EVE SPAC Presentation Deck

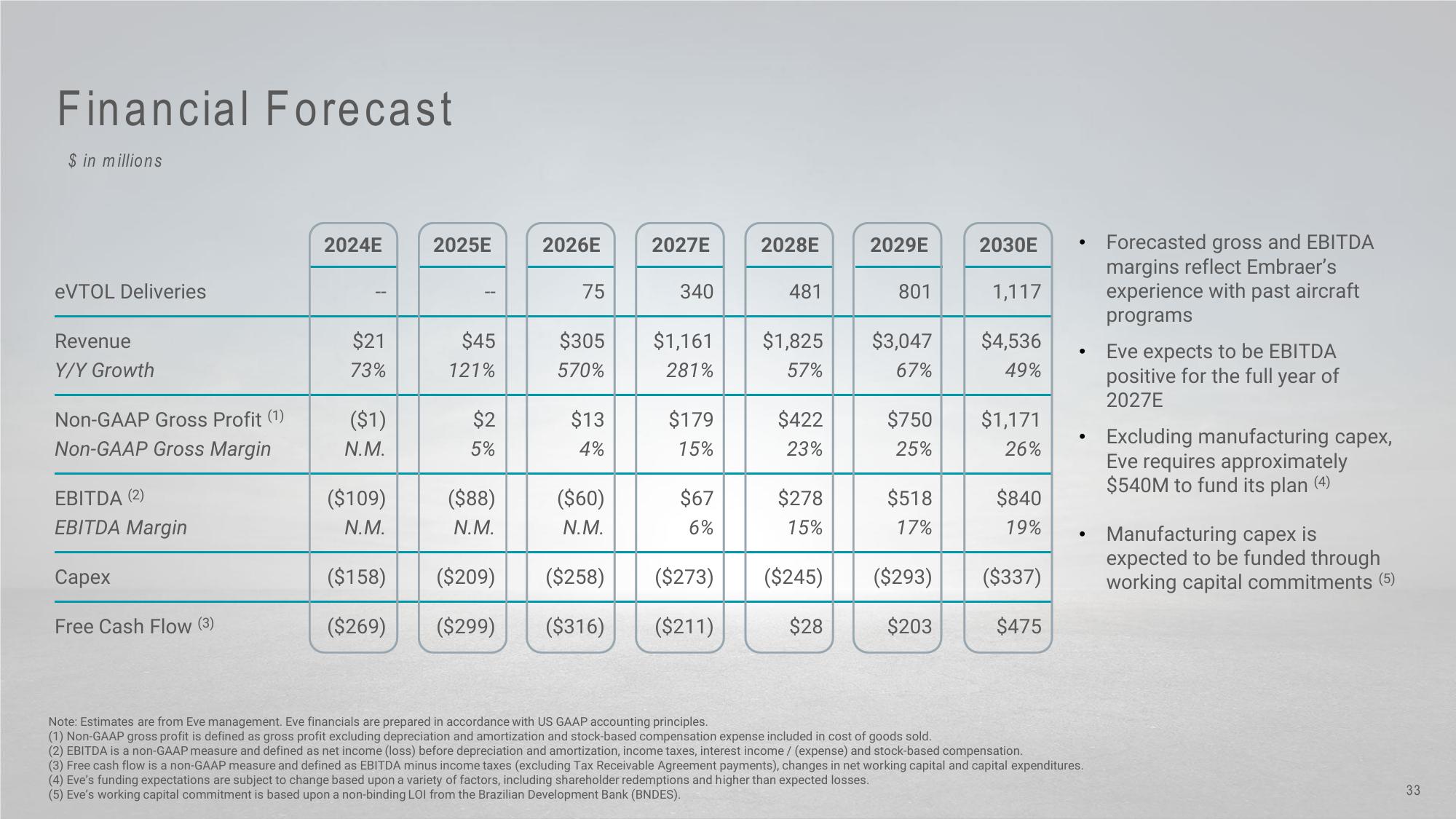

Financial Forecast

$ in millions

eVTOL Deliveries

Revenue

Y/Y Growth

Non-GAAP Gross Profit (1)

Non-GAAP Gross Margin

EBITDA (2)

EBITDA Margin

Capex

Free Cash Flow (3)

2024E

$21

73%

($1)

N.M.

($109)

N.M.

($158)

($269)

2025E

$45

121%

$2

5%

($88)

N.M.

($209)

($299)

2026E

75

$305

570%

$13

4%

($60)

N.M.

($258)

($316)

2027E

340

$1,161

281%

$179

15%

$67

6%

($273)

($211)

2028E

481

$422

23%

$1,825 $3,047

57%

67%

$278

15%

2029E

($245)

$28

801

$750

25%

$518

17%

($293)

$203

2030E

1,117

$4,536

49%

$1,171

26%

$840

19%

($337)

$475

●

●

●

●

Note: Estimates are from Eve management. Eve financials are prepared in accordance with US GAAP accounting principles.

(1) Non-GAAP gross profit is defined as gross profit excluding depreciation and amortization and stock-based compensation expense included in cost of goods sold.

(2) EBITDA is a non-GAAP measure and defined as net income (loss) before depreciation and amortization, income taxes, interest income / (expense) and stock-based compensation.

(3) Free cash flow is a non-GAAP measure and defined as EBITDA minus income taxes (excluding Tax Receivable Agreement payments), changes in net working capital and capital expenditures.

(4) Eve's funding expectations are subject to change based upon a variety of factors, including shareholder redemptions and higher than expected losses.

(5) Eve's working capital commitment is based upon a non-binding LOI from the Brazilian Development Bank (BNDES).

Forecasted gross and EBITDA

margins reflect Embraer's

experience with past aircraft

programs

Eve expects to be EBITDA

positive for the full year of

2027E

Excluding manufacturing capex,

Eve requires approximately

$540M to fund its plan (4)

Manufacturing capex is

expected to be funded through

working capital commitments (5)

33View entire presentation