Grove Investor Presentation Deck

M&A Provides Step-Change Upside Opportunity

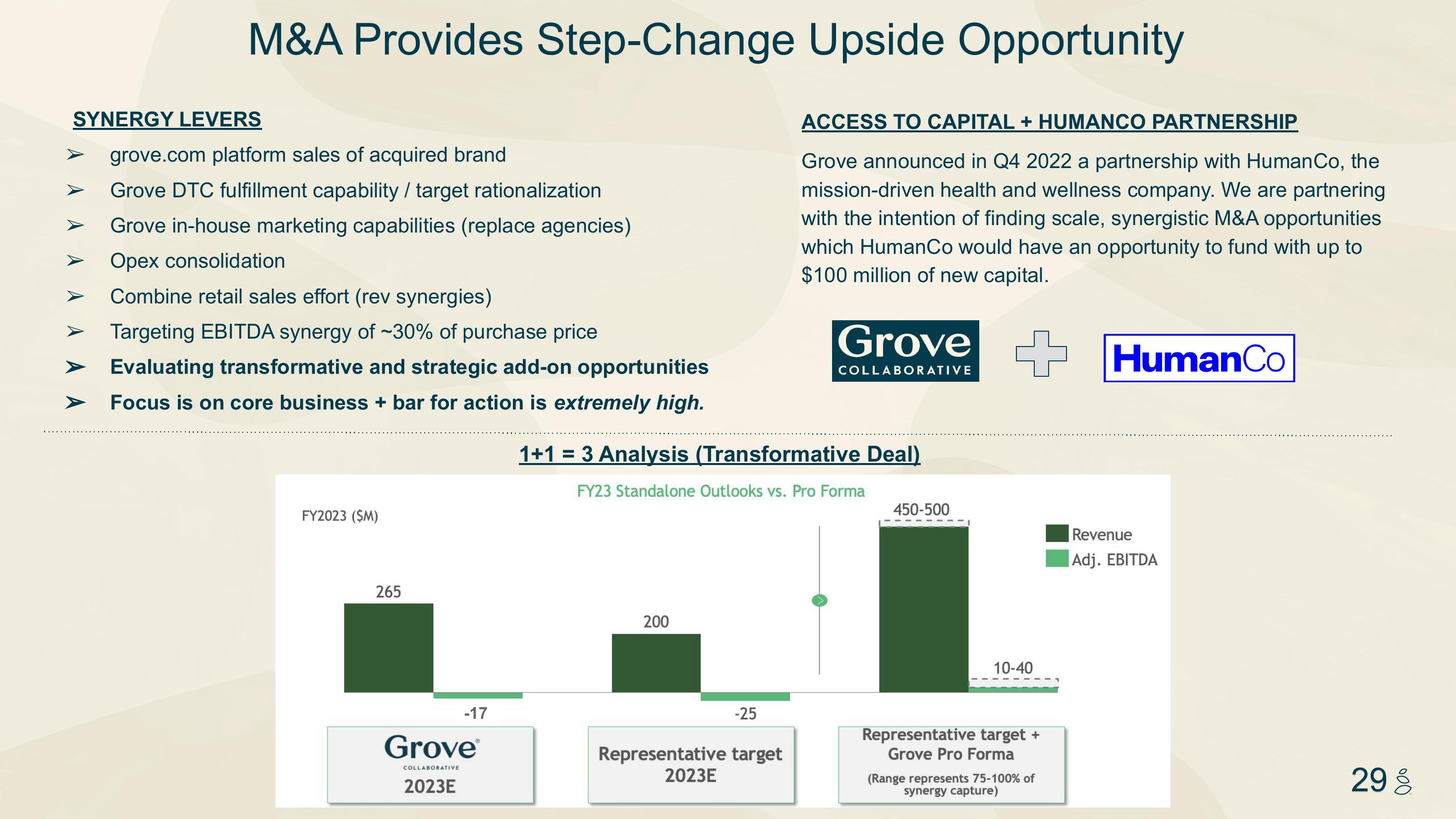

SYNERGY LEVERS

grove.com platform sales of acquired brand

Grove DTC fulfillment capability / target rationalization

Grove in-house marketing capabilities (replace agencies)

Opex consolidation

Combine retail sales effort (rev synergies)

Targeting EBITDA synergy of ~30% of purchase price

Evaluating transformative and strategic add-on opportunities

Focus is on core business + bar for action is extremely high.

A A

FY2023 ($M)

265

-17

Grove

COLLABORATIVE

2023E

200

1+1 = 3 Analysis (Transformative Deal)

FY23 Standalone Outlooks vs. Pro Forma

-25

ACCESS TO CAPITAL + HUMANCO PARTNERSHIP

Grove announced in Q4 2022 a partnership with Human Co, the

mission-driven health and wellness company. We are partnering

with the intention of finding scale, synergistic M&A opportunities

which HumanCo would have an opportunity to fund with up to

$100 million of new capital.

Representative target

2023E

Grove

COLLABORATIVE

450-500

10-40

Representative target +

Grove Pro Forma

(Range represents 75-100% of

synergy capture)

HumanCo

Revenue

Adj. EBITDA

29 8View entire presentation