Melrose Mergers and Acquisitions Presentation Deck

Interim results: Melrose Group highlights

Melrose

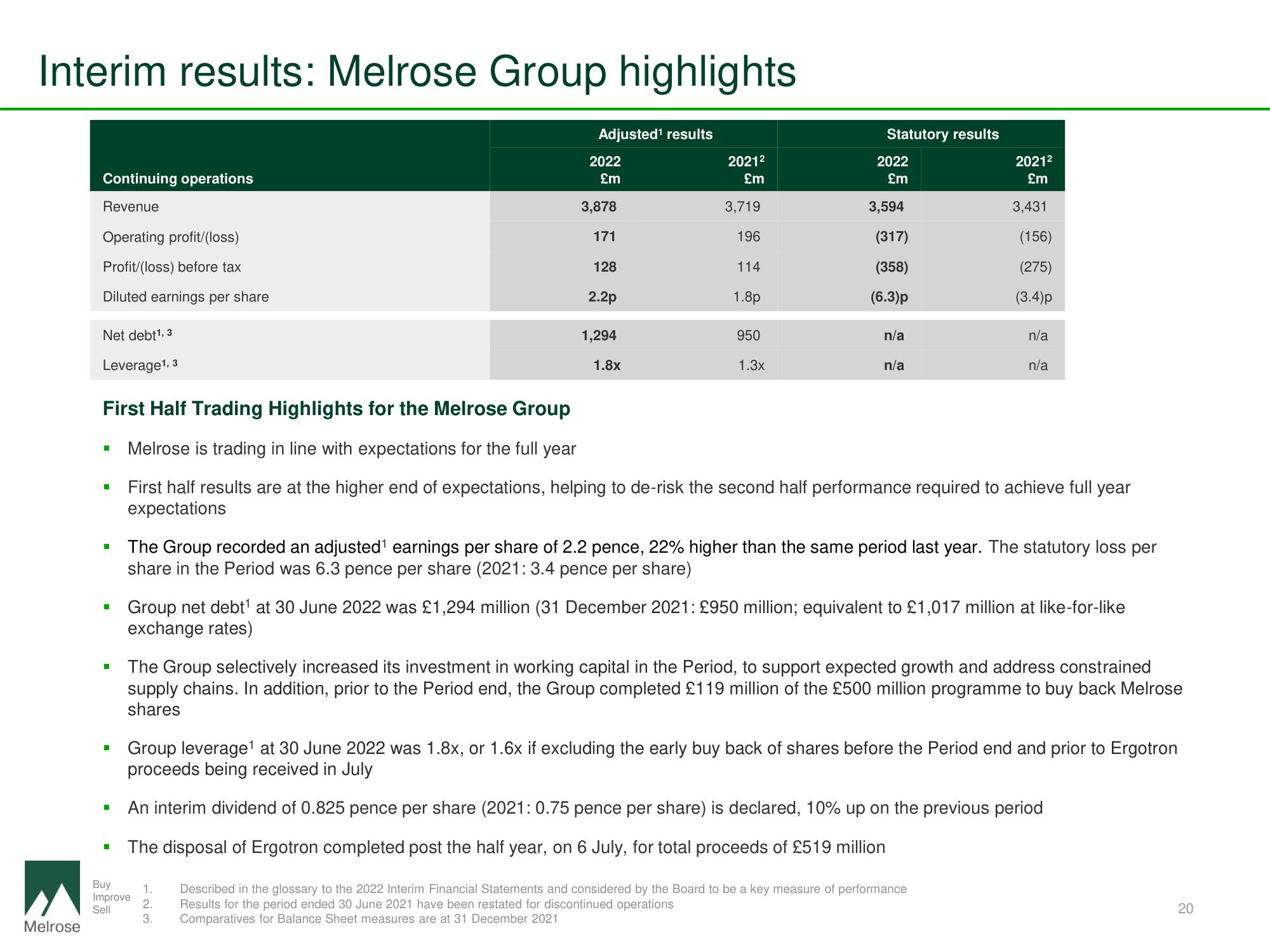

Continuing operations

Revenue

Operating profit/(loss)

Profit/(loss) before tax

Diluted earnings per share

Net debt¹, 3

Leverage¹, 3

■

■

I

■

■

I

I

Adjusted¹ results

2022

£m

3,878

171

128

2.2p

1,294

1.8x

Buy

Improve

Sell

2021²

£m

1.

2.

3.

3,719

196

114

1.8p

950

1.3x

Statutory results

2022

£m

First Half Trading Highlights for the Melrose Group

Melrose is trading in line with expectations for the full year

First half results are at the higher end of expectations, helping to de-risk the second half performance required to achieve full year

expectations

3,594

(317)

(358)

(6.3)p

n/a

n/a

2021²

£m

3,431

(156)

(275)

(3.4)p

n/a

The Group recorded an adjusted¹ earnings per share of 2.2 pence, 22% higher than the same period last year. The statutory loss per

share in the Period was 6.3 pence per share (2021: 3.4 pence per share)

n/a

Group net debt¹ at 30 June 2022 was £1,294 million (31 December 2021: £950 million; equivalent to £1,017 million at like-for-like

exchange rates)

The Group selectively increased its investment in working capital in the Period, to support expected growth and address constrained

supply chains. In addition, prior to the Period end, the Group completed £119 million of the £500 million programme to buy back Melrose

shares

Group leverage¹ at 30 June 2022 was 1.8x, or 1.6x if excluding the early buy back of shares before the Period end and prior to Ergotron

proceeds being received in July

Described in the glossary to the 2022 Interim Financial Statements and considered by the Board to be a key measure of performance

Results for the period ended 30 June 2021 have been restated for discontinued operations

Comparatives for Balance Sheet measures are at 31 December 2021

An interim dividend of 0.825 pence per share (2021: 0.75 pence per share) is declared, 10% up on the previous period

The disposal of Ergotron completed post the half year, on 6 July, for total proceeds of £519 million

20View entire presentation