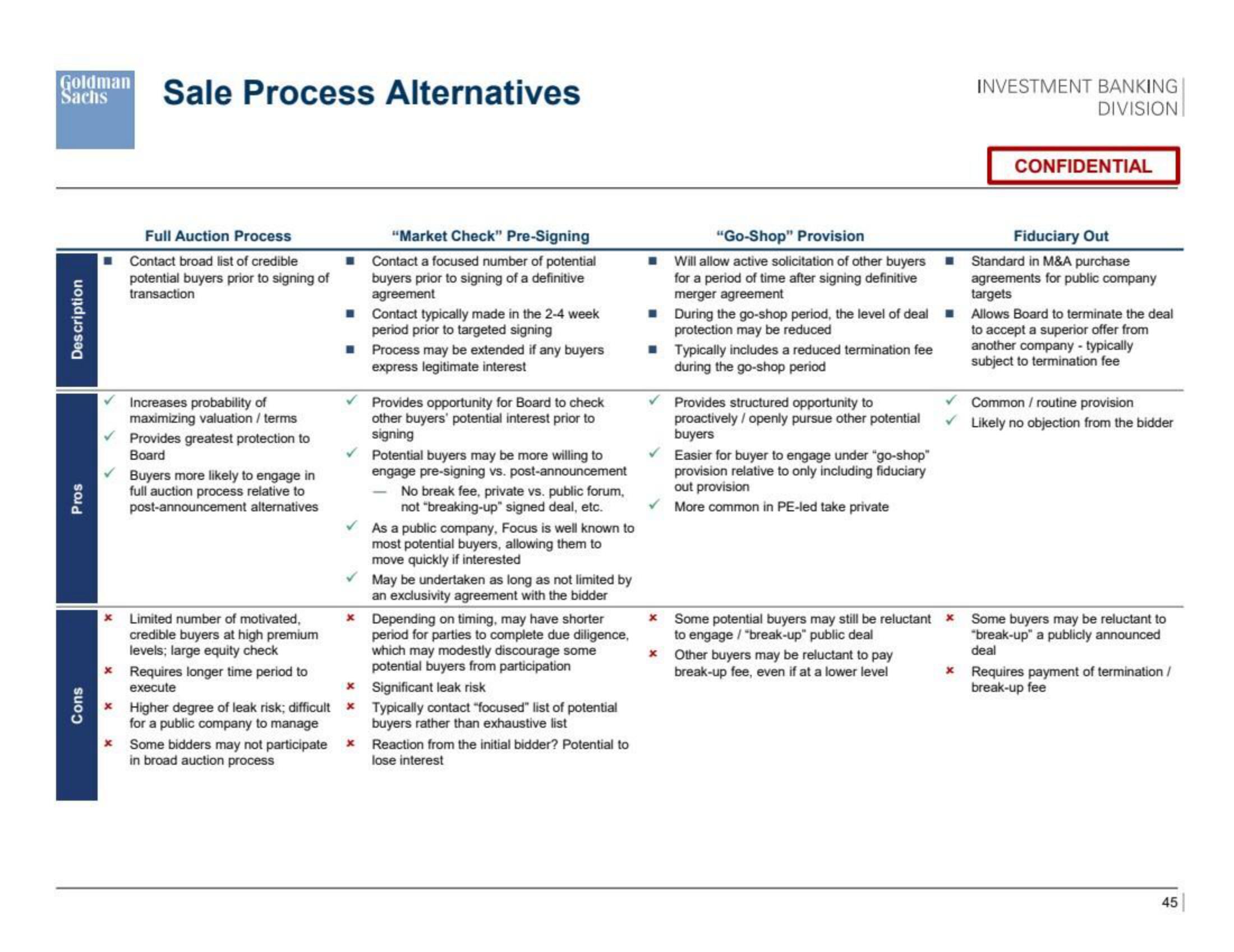

Sale Process Alternatives

Full Auction Process

Contact broad list of credible

potential buyers prior to signing of

transaction

*

Increases probability of

maximizing valuation / terms

Provides greatest protection to

Board

Buyers more likely to engage in

full auction process relative to

post-announcement alternatives

*Limited number of motivated,

credible buyers at high premium

levels; large equity check

*

* Higher degree of leak risk; difficult

for a public company to manage

Requires longer time period to

execute

Some bidders may not participate

in broad auction process

■

■

"Market Check" Pre-Signing

Contact a focused number of potential

buyers prior to signing of a definitive

agreement

Contact typically made in the 2-4 week

period prior to targeted signing

Process may be extended if any buyers

express legitimate interest

Provides opportunity for Board to check

other buyers' potential interest prior to

signing

Potential buyers may be more willing to

engage pre-signing vs. post-announcement

No break fee, private vs. public forum,

not "breaking-up" signed deal, etc.

As a public company, Focus is well known to

most potential buyers, allowing them to

move quickly if interested

May be undertaken as long as not limited by

an exclusivity agreement with the bidder

* Depending on timing, may have shorter

period for parties to complete due diligence,

which may modestly discourage some

potential buyers from participation

Significant leak risk

*

*

Typically contact "focused" list of potential

buyers rather than exhaustive list

*

Reaction from the initial bidder? Potential to

lose interest

■

■

"Go-Shop" Provision

Will allow active solicitation of other buyers

for a period of time after signing definitive

merger agreement

During the go-shop period, the level of deal

protection may be reduced

Typically includes a reduced termination fee

during the go-shop period

✓ Provides structured opportunity to

proactively / openly pursue other potential

buyers

Easier for buyer to engage under "go-shop"

provision relative to only including fiduciary

out provision

More common in PE-led take private

*

Some potential buyers may still be reluctant

to engage / "break-up" public deal

*

Other buyers may be reluctant to pay

break-up fee, even if at a lower level

I

✓

*

INVESTMENT BANKING

DIVISION

CONFIDENTIAL

Fiduciary Out

Standard in M&A purchase

agreements for public company

targets

Allows Board to terminate the deal

to accept a superior offer from

another company - typically

subject to termination fee

Common / routine provision

Likely no objection from the bidder

Some buyers may be reluctant to

"break-up" a publicly announced

deal

* Requires payment of termination /

break-up fee

45View entire presentation