Gogoro SPAC Presentation Deck

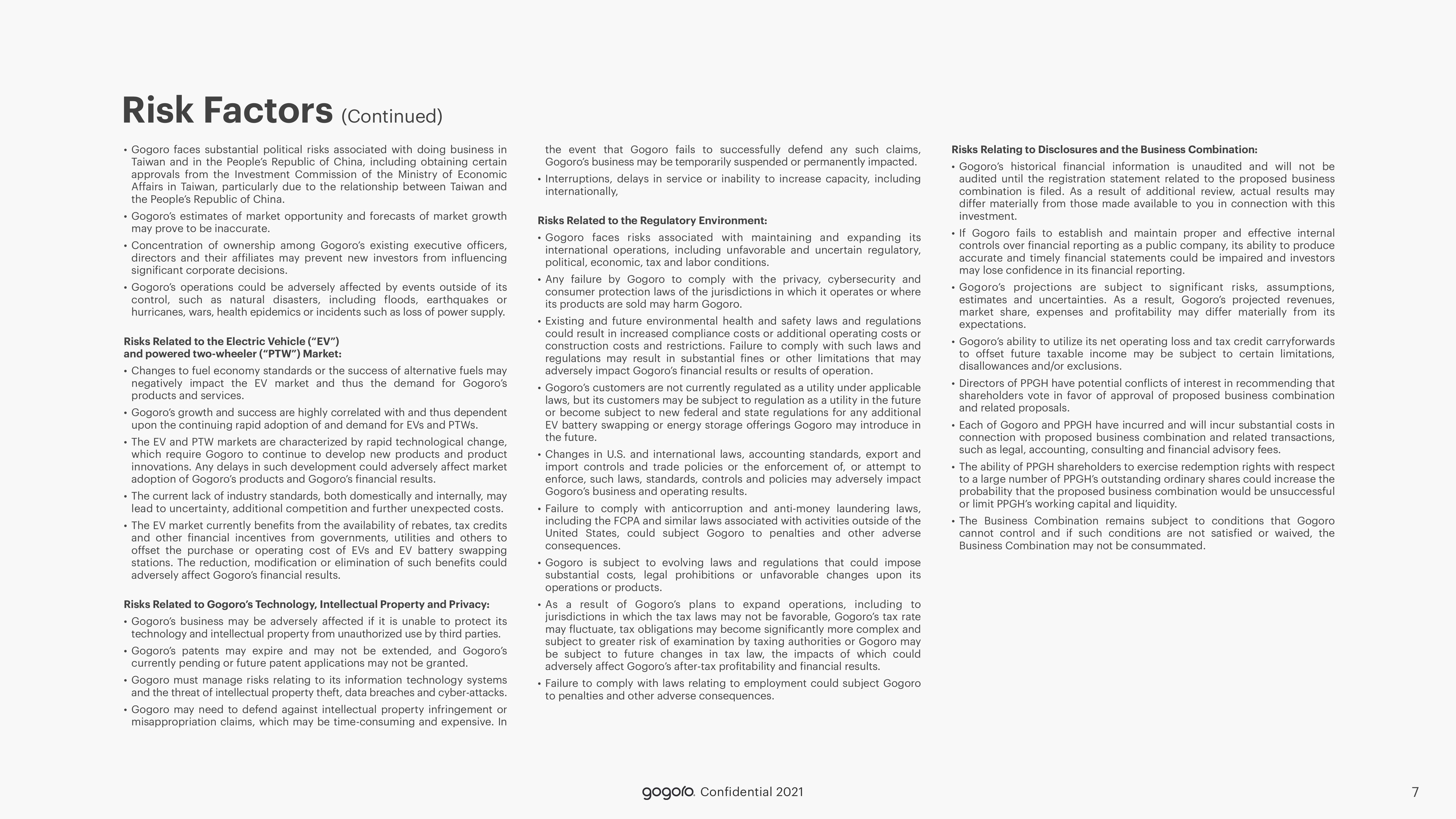

Risk Factors (Continued)

• Gogoro faces substantial political risks associated with doing business in

Taiwan and in the People's Republic of China, including obtaining certain

approvals from the Investment Commission of the Ministry of Economic

Affairs in Taiwan, particularly due to the relationship between Taiwan and

the People's Republic of China.

• Gogoro's estimates of market opportunity and forecasts of market growth

may prove to be inaccurate.

• Concentration of ownership among Gogoro's existing executive officers,

directors and their affiliates may prevent new investors from influencing

significant corporate decisions.

• Gogoro's operations could be adversely affected by events outside of its

control, such as natural disasters, including floods, earthquakes or

hurricanes, wars, health epidemics or incidents such as loss of power supply.

Risks Related to the Electric Vehicle ("EV")

and powered two-wheeler ("PTW") Market:

• Changes to fuel economy standards or the success of alternative fuels may

negatively impact the EV market and thus the demand for Gogoro's

products and services.

• Gogoro's growth and success are highly correlated with and thus dependent

upon the continuing rapid adoption of and demand for EVS and PTWs.

• The EV and PTW markets are characterized by rapid technological change,

which require Gogoro to continue to develop new products and product

innovations. Any delays in such development could adversely affect market

adoption of Gogoro's products and Gogoro's financial results.

• The current lack of industry standards, both domestically and internally, may

lead to uncertainty, additional competition and further unexpected costs.

• The EV market currently benefits from the availability of rebates, tax credits

and other financial incentives from governments, utilities and others to

offset the purchase or operating cost of EVs and EV battery swapping

stations. The reduction, modification or elimination of such benefits could

adversely affect Gogoro's financial results.

Risks Related to Gogoro's Technology, Intellectual Property and Privacy:

• Gogoro's business may be adversely affected if it is unable to protect its

technology and intellectual property from unauthorized use by third parties.

. Gogoro's patents may expire and may not be extended, and Gogoro's

currently pending or future patent applications may not be granted.

. Gogoro must manage risks relating to its information technology systems

and the threat of intellectual property theft, data breaches and cyber-attacks.

. Gogoro may need to defend against intellectual property infringement or

misappropriation claims, which may be time-consuming and expensive. In

the event that Gogoro fails to successfully defend any such claims,

Gogoro's business may be temporarily suspended or permanently impacted.

Interruptions, delays in service or inability to increase capacity, including

internationally,

Risks Related to the Regulatory Environment:

. Gogoro faces risks associated with maintaining and expanding its

international operations, including unfavorable and uncertain regulatory,

political, economic, tax and labor conditions.

. Any failure by Gogoro to comply with the privacy, cybersecurity and

consumer protection laws of the jurisdictions in which it operates or where

its products are sold may harm Gogoro.

• Existing and future environmental health and safety laws and regulations

could result in increased compliance costs or additional operating costs or

construction costs and restrictions. Failure to comply with such laws and

regulations may result in substantial fines or other limitations that may

adversely impact Gogoro's financial results or results of operation.

Gogoro's customers are not currently regulated as a utility under applicable

laws, but its customers may be subject to regulation as a utility in the future

or become subject to new federal and state regulations for any additional

EV battery swapping or energy storage offerings Gogoro may introduce in

the future.

• Changes in U.S. and international laws, accounting standards, export and

import controls and trade policies or the enforcement of, or attempt to

enforce, such laws, standards, controls and policies may adversely impact

Gogoro's business and operating results.

• Failure to comply with anticorruption and anti-money laundering laws,

including the FCPA and similar laws associated with activities outside of the

United States, could subject Gogoro to penalties and other adverse

consequences.

. Gogoro is subject to evolving laws and regulations that could impose

substantial costs, legal prohibitions or unfavorable changes upon its

operations or products.

. As a result of Gogoro's plans to expand operations, including to

jurisdictions in which the tax laws may not be favorable, Gogoro's tax rate

may fluctuate, tax obligations may become significantly more complex and

subject to greater risk of examination by taxing authorities or Gogoro may

be subject to future changes in tax law, the impacts of which could

adversely affect Gogoro's after-tax profitability and financial results.

• Failure to comply with laws relating to employment could subject Gogoro

to penalties and other adverse consequences.

gogoro. Confidential 2021

Risks Relating to Disclosures and the Business Combination:

. Gogoro's historical financial information is unaudited and will not be

audited until the registration statement related to the proposed business

combination is filed. As a result of additional review, actual results may

differ materially from those made available to you in connection with this

investment.

If Gogoro fails to establish and maintain proper and effective internal

controls over financial reporting as a public company, ability to produce

accurate and timely financial statements could be impaired and investors

may lose confidence in its financial reporting.

. Gogoro's projections are subject to significant risks, assumptions,

estimates and uncertainties. As a result, Gogoro's projected revenues,

market share, expenses and profitability may differ materially from its

expectations.

• Gogoro's ability to utilize its net operating loss and tax credit carryforwards

to offset future taxable income may be subject to certain limitations,

disallowances and/or exclusions.

• Directors of PPGH have potential conflicts of interest in recommending that

shareholders vote in favor of approval of proposed business combination

and related proposals.

• Each of Gogoro and PPGH have incurred and will incur substantial costs in

connection with proposed business combination and related transactions,

such as legal, accounting, consulting and financial advisory fees.

• The ability of PPGH shareholders to exercise redemption rights with respect

to a large number of PPGH's outstanding ordinary shares could increase the

probability that the proposed business combination would be unsuccessful

or limit PPGH's working capital and liquidity.

• The Business Combination remains subject to conditions that Gogoro

cannot control and if such conditions are not satisfied or waived, the

Business Combination may not be consummated.

7View entire presentation